US Inflation Rises, and Canadian Inflation Is About to Follow

August 14, 2023Why Another Bank of Canada Rate Hike Is Still Possible

September 5, 2023

Last week Statistics Canada confirmed that our headline Consumer Price Index (CPI) increased from 2.8% to 3.3% in July (annualized).

An inflation uptick had been widely expected because comparisons to price increases a year ago are now less favourable, but the July result still exceeded the consensus forecast of 3%.

Our CPI increased by a surprising 0.6% on a month-over-month basis in July. That price pressure was also broadly based (prices accelerated in five of the seven sub-categories that make up our CPI basket).

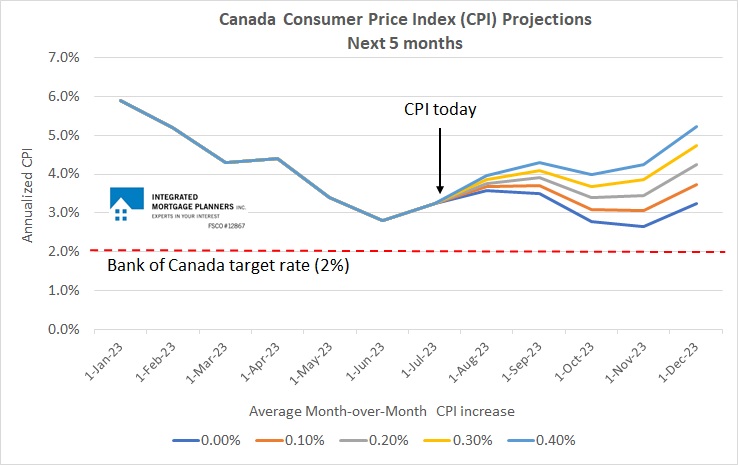

I have updated the chart below, which I originally drafted four weeks ago, to include this latest month-over-month result. It shows what will happen to our headline CPI if we average monthly prints of 0.0%, +0.1%, +0.2%, +0.3% and +0.4% over the five remaining months of 2023.

At this point we’ll be lucky if our CPI finishes the year in the mid-4% range.

As I warned in this recent post, our July inflation results are just the beginning. There will be plenty of additional upward pressure on our CPI over the remainder of this year.

Consider the following:

- Over the first half of 2023 our CPI data were helped by base effects, which occur when large price increases from last year roll out of the CPI data set. The average monthly print that rolled off during the first half of the year was 1.0%, but over the second half of 2023 the monthly prints rolling off will average only 0.02%. Base effects have just morphed from strongly disinflationary to inflationary, and that will likely remain the case for the remainder of 2023.

- Mortgage interest costs remain the largest contributor to headline inflation. While many market watchers believe that this will be less concerning to the BoC because higher mortgage costs are inflation of the Bank’s own making, I think that view is overstated. The BoC won’t forsake its mandate to maintain price stability just because interest rates are the main source of our current inflation overshoot. Those higher borrowing costs are still fuelling consumer and business inflation expectations, which can become self-reinforcing if left unchecked.

- Energy prices led our inflation surge in 2022, and they have made the largest contribution to our CPI drop thus far in 2023. But those globally based prices are swinging higher now, and the BoC has no control over them.

- Our labour market remains tight, despite the job losses in our latest employment report. This recent article in the Financial Post noted that “Unionized workers have staged 78 major strikes in the first six months of 2023 and pushed the average yearly wage settlement up to 2.9 per cent … [which is] the highest level in at least a decade …”. Labour is a pervasive cost, and it will take longer for inflation to return to 2% if annual pay increases above that level are being baked into union contracts.

- On the topic of strikes, the BC port-workers strike is estimated to have impacted about $10 billion worth of trade across the country. While it ended in early August, the strike’s inflationary impact will continue to reverberate through supply chains in industries across Canada for months to come.

Last month’s CPI data bolster the belief that a higher-for-longer rate path will be needed to bring inflation to heel, and bond-market investors are increasingly pricing in that view. The bond-futures market has now increased the odds of a BoC rate hike at its next meeting to about 33%, and it is assigning a 90% probability of another 0.25% increase by the end of the year.

Some market watchers are pointing to signs that our economic momentum is finally starting to slow to assuage concerns about last month’s CPI results. It’s true that consumer spending is down, credit-card utilization rates are up, and the supply of labour is increasing more rapidly than its demand. But those details miss a key point that I will keep emphasizing.

Slowing growth and a cooling job market are necessary but not sufficient conditions for returning inflation to target. The BoC’s monetary-policy tightening can’t influence every price, and the ones beyond its control will also influence how long it takes to return to 2%. (Commodity prices are one prominent example, and many of those are still running hot.)

In the meantime, while we can continue to speculate about where inflation and mortgage rates are headed, it’s clear that, post pandemic, almost all the surprises relating to both topics have been to the high side.

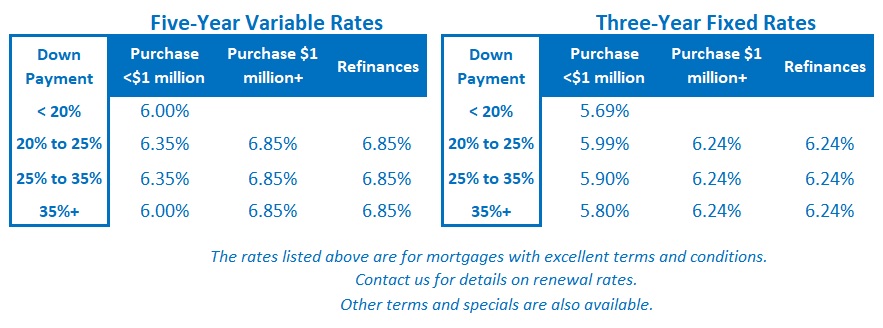

The Bottom Line: Government of Canada (GoC) bond yields followed their global counterparts higher last week, and fixed mortgage rates could ratchet up again this week.

The Bottom Line: Government of Canada (GoC) bond yields followed their global counterparts higher last week, and fixed mortgage rates could ratchet up again this week.

I continue to believe that today’s three-year fixed rates are a good option for conservative borrowers because they are significantly cheaper than shorter-term fixed rates, and because they also reduce the risk that borrowers will be paying an above-market rate in the latter part of their term (when compared to five-year fixed-rate options).

Five-year variable-rate discounts were unchanged last week.

Last month’s inflation data and the newly forming headwind from CPI base effects reinforce my belief that we will see at least one more 0.25% BoC rate hike (and variable-rate increase) before the year is out.