Inflation Falls, But Bond Yields Rise Anyway

February 27, 2023Five Key Updates for Canadian Mortgage Rates

March 13, 2023 Let’s start with this week’s most welcome news.

Let’s start with this week’s most welcome news.

There is a zero percent chance that the Bank of Canada (BoC) will raise its policy rate when it meets this Wednesday. That means that variable-rate borrowers won’t be seeing their ninth increase in twelve months.

At its last meeting, the Bank said that it would pause from making additional rate increases over the near term, and a hike this Wednesday would renege on that commitment.

The Bank said that it will now also require “an accumulation of evidence” before abandoning its pause, and thus far it has seen only five weeks of additional data.

It needs more time to determine whether the series of rapid increases it has made to date will be “sufficiently restrictive to bring inflation back to the 2% target.” By the Bank’s own estimate, it can take up to 24 months before the impact of each hike is fully evident.

While the BoC isn’t going to raise rates this week, its latest policy statement could certainly impact the Government of Canada (GoC) bond yields, which our fixed mortgage rates are priced on.

Until recently, the bond market had been pricing in rate cuts by the BoC in the second half of this year, but the Bank did its best to push back against that notion at its last meeting. It warned that our economy had not cooled by as much as it had expected, and that it was still “more concerned about upside risks”.

Since then, we have received a blockbuster jobs report, a stronger-than-expected retail sales number, and housing markets that have shown surprising resilience. Inflation has cooled somewhat, but that decline was mostly credited to falling gasoline prices. Roughly two-thirds of the prices in our Consumer Price Index are still rising by 5% or more.

Not surprisingly, many bond-market investors are now leaning toward the higher-for-longer view. Rate-cut bets have diminished, and now the bond futures market thinks we may even see one more BoC rate hike before the year is out.

The Bank’s decision to pause from making additional hikes may itself add to our inflation pressures.

The US Federal Reserve is expected to keep raising its policy rate over its next several meetings, and the wider the gap in our policy rates becomes, the more the Loonie can be expected to weaken against the Greenback. That will further raise the price of everything we buy from the US (which adds up to 80% of our total imports).

Regardless, a temporary divergence in US and Canadian monetary policies makes good sense at this point for the following reasons:

- The US economy is still experiencing more inflation than the Canadian economy, so it stands to reason that it would need a higher policy rate to bring inflation to heel.

- The average American is also considerably less impacted by rate hikes because their household debt-to-income levels are much lower than those in Canada.

- The typical US mortgage has a 25- or 30-year term, whereas in Canada 5-year terms are by far the most popular.)

- Both countries are experiencing a slowdown in their interest-rate sensitive real-estate sectors, but real estate accounts for a much larger proportion of Canada’s total economic output. That will magnify the impact of each rate hike.

The Loonie has already weakened in anticipation of a gap between the BoC and Fed policy rates. Right now, currency traders expect that gap to peak at about 0.75%. Interestingly, US bond-market investors are pricing in another 1.00% in Fed rate hikes. Those bets will converge at some point, and if the US bond market is proven right, the Loonie will fall further.

Here’s an important factor that I don’t expect to see in the BoC’s statement this week:

An acknowledgement that the excess saving that built up on our household balance sheets during the pandemic has temporarily weakened the feedback loop between monetary policy and economic activity.

The Bank’s ability to cool inflation will be limited as long as consumers are willing (and able) to continue spending at today’s higher prices. Practically speaking, that will mean waiting it out until most Canadians have burned through most of their surplus cash. The Bottom Line: I expect the BoC to maintain a hawkish stance and to stay focused on upside risks. I think it likes the fact that the higher-for-longer bandwagon is strengthening.

The Bottom Line: I expect the BoC to maintain a hawkish stance and to stay focused on upside risks. I think it likes the fact that the higher-for-longer bandwagon is strengthening.

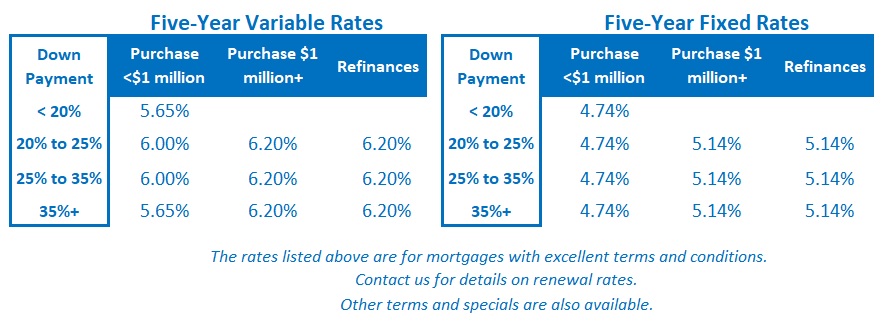

Several lenders ratcheted up their fixed rates last week, and the rest can be expected to follow soon.

GoC bond yields swung higher again early last week, continuing their piggy-back ride on US bond yields, which have been surging since early February.

At some point, the usual high correlation between US Treasury yields and their Canadian equivalents should temporarily weaken as our inflation and monetary-policy paths diverge, but there is no clear evidence of that yet.

Variable-rate discounts were unchanged last week.

More importantly, beleaguered variable-rate borrowers who have endured rate hikes of 4.25% over the past twelve months can look forward to the fact that their rates won’t be heading higher when the BoC meets this Wednesday.