Is Canadian Employment Really as Strong as It Looked Last Month?

February 12, 2024Why Canadian Fixed and Variable Mortgage Rates May Be Heading in Different Directions

February 26, 2024

Dog reading book with glasses.

I hope that you enjoyed the Family Day long weekend.

I used the holiday yesterday for its stated purpose, so there won’t be a new post this week.

I’ll be back next Monday as usual, and in the meantime, here are links to five recent posts that outline key factors that are impacting Canadian mortgage rates:

In this post I explain why the latest employment data showed that our labour market is softening despite the stronger-than-expected headline result.

This post explains why I believe a recession is still more likely than a soft landing in 2024 (and it also outlines the implications for Canadian mortgage rates).

This post summarizes my five key takeaways from the Bank of Canada’s (BoC) most recent policy-rate meeting.

This post explains why the composition of our current inflation pressure puts the BoC in a dilly of a pickle.

This post offers some mortgage-rate related predictions for 2024, and it looks back at how my 2023 predictions worked out. The Bottom Line: US inflation came in hotter than expected last Tuesday. US Treasury yields, and their Government of Canada equivalents, initially surged higher in response. But the rally quickly fizzled out, and bond yields on both sides of the 49th parallel ended up finishing flat for the week.

The Bottom Line: US inflation came in hotter than expected last Tuesday. US Treasury yields, and their Government of Canada equivalents, initially surged higher in response. But the rally quickly fizzled out, and bond yields on both sides of the 49th parallel ended up finishing flat for the week.

When upside surprises no longer push bond yields higher, which has been the case in back-to-back weeks first with the US employment data and then with the latest US inflation report, that implies that they are close to the top of their near-term range. That reality increases the likelihood that the next sustainable move in bond yields, and the fixed mortgage rates that are priced on them, will be lower.

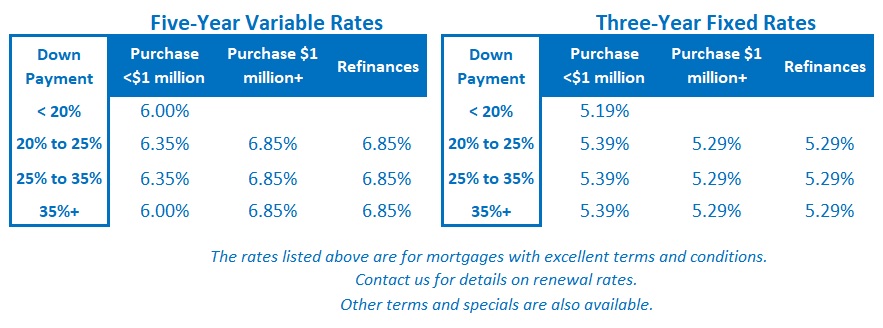

Five-year variable-rate discounts were unchanged last week.

The bond futures market still expects the BoC to start cutting its policy rate in June, but investors have reduced their bets on the Bank’s total policy-rate reduction in 2024 from 1.00% to 0.75%.