US Inflation Heats Up Ahead of Trump’s Tariff-Related Price Increases

February 18, 2025Why Canada’s Strong GDP Growth Hasn’t Impacted Our Mortgage Rates

March 3, 2025

The Bank of Canada (BoC) won’t be feeling much Valentine’s Day love for our most recent inflation data, released by Statistics Canada last week.

Our Consumer Price Index (CPI) increased from 1.8% in December to 1.9% in January on a year-over-year (YoY) basis, consistent with the consensus forecast.

But that result was skewed by Prime Minister Trudeau’s temporary GST/HST holiday. TD Bank Senior Economist James Orlando estimated that our CPI would have increased by 2.5% YoY last month without that tax reprieve.

The BoC’s two key gauges of core inflation (CPI-trim and CPI-median) also ticked higher in January. Both increased by 2.7% YoY, a little above what market watchers expected. Mr. Orlando noted that nearer-term data indicate that “core inflation should continue to grind higher” in the months ahead.

But it wasn’t all bad news.

Shelter prices, which have been the main source of our inflation pressure over the past year, decelerated a little last month. Both average rent and mortgage-interest costs fell on a month-over-month basis, and further declines in both numbers are expected.

Our CPI ex-shelter increased by only 1.3% YoY in January (hat tip to Ben Rabidoux for that observation).

So, here’s the rub.

If we focus on our YoY inflation data, we’re in good shape.

All our key inflation gauges measured over that time span are within the BoC’s target range of 1% to 3%.

But they are currently being helped by base effects, which occur when substantial price increases from a year ago roll out of our CPI data set (because it only captures price changes over the most recent twelve months on a rolling basis).

A look at price changes occurring over a shorter time frame raises more concern, in part because the inflationary impact of the weaker Loonie is increasingly evident.

To state the obvious, today’s near-term month-over-month trends can’t be ignored because they often evolve to become tomorrow’s YoY trends.

But all considered, I still expect the BoC to continue reducing its policy rate for the following reasons:

- The powerful negative impacts from a US trade war are now its primary concern.

- The BoC’s monetary-policy tools are best suited to cooling inflation (as opposed to counteracting outright deflation, which is now also a looming risk).

- The Bank’s policy rate is currently 3%, which is at the upper end of its neutral range. It won’t be stimulating economic growth until it hits 2%. I think the Bank will want to continue cutting until it gets closer to that level.

- An increasing number of mortgage borrowers will be renewing their ultra-low pandemic rates in 2025. More BoC rate cuts will help reduce the payment shocks those renewers will face and thereby help to mitigate this still-intensifying economic headwind.

- The BoC recently assessed that inflation expectations have now effectively normalized. That gives it more flexibility to be accommodative.

The Bottom Line: Government of Canada bond yields rose a little after our most recent CPI data were released, but the rise didn’t last. Yields finished a little lower for the week and remained within their recent ranges.

The Bottom Line: Government of Canada bond yields rose a little after our most recent CPI data were released, but the rise didn’t last. Yields finished a little lower for the week and remained within their recent ranges.

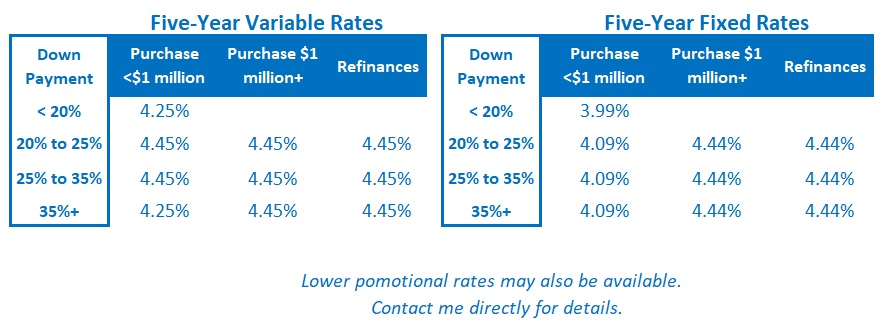

There is no immediate pressure on our fixed mortgage rates in either direction.

Variable mortgage rate discounts were unchanged last week.

For all the reasons outlined above, I think the BoC will continue to cut its policy rate over the near term and, ultimately, by more than the additional 0.50% reduction that the consensus currently expects.