How Will Weak Employment Data Impact Canadian Mortgage Rates?

July 8, 2024Inflation and Inflation Expectations Have Reset Lower. Are Mortgage Rates Next?

July 22, 2024

Last week we learned that US inflation cooled in June. That was welcome news for anyone keeping an eye on Canadian mortgage rates.

The US Consumer Price Index (CPI) increased by 3.0% year-over-year in June, down from 3.3% in May, and below the consensus forecast of 3.1%. The US CPI also decreased by 0.1% month-over-month, marking its first monthly drop since May 2020.

That downside surprise was particularly welcome news because the US inflation prints from the three prior months had all come in hotter than expected.

US core CPI, which excludes food and energy prices, decreased from 3.4% in May to 3.3% in June. That result was below the consensus forecast of 3.4% and marked the lowest level for US CPI since April 2021.

US CPI excluding shelter costs declined to 1.8% in June.

US CPI shelter cost remains the primary driver of US inflation pressure, but that is in part because it is a lagging indicator (meaning that it takes longer for price changes at its margin to impact the measured inflation data). While CPI shelter cost is still high with an increase of 5.13% year-over-year in June, its rate of increase has decelerated each month since March 2023. That consistent trend gives the US Federal Reserve leeway to discount the impact of shelter costs on overall CPI.

US bond-market investors responded to the latest inflation data by raising the odds of a Fed rate cut at its meeting on September 18 to 95%. They are now putting about the same odds on a second Fed rate cut before the end of the year.

Continuing US disinflation is very welcome news to mortgage borrowers on both sides of the 49th parallel.

US Treasury yields fell sharply, and Government of Canada (GoC) bond yields were taken along for the ride. That will put downward pressure on fixed mortgage rates in both countries.

If the Fed follows through with the expected two cuts by the end of this year, that will also give the Bank of Canada (BoC) room to enact more cuts without fear that the gap between US and Canadian policy rates will get too wide and cause the Loonie to continue weakening against the Greenback. (A weaker Loonie is inflationary because it increases the price of everything we import from US markets, which we must pay for in USD.)

Last Tuesday, during his testimony to the US Congress, US Fed Chair Jerome Powell said “more good data would strengthen” the case for looser US monetary policy, and last Thursday the latest US CPI data delivered right on cue. The Bottom Line: GoC bond yields moved sharply lower last week after the latest US inflation data were released. We’ll receive the latest Canadian inflation data tomorrow. The consensus expects our overall CPI to decline from 2.9% in May to 2.8% in June.

The Bottom Line: GoC bond yields moved sharply lower last week after the latest US inflation data were released. We’ll receive the latest Canadian inflation data tomorrow. The consensus expects our overall CPI to decline from 2.9% in May to 2.8% in June.

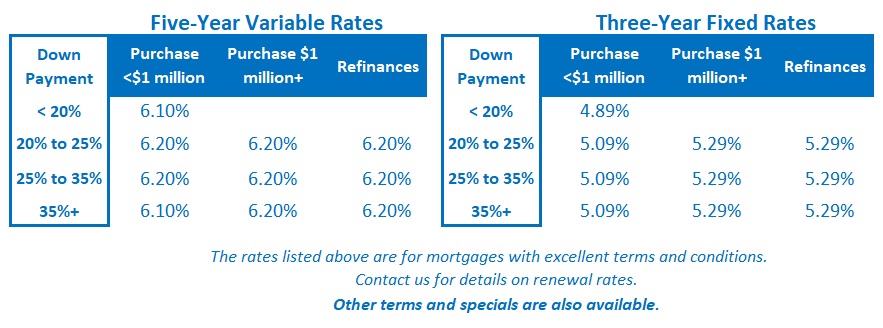

If a resumption of disinflation is confirmed, we may finally see our fixed mortgage rates break below their current ranges.

The bond-futures market is currently putting the odds of a BoC rate cut at its next meeting on July 24 at about 60%, but those odds will move higher if our inflation data are encouraging.

In the meantime, the BoC will also be releasing the results of its Survey of Consumer Expectations and its Business Outlook Survey for Q2 later this morning. Those reports will provide important updates on how our slowing economy is impacting inflation expectations.

I’ll be back next week with my take on the inflation and survey data.