Finally Some Good News for Canadian Variable-Rate Mortgage Borrowers

March 6, 2023Where’s My Rate Drop?

March 20, 2023Last week was a busy one for anyone keeping an eye on Canadian mortgage rates.

We heard hawkish statements from the Bank of Canada (BoC) and the US Federal Reserve. They re-emphasized their commitments to do whatever is necessary to bring inflation to heel.

We also received the latest Canadian and US employment reports, for February. Both came in better than expected and confirmed that the demand for labour remains strong on both sides of our shared border.

That’s when things got interesting. The bond market’s response was the opposite of what we would have intuitively expected on first pass.

Instead of surging higher once our latest employment data confirmed that tight labour markets would continue to stoke inflationary pressures, our bond yields plunged. To wit, the Government of Canada (GoC) five-year bond yield, which began the week at 3.58%, had dropped all the way to 3.21% when the dust had settled after Friday’s close.

Here is a summary of each key development last week, along with my take on why the bond market’s reaction left us scratching our heads.

- The BoC didn’t increase its policy rate (but did reiterate its hawkish bias).

Canadian variable-rate borrowers rejoiced last Wednesday after the BoC announced that it would hold its policy rate steady (for the first time in nine meetings, going back to March 2022).

In its accompanying policy statement , the Bank assessed that economic developments since its last meeting were “in line with the [its] expectation that CPI inflation will come down to around 3% in the middle of this year.” As a reminder, the BoC has repeatedly insisted that inflation must return all the way back to its 2% target before rate cuts will be considered. The closer we get to that level, the harder it will be to achieve incremental price cooling.

The Bank’s carefully worded closing statement reiterated that its pause is conditional on the inflation data evolving as expected. It also reconfirmed the Bank’s hawkish bias when it reminded Canadians that it is “prepared to increase the policy rate further if needed” and “remains resolute in its commitment to restoring price stability for Canadians”.

Then, in a follow-up speech the next day, Senior Deputy Governor Carolyn Rogers noted the Bank’s concern that rising wages haven’t been accompanied by improving labour productivity. She highlighted the Bank’s blunt assessment that “unless a surprisingly strong pickup in productivity growth occurs, sustained 4 per cent to 5 per cent wage growth is not consistent with achieving the 2 per cent inflation target.”

- The latest Canadian employment data beat expectations (again).

Our labour market has been on fire of late.

We added 69,000 new jobs in December and another 150,000 new jobs in January. This was a whopping ten times the consensus estimate.

It would not have been a surprise to see some give back in February. That is often the case in a month that follows a significant surge. But our employment market, which at this point we could dub the Little Engine That Could, easily beat expectations once again.

Our economy added 21,800 jobs last month, more than double the consensus estimate of 10,000.

Further, and encouragingly, most of the new jobs were in the private sector and were full-time. Average hours worked also increased by 0.6% month-over-month, down from 0.8% in January but still a robust pace. Average hourly wages increased by 5.4% year-over-year, up from 4.5% in January.

While our February headline result was lower than the previous two spectacular months, we are still adding jobs at well above our long-term average range of 10,000 to 15,000/month, and our labour costs are still surging higher.

- US Fed Chair Powell warns investors to expect more hikes “than previously anticipated”.

US bond-market investors had been expecting the Fed’s funds rate to peak at about 1.00% above its current range of 4.50% to 4.75% and were pricing another 0.25% at the Fed’s next meeting on March 22.

But that changed last week after US Federal Reserve Chairman Jerome Powell’s semi-annual Monetary Policy Report to the US Senate banking committee. He warned that recent economic data “have come in higher than expected” and that “the ultimate level of interest rates is likely to be higher than previously anticipated”.

Bond market investors quickly briefly upped their bets to a 0.50% hike by the Fed. (We’re back to a quarter-point hike again now, but volatility is still the order of the day.)

If the Fed accelerates its rate-hike pace and the BoC maintains its current pause, the Loonie will continue to weaken against the Greenback. That will raise our inflation rate by increasing the price of everything we import from US markets (which accounts for about 80% of our total imports).

- The latest US employment data were stronger than expected.

Last week we learned that the US economy added an estimated 335,000 new jobs in February, well above the consensus forecast of 205,000.

The latest US employment data weren’t quite as strong as the data in Canada. Average weekly earnings dropped from an increase of 4.7% in January to 4.0% in February, average hours worked declined by 0.1%, there was a big jump in the newly unemployed ranks, and many of the newly created jobs were part-time and of the lower paying variety.

That said, the US economy is still adding jobs at well above its long-term pace of about 175,000/month. There are still almost two job openings for each unemployed worker. Wage growth is still well above the level needed to return inflation anywhere near to its 2% target.

- Despite all of this, a US bank failure caused US and Canadian bond yields to plunge.

Last week’s hawkish news on both sides of the 49th parallel should have pushed bond yields up as investors priced in higher-for-longer inflation and policy rates.

Surprisingly, on first glance, that didn’t happen.

Instead, investors piled into US Treasuries and GoC bonds and drove their yields sharply lower. They behaved as if the BoC and Fed had announced that inflation would soon return to target and rate cuts were imminent.

Simply put, the sudden insolvency of Silicon Valley Bank has triggered a flight to safe-haven assets.

The largest US bank failure since 2008 has many US investors worried about knock-on effects, the potential failure of other banks, and overall systemic risk. We have now quite quickly entered a period where the return of capital matters more than the return on capital. (The debt-ceiling fight in the US House of Representatives isn’t helping either.)

If you’re in the market for a mortgage today, here is my assessment of the current landscape.

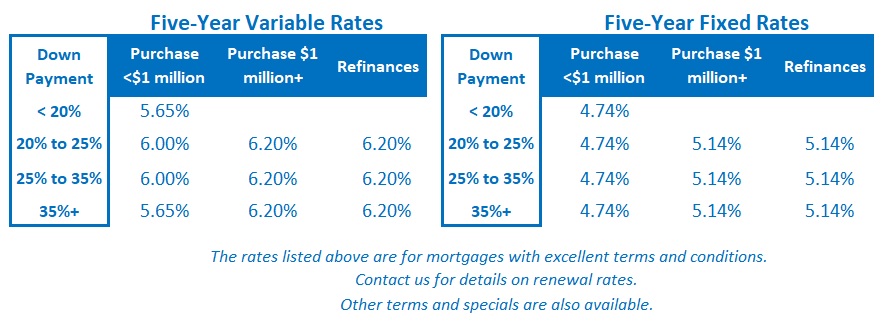

Today’s five-year variable rates start out with a significant premium over their five-year fixed-rate equivalents (see rate chart below).

That means you must pay more at the outset in the hope that you will recover that additional cost, and then some, later in your term. While I certainly won’t rule out that possibility, I would call it an aggressive bet for the average Canadian borrower under today’s conditions.

Alternatively, you could opt for a fixed rate to ride out the current volatility.

Five-year fixed rates are currently offered at lower rates than shorter fixed-term options (thanks to today’s inverted bond-yield curve). That too involves a trade off, because there is a reasonable chance that rates will fall from today’s levels before your term is up.

If that happens, the wording of the penalty clause in your five-year fixed-rate mortgage contract is critical. It could be the difference between saving thousands by refinancing or just hoping that rates stay low until your five years is up, because breaking your mortgage early will cost you an arm and a leg. Borrower beware.

For now, I continue to believe that three-year fixed rate options offer the best combination of protection and flexibility. You can find them today at rates that are only a little above five-year fixed rates. It is reasonable to expect that three years should be enough time to ride out the current inflation spike.

The Bottom Line: GoC bond yields plunged late last week. Suddenly, fixed mortgage rates could be on the way down.

That said, lenders may wait for bond-yields stabilize within their new ranges, and when a bond-yield plunge is driven by financial stability concerns, investors demand significant risk premiums which increase lender funding costs. (And as always, mortgage rates take the elevator on the way up and the stairs on the way down.)

Five-year variable rate discounts were unchanged last week. The BoC held its policy rate steady, which means that lender prime rates, and the variable mortgage rates that are priced on them, will remain at their current levels for the time being.

Looking forward, I still don’t think we’ll see variable rates move up or down over the balance of 2023. If I’m wrong, I continue to believe that it will be because more tightening is required.