The Bank of Canada Cuts Again (and More Should Still Be on the Way)

December 16, 2024Canadian Mortgage and Real-Estate Predictions for 2025

January 6, 2025

I would like to wish my readers a healthy and happy holiday season.

My next post will be uploaded on January 6. In the meantime, here are links to a few of my most widely read recent posts.

They offer key insights on why the Bank of Canada (BoC) is likely to continue reducing its policy rate, why our fixed mortgage rates may be bottoming out, and why our recent inflation uptick isn’t likely to alter the Bank’s plans:

This post provides highlights from the BoC’s most recent 0.50% rate cut and explains why I think our variable mortgage rates will decrease further from here.

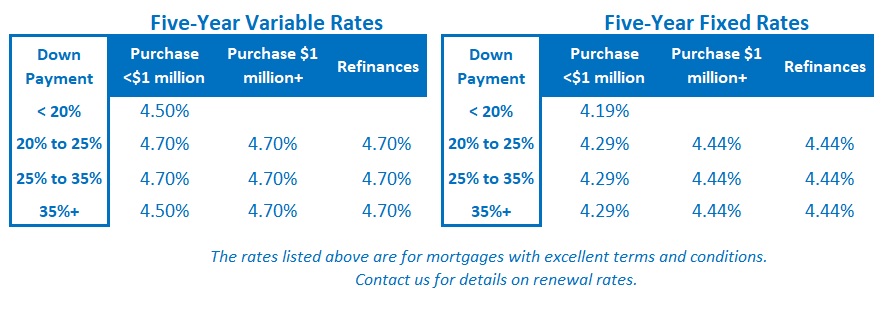

These posts outline a significant shift in my mortgage-rate outlook. They explain why I believe that our fixed mortgage rates may have bottomed out and why I believe that five-year fixed rates are worth a fresh look.

This post explains why I think bond-market investors overreacted to our slightly higher-than-expected inflation print for October and why I didn’t think our recent inflation uptick would alter the BoC’s rate-cut trajectory. (That prediction proved correct for the Bank’s meeting on December 11, and my rationale remains applicable to

further cuts.) The Bottom Line: Government of Canada (GoC) bond yields continued to edge higher last week, pulled along by their rising US Treasury equivalents.

The Bottom Line: Government of Canada (GoC) bond yields continued to edge higher last week, pulled along by their rising US Treasury equivalents.

While there is no immediate pressure on our fixed mortgage rates right now in either direction, the GoC bond yields, which they are priced on, have moved steadily higher so far in December.

Variable-rate borrowers saw their rates drop by 1.25% in 2024. The bond market is now only pricing in another 0.50% in cuts in 2025, but I think more will ultimately materialize.

This view is based, in part, on the fact that the BoC’s policy rate, which currently stands at 3.25%, has bottomed out at 2% or lower over each of the Bank’s previous five rate-cut cycles. (Hat tip to economist David Rosenberg for that stat.)