Was Our Latest Employment Data Just Sound and Fury?

May 13, 2024Softer Inflation Should Usher in the First Bank of Canada Rate Cut

May 27, 2024

I hope that you enjoyed the Victoria Day long weekend.

I took the weekend off from writing, so there won’t be a new post this week.

I’ll be back next Monday as usual. In the meantime, here are links to five recent posts on the key topics currently impacting Canadian mortgage rates:

This post explains why I don’t expect the stronger-than-expected April employment data to alter the Bank of Canada’s (BoC) rate-cut timetable.

This post explains why the US Federal Reserve’s latest policy-rate announcement provided welcome relief to Canadian fixed mortgage rates.

- Canadian Variable Mortgage Rates Should Fall Soon, But Fixed Mortgage Rates Are Headed the Other Way.

This post explains how our fixed and variable mortgage rates are driven by different factors and warns that the two may be moving in opposite directions over the near term. I also offer specific mortgage selection advice based on our current mortgage-rate backdrop.

This post offers a contrarian take on why our federal government’s bad budget may have a silver lining.

This post provides the highlights from the BoC’s last policy-rate meeting The Bottom Line: The latest US inflation, for April, came in lower than expected last week. That pushed US Treasury yields lower, and Government of Canada bond yields followed in their wake.

The Bottom Line: The latest US inflation, for April, came in lower than expected last week. That pushed US Treasury yields lower, and Government of Canada bond yields followed in their wake.

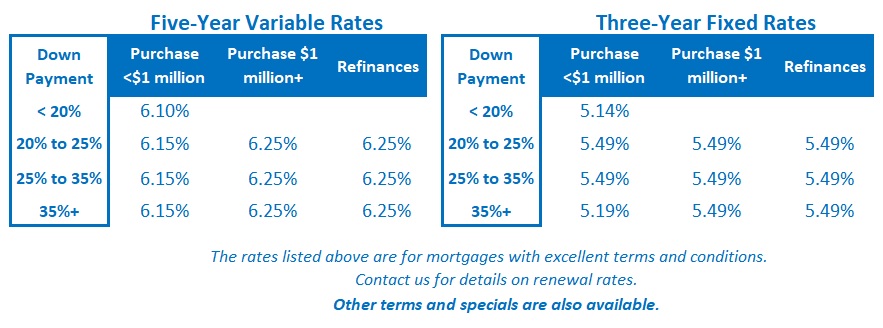

That removed some of the upward pressure on our fixed mortgage rates, and they remained range bound.

Five-year variable-rate discounts were unchanged last week.

All eyes will be on Statistics Canada’s release of our April inflation data later today. If the report confirms that prices have continued to cool, that may tip the balance in favour of a BoC rate cut at its next meeting on June 5.