The Longer the First Rate Cut Takes, the Lower Our Variable Mortgage Rates Will Go

March 11, 2024Canadian Mortgage-Related News Update – Separating Wheat from Chaff

April 1, 2024 Last week was chock full of news with implications for Canadian mortgage rates.

Last week was chock full of news with implications for Canadian mortgage rates.

Here are five key updates for anyone keeping an eye on Canadian mortgage rates:

- The latest Canadian Consumer Price Index (CPI) data

Last week Statistics Canada confirmed that our overall CPI fell to 2.8% in February on a year-over-year basis. That was down from 2.9% for January, and below the consensus forecast of 3.1%. The Bank’s most closely watched measures of core inflation, CPI-trim and CPI-median, also declined to 3.2% and 3.1% last month.

Shelter costs were once again the largest contributor. They increased by 6.5% year-over-year last month, primarily due to higher mortgage interest costs, which increased by 26.3%. By comparison, our CPI came in at 1.3% last month with shelter costs excluded.

Rising shelter costs are primarily a result of two key factors: 1) A supply/demand imbalance for housing, which is being exacerbated by record immigration, and 2) higher mortgage interest rates, which are directly tied to the Bank of Canada’s policy-rate level. As I wrote in this recent post, that means that the main sources of our remaining inflation pressure are either immune to, or exacerbated by, higher policy rates.

Softer-than-expected inflation gives the BoC leeway to cut its policy rate sooner, and the bond futures market is now assigning 50/50 odds that it will enact its first rate cut in June.

- The release of the minutes from the BoC’s most recent policy-rate decision

Last week the BoC released the Summary of Deliberations from its latest policy-rate decision and there were several points of interest:

- “Labour markets continued to ease gradually” and “compensation of employees rose an annualized 3.2% in the fourth quarter of 2023, the slowest growth rate since the second quarter of 2020.” Wage pressures are one of the most important factors being monitored by the BoC and this moderating trend is encouraging.

- “Governing Council members expressed concern that the housing market continued to pose upside risks to the inflation outlook. While house prices continued to fall in January, recent strength in resales could translate into a pickup in house prices and stoke shelter price inflation.” This concern is well founded. There is a lot of ancillary demand tied to real-estate purchases, so the Bank is right to be concerned that rate cuts will re-ignite our housing markets. This may well be the main reason why the Bank prefers to err on the side of over-tightening.

- The BoC’s council members agreed that “underlying inflation is not measured by a single statistic but rather by a collection of indicators”. For example, they are focused on the fact that “the share of components of the CPI growing above 3% continued to decline but was still close to 45% and significantly above the historical average.” The share of CPI components that have increased by more than 3% year-over-year did, however, decrease a little more in February.

- “Members discussed how they should consider the impact of persistently high shelter cost increases, which could make it more difficult to get inflation all the way back to 2% … [and] agreed that if mortgage interest costs were the only component holding up inflation, there could be some capacity to look through them.” However, they assessed “that this was not the current situation” and that “most components of shelter inflation, such as rent and expenses related to home ownership (including insurance, taxes and repairs), were still rising significantly in January.” With that said, some of those costs, particularly rents, are directly linked to mortgage interest costs.

- The members assessed that “core inflation had yet to show much downward momentum.” Our core CPI measures all declined again in February, for the second month, so we have seen more downward momentum since the BoC’s members made that assessment.

- Our federal government announces plans to reduce immigration.

Last week Marc Miller, our federal Immigration Minister, announced a plan to reduce the number of temporary workers as a percentage of our total population from its current level of 6.2% down to 5% by 2027.

This move follows the announcement of a two-year cap on international student visas in January.

Curbing our record levels of immigration will help reduce the supply/demand imbalance in some of our regional housing markets, and that will, in turn, help alleviate some of the upward pressure on the shelter costs that BoC rate hikes can do little to affect.

It is encouraging to see our federal government now rowing in the same direction as the BoC. Reduced immigration will help speed a return to the BoC’s 2% inflation target.

- The US Federal Reserve looks past the recent US inflation spike.

The Fed held its policy rate steady last week, as expected, but US Fed Chair Jerome Powell surprised markets with his accompanying commentary. Market watchers were expecting a hawkish turn in light of the US inflation uptick in February, but that’s not what they got.

Although Powell reiterated that the Fed still needed to have “greater confidence that inflation is moving sustainably toward 2 percent” before starting to cut, he also assessed that the US inflation uptick in February was likely only a bump in the road and didn’t change “the overall story which is that of inflation moving down gradually”.

The Fed continues to project a total of three 0.25% policy-rate cuts in 2024, and the US bond futures market now agrees with that forecast. That alignment in expectations held steady last week, and so did US bond yields after the meeting.

- The first international rate-cut domino has now fallen.

Last week saw the first cut by a major central bank since the pandemic ended.

The Swiss National Bank (SNB) lowered its policy rate from 1.75% to 1.50% and declared victory over its inflation surge when it said the fight against inflation over the past two-and-a-half years has been effective … [and] inflation is also likely to remain in this range over the next few years.”

This cut surprised financial markets, especially when coming from a central bank that is known for its cautious approach.

The Swiss franc weakened following the announcement, which will increase Switzerland’s import costs, but Swiss inflation came in at only 1.2% in February. That gave the Swiss National Bank (SNB) leeway to prioritize the boost that a softer currency will give to its exports and its anemic rate of economic growth.

The SNB’s cut will put pressure on other European central banks to follow suit. Economic growth is moribund throughout Europe. Any gains that Switzerland accrues through its weaker currency will come at the expense of other countries.

The global easing cycle has now officially begun. The Bottom Line: Government of Canada (GoC) bond yields were mostly flat last week, despite our better-than-expected inflation news. As is typically the case, GoC bond yields piggy-backed on their US equivalents, and they held steady following the Fed’s policy-rate meeting.

The Bottom Line: Government of Canada (GoC) bond yields were mostly flat last week, despite our better-than-expected inflation news. As is typically the case, GoC bond yields piggy-backed on their US equivalents, and they held steady following the Fed’s policy-rate meeting.

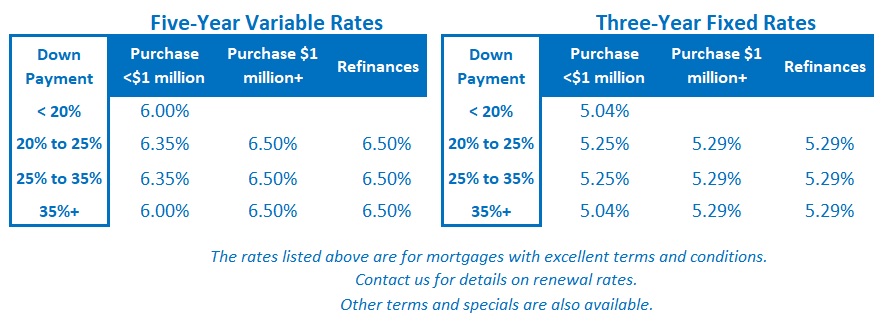

Fixed mortgage rates remain range bound, and variable-rate mortgage discounts were unchanged.

Lower Canadian inflation, reduced immigration, a less-hawkish-than-expected Fed, and the first rate cut by the central bank of a major economy are all encouraging developments for variable rate borrowers awaiting the BoC’s first rate cut. The bond market is currently giving 50/50 odds that we’ll see the first cut in June and about an 80% chance that it will happen by July.