Why the Bank of Canada Probably Won’t Talk About Rate Cuts This Week

April 8, 2024Why A Bad Budget May Actually Leave Us Better Off

April 22, 2024

The Bank of Canada (BoC) held its policy rate steady last week, as expected. That means the lender prime rates on which our variable mortgage rates are priced will remain unchanged until its next meeting on June 5.

In its accompanying policy statement and Monetary Policy Report (MPR), the Bank acknowledged encouraging progress on the inflation front but still stopped short of hinting at rate cuts on the near horizon.

While many market watchers expected the BoC to begin to lay the groundwork for lower rates, that seemed unlikely to this blogger. My view was that the BoC hadn’t seen enough to meet its definition of inflation being “on a clear path” back to 2%. It would have also remembered that the last time it spoke of imminent rate cuts, it set off bond-market and real-estate rallies that undermined its continuing efforts to quell demand.

Here are five key observations about the BoC’s latest communications, which will be of interest to anyone keeping an eye on Canadian mortgage rates.

- Inflation has continued to cool, but the BoC wants to see further confirmation.

At the BoC’s press conference, Governor Macklem said that the Bank is “seeing the progress we need to see” with inflation, but that it needs “to see it for longer to be confident that we are clearly on a path to 2%”.

For example, on a rolling three-month basis, our overall CPI is now tracking at a rate of 1.3% (annualized), and the Bank’s key measures of core inflation are all tracking in the low 2% range.

Those three-month measures are all well below their twelve-month averages, which means that inflation is slowing. But shorter-term data are more volatile, and the Bank wants to see confirmation over a longer period. (On that note, it will receive two more months of economic data before it next meets in June.)

The Bank also observed that “recent easing in inflation has been broad based … with a declining share of prices rising by more than 3%”. Shelter costs, which are significantly increased by the BoC’s high policy rate, remain the main contributor to our current inflation pressure.

The Bank will also be keeping a close eye on how oil prices respond to ongoing geopolitical conflicts. They have been rising steadily of late, and that trend alone could cause inflation to swing higher again.

- Update on the four areas the BoC is watching most closely.

The evolution of supply and demand – Governor Macklem reiterated the Bank’s assessment that our economy has moved from a state of excess demand in the second half of 2023 to one of excess supply in early 2024.

Conclusion: Excess supply will help create more of the disinflation that we need to see.

Inflation expectations – The BoC observed that “near-term inflation expectations moderated over the first quarter of 2024 but remain elevated”.

Conclusion: Inflation expectations remain a concern, and as such, are an impediment to near-term rate cuts. The Bank won’t receive its next round of consumer and business surveys until June 30 (which will be after its next policy-rate meeting on June 5).

Wage growth – The BoC noted that “most measures of wage growth have declined since the fourth quarter of 2023”, but it also assessed that “productivity growth would need to increase substantially” for our current wage growth rates “to be compatible with the 2% inflation target”.

Conclusion: Our overall productivity has declined in six of the last seven quarters, and in a recent speech, BoC Deputy Governor Rogers assessed that it has declined to “emergency” levels. Wage growth needs to slow further, but productivity also needs to get up off the mat.

Corporate price setting – The Bank noted that “fewer businesses are planning unusually large price increases over the next twelve months”. It also noted that the frequency of price changes, which tracks closely with inflation momentum, is also now declining.

Conclusion: If companies do what they say they plan to do (and if past is prologue, that is not a guarantee), corporate price increases should continue to moderate.

- The BoC expects growth to come from immigration, government spending and stronger-than-expected US demand.

In its latest forecasts, the BoC increased its estimates for our GDP growth in 2024 from 0.8% to 1.5%, and it attributed this change mainly to strong population growth. Interestingly, while the Bank now expects our headline GDP to increase by more this year, it is still forecasting a decline in GDP per capita (which is the economic momentum that individual Canadians feel).

The Bank also reduced its GDP growth estimate from 2.4% to 2.2% to account for the immigration caps that will kick in when we get to that point.

The Bank expects government spending to “bolster demand” by more than previously estimated considering recently announced provincial budgets. While it didn’t mention the federal budget that will be released tomorrow, the several new spending measures that have already been announced will also increase demand. The BoC has recently been critical of fiscal policies that are out of sync with monetary policy. The latest increases in deficit spending, at both the provincial and federal levels of government, will exacerbate that divergence.

The Bank observed that US economic growth has been “surprisingly resilient”, with “a strong job market boosting consumer spending” and increased business investment “due to increasing demand and government incentives”. It boosted its forecast for US GDP growth from 1.7% to 2.7% in 2024 and from 1.2% to 1.8% in 2025. On a related note, it also raised its forecast for the contribution that exports will make to our GDP growth this year from 0.3% to 1%.

(The BoC made no mention of the latest US CPI data, which were released just ahead of its meeting on Wednesday. That print came in higher than expected and led to a broad sell-off in financial markets, even though the results were only slightly higher than the consensus forecast.)

- The BoC is forecasting “robust growth in residential investment”.

The Bank is forecasting a rebound in housing related activity, which it attributed to several tailwinds:

- The “recent strength in population growth and an ongoing shortfall in housing supply that is not expected to close over the [three-year] projected horizon”

- “Easing financial conditions and the waning effects of past increases in interest rates”

- “The supply of new housing [that] is supported by recently announced government policies”

- “Tight supply” which will lead to “moderate growth in house prices over the next two years”

That improved forecast aside, the Bank also highlighted the risk that “house prices could rise sharply” as one of its three key upside risks to its inflation outlook and warned that “sustained expectations for large increases in housing prices could amplify this risk”.

- The BoC increases its neutral-rate estimate.

The neutral rate is defined as the policy rate that will neither stimulate nor restrict growth at the point when our economy has achieved supply/demand balance, when inflation is at target (2%), and when there are no shocks (positive or negative) affecting our economic momentum.

While this is theoretical construct that cannot be precisely measured, it is useful to anyone keeping an eye on mortgage rates because it gives us an idea of where the BoC’s policy rate may end up farther down the road if/when conditions normalize.

The Bank’s previous neutral-rate range was 2% to 3%, and last week as part of its annual neutral-rate review, it increased that range to 2.25% to 3.25%. Looked at another way, the Bank just increased the mid-point of its neutral-rate range from 2.5% to 2.75%.

As a reminder, the BoC’s policy rate stands at 5% today (a level that is considered by most to be highly restrictive to growth, but necessary for as long as we need inflation to keep falling). The Bottom Line: Government of Canada bond yields were carried higher last week by their US Treasury equivalents, which spiked in response to the higher-than-expected US CPI data for March.

The Bottom Line: Government of Canada bond yields were carried higher last week by their US Treasury equivalents, which spiked in response to the higher-than-expected US CPI data for March.

Lenders began to increase their fixed mortgage rates in response late last week, and that will likely continue over the week ahead.

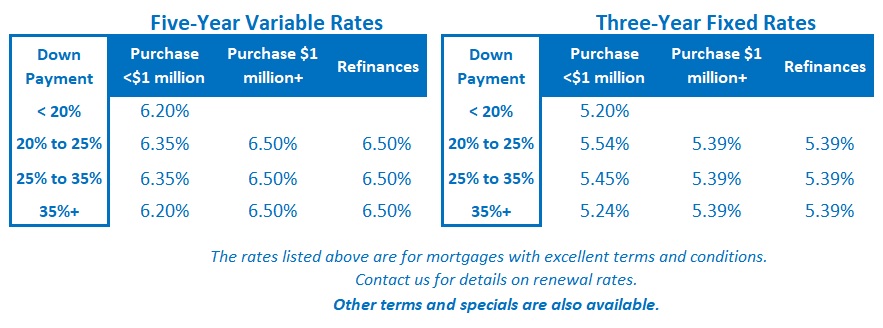

Five-year variable rate discounts were unchanged last week, as were the lender prime rates on which our variable-rate mortgages are priced.

If the BoC’s actions match its words, its first rate cut is likely not coming in June. On that note, the bond futures market reduced the probability of a June cut from 70% before the Bank’s meeting to about 50% immediately afterwards.

That said, the longer the Bank waits to cut, the greater the risk that it will overtighten, and the larger the rate reductions that will then have to follow.