Why I’m Still Not Buying the Bond Market’s Rate Cut Bets

May 15, 2023Monday Mortgage Interest Rate Update

May 29, 2023 The Canadian Consumer Price Index (CPI) increased by 4.4% on a year-over-year basis in April, up from 4.3% in March.

The Canadian Consumer Price Index (CPI) increased by 4.4% on a year-over-year basis in April, up from 4.3% in March.

That result surprised bond-market investors.

Nine straight months of steadily falling inflation had emboldened them to bet on Bank of Canada (BoC) rate cuts starting this fall, even as the Bank itself pushed back against that notion.

Those bets unwound after Statistics Canada released its latest inflation report on Tuesday.

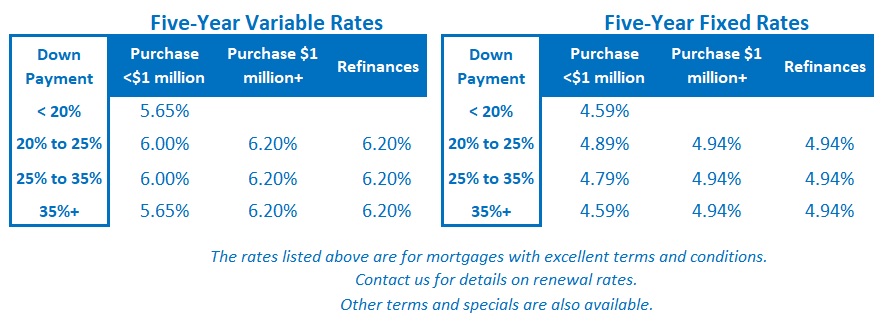

The five-year Government of Canada (GoC) bond yields increased from 3.09% on Tuesday morning to 3.32% by the close of business on Friday, and lenders have started to raise their fixed mortgage rates in response.

As I have written repeatedly in my weekly blogs, I thought the bond market was too optimistic with its rate-cut bets. I think the new warnings that another BoC rate hike is imminent will prove to be a similar over-reaction.

Inflation did tick higher last month, but about one-third of that rise in prices came from rising shelter costs, which in turn have been driven higher by a 28.5% year-over-year increase in mortgage interest costs. That specific price pressure is less concerning to the BoC because it is by design and of its own making.

Also, while our job market has proved surprisingly resilient and wage growth now slightly exceeds inflation, our economy’s demand for labour is no longer outstripping its supply.

Last month, as widely reported, we added 41,000 new jobs. But our labour force increased by 47,000 and our population increased by 72,000 over the same period. Those important contextual details were hardly mentioned.

When the BoC announced that it would pause its rate-hike cycle, it said that it would take an accumulation of evidence to move it off the sidelines in either direction.

Last month’s CPI data confirm that our inflation is getting stickier. That stickiness should eliminate near-term rate-cut hopes, but our economic momentum is also now slowing, and that reduces the urgency for more near-term hikes. (Stats Can’s most recent estimates have our GDP growing by 0.1% month-over-month in February and shrinking by 0.1% in March.)

The X factor influencing the BoC’s next rate move will continue to be the path of inflation expectations. The next round of consumer and business survey results will be released in early July, and if they show that inflation expectations haven’t continued to moderate, all bets are off.

In recent posts, I have offered a theory to help explain why our economic data have proven more resilient than expected in the face of the sharpest series of rate hikes on record.

Simply put, many Canadian consumers still have the excess cash they saved during the pandemic, and that cash has provided a buffer that has allowed them to absorb higher prices without much pain. This savings-fueled resilience in consumer spending is also stimulating labour demand. But that extra cash is dwindling. When it is spent, our economic momentum will diminish.

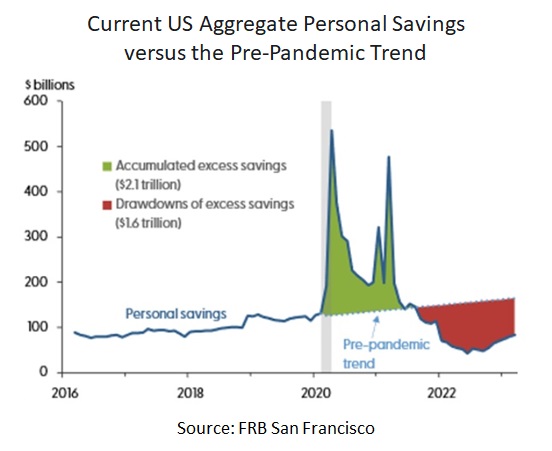

Last week, economist David Rosenberg highlighted the same theory to explain US economic resilience in a recent report by the San Francisco Fed.

It noted “unprecedented levels of excess savings” on US household balance sheets and concluded that “this dynamic in excess savings associated with the pandemic period is remarkably unlike any past recessions”. If you’re wondering why the economy is responding differently now than it has during past slow downs, there is at least part of the answer.

The report predicts that “these excess savings could continue to support consumer spending at least into the fourth quarter of 2023”.

The chart below illustrates how US household saving levels have fluctuated. They peaked at $2.1 trillion in August 2021 and have been drawn down by $1.6 trillion since then. That remaining savings buffer of about $500 billion will continue to insulate the US economy from the typical recessionary headwinds that accompany rate-hike cycles for a while longer.

That remaining savings buffer of about $500 billion will continue to insulate the US economy from the typical recessionary headwinds that accompany rate-hike cycles for a while longer.

If the San Francisco Fed’s forecast is roughly correct, and assuming that the path for the Canadian savings drawdown is similar, our economies won’t have slowed enough to bring inflation close to 2% until sometime in 2024. And our central bankers remain adamant that rate cuts won’t materialize until we reach that point.

Food for thought if you are a variable-rate borrower wondering when the BoC will start cutting your rate. The Bottom Line: Bond yields surged higher last week after Statistics Canada confirmed that inflation re-accelerated in April. Lenders began raising their fixed rates in response on Friday, with the rates offered on default-insured mortgages increasing the most thus far, by about 0.25%.

The Bottom Line: Bond yields surged higher last week after Statistics Canada confirmed that inflation re-accelerated in April. Lenders began raising their fixed rates in response on Friday, with the rates offered on default-insured mortgages increasing the most thus far, by about 0.25%.

This will be a slow week for mortgage related news and, without a new catalyst to cause change, more fixed mortgage-rate increases are likely over the week ahead.

Five-year variable mortgage-rate discounts were unchanged last week.

Higher near-term inflation has eliminated the bond market’s bets on rate cuts later this year. At the same time, the unprecedented household savings buffers in both Canada and the US will increase inflation’s stickiness, and along with it, the likelihood that rate cuts won’t materialize in either country until sometime in 2024.