Straight Talk From Our Central Bankers

June 20, 2022New Mortgage-Rule Changes: HELOCs & Reverse Mortgages

July 4, 2022Statistics Canada confirmed that our overall Consumer Price Index (CPI) surged higher again last month, up from 6.8% in April to 7.7% in May on a year-over-year (YoY) basis. That marked its highest level in nearly forty years.

The single largest contributor to last month’s CPI spike was gasoline, which rose by 12% month-over-month (MoM), and have now risen by a whopping 48% YoY. (If we excluded gasoline, our overall CPI would have risen from 5.8% in April to 6.3% in May.)

Not all price increases affect people the same way.

Some can be avoided by substituting cheaper alternatives or by simply forgoing purchases, but energy is critical to our functioning. Higher energy prices raise costs for businesses and that, in turn, creates broader inflation across our economy. At the same time, the more consumers spend on their energy needs, the less they have for more discretionary spending.

Gasoline costs in particular seem to have an outsized impact on people’s expectations about future inflation – in part because they are hard to reduce but probably also because gas prices are prominently displayed at every station we pass along the way.

Gasoline and fuel prices are currently being driven higher by three main factors:

- Demand for oil and gas has increased in countries that are in the midst of their pandemic re-opening, and also as part of a regular seasonal surge tied to better weather and increased vacation time.

- Several years of low profitability and widespread government commitments to pivot away from fossil fuels have led to under investment in the oil and gas industry. That has limited both overall capacity and the ability to quickly increase it.

- Russia’s invasion of Ukraine has led to sanctions restricting the sale of Russian oil and gas, and that has significantly reduced overall global supply, particularly in Western democracies.

Our overall CPI isn’t going to moderate over the short term until gas prices, and energy prices more broadly, are reined in.

Today’s higher energy prices will help to reduce the demand for energy on their own, and rate hikes by the Bank of Canada (BoC) and the US Federal Reserve will also help in that regard. But even if those prices stop increasing and are no longer driving our CPI higher, today’s high energy prices will remain an economic headwind until supply issues are resolved over the longer term.

Here are some other noteworthy inflation tidbits:

- Many elevated price pressures are still primarily attributable to a mix of ongoing supply challenges, Russia’s invasion of Ukraine, a spike in the demand for goods and services tied to re-openings, and adverse agricultural conditions.

- The other key contributors to last month’s CPI increase were food prices (+9.7% YoY), hotel prices (+40.2% YoY), shelter costs (+7.4% YoY), and restaurant prices (+6.8% YoY).

- Average hourly wages rose by 3.9% YoY in May, up from 3.3% in April. Wage growth is accelerating, but still lags overall inflation. As such, the average Canadian continues to lose purchasing power.

- Not all of today’s inflation is being caused by higher actual costs. This article notes that the overall pre-tax profits of US corporations increased by $2.8 trillion (25%) in 2021, which marked their most profitable year since 1950. Corporations that have raised their prices opportunistically will have extra room to reduce them if demand falls.

- In an encouraging sign that supply lines are starting to normalize, amidst all of the doom and gloom that otherwise surrounds the current inflation narrative, economist David Rosenberg recently noted that freight rates from China to the US West Coast have plunged 34% this year, and are now down 50% from a year ago.

If you’re in the market for a mortgage today, here is what the market is telling you now about how future rates will be impacted by inflation.

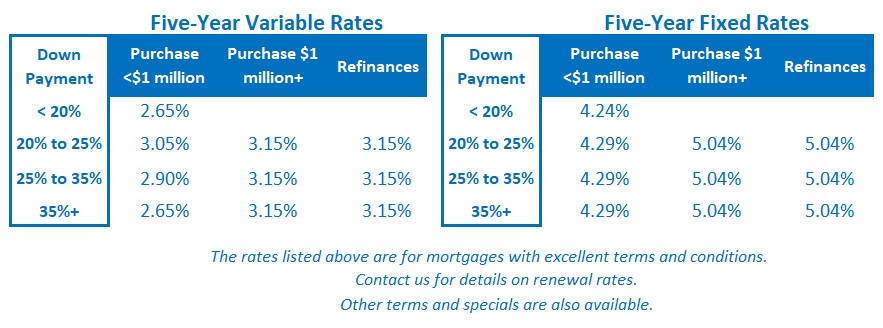

Five-year fixed rates are now up in the 5% range, and that pricing reflects the belief that the BoC will have to raise its current policy rate (1.50%) by about another 2.25% to rein inflation in. If that forecast proves correct, today’s five-year fixed and variable rates will produce costs that are about the same over their full terms.

For my part, I continue to believe that the BoC won’t have to hike by that much to sufficiently slow our economic momentum and bring inflation to heel, because the impact of each rate hike will be magnified by our record high debt levels. Furthermore, if the Bank does hike by as much as the bond market expects (or more), I believe that will drive our economy into a recession. At that point, I expect that the BoC would be forced to cut its policy rate in response (and in the US, even though household debt levels are much lower, the bond market is currently pricing in that same scenario.).

Simply put, if you can stomach a steady diet of BoC rate increases that will take today’s five-year variable rates from their current 3% range up to at least the mid-4% range, I still like your chances of beating today’s five-year fixed-rate equivalents over your full term. (And for those who are just happier knowing their rate is fixed, I recommend shorter two- or three-year fixed-rate terms, which will allow you earlier access to lower rates if and when they drop.) The Bottom Line: The five-year Government of Canada (GoC) bond yield, which our five-year fixed rates are priced on, finished lower last week despite the update on our latest inflation surge.

The Bottom Line: The five-year Government of Canada (GoC) bond yield, which our five-year fixed rates are priced on, finished lower last week despite the update on our latest inflation surge.

Some market watchers interpreted that development as a positive signal that the market had already priced in another inflation spike, but I disagree. The US five-year Treasury yield fell last week and took its GoC equivalent along for the ride – and that recurring fact also explains why this Canadian mortgage blogger spends so much time writing about US economic news.

Our five-year fixed rates now have some air under them, but I don’t expect them to move lower right away. Remember that lenders take the elevator when rates rise and the stairs when they fall. For now, we’ll have to make due with a reprieve from further hikes.

Five-year variable-rate discounts held steady last week. The market continues to price in a 0.75% increase by the BoC at its next meeting on July 13, but for now I’m still betting on a 0.50% hike.

4 Comments

Thank you! excellent information

Thanks Andrew. I’m glad you found the post useful.

Best,

Dave

Thank you for your insights. I am a lay person (on this subject), and I’ve been following your blogs for some time now and find the information very helpful.

Thank you for your note Monique – and happy to hear that you have enjoyed my posts.

Best,

Dave