Mortgage-Rate Update: What to Make of the Bank of Canada’s Hawkish Hold

October 30, 2023Canadian Fixed Mortgage Rates Fell (But by Less Than Expected)

November 13, 2023

In today’s post I’ll start by touching on the Fed’s decision to hold steady last week. Then I’ll take a quick look at some key US and Canadian economic data releases before closing with a look at some noteworthy comments by BoC Governor Tiff Macklem to the House of Commons Standing Committee on Finance.

The US Federal Reserve Stands Pat

Last week the US Federal Reserve matched the Bank of Canada’s (BoC) decision with a hawkish hold (meaning that it held its policy rate steady but warned that it will raise again if necessary).

In its policy statement, the Fed noted that “tighter financial and credit conditions … are likely to weigh on economic activity, hiring, and inflation”.

Most of the recent tightening in US financial conditions has been caused by surging US bond yields as investors have continued to hold a higher-for-longer rate view. Those rising bond yields have increased borrowing costs and impacted the US economy in ways that are more like Fed policy-rate increases.

Simply put, higher US bond yields are reducing the need for more Fed hikes.

Interestingly, US bond yields fell sharply in response to the Fed’s rate announcement – so some of the tightening impact from higher bond yields dissipated almost immediately after that was acknowledged.

The US economy is still running hot, clocking 4.9% GDP growth in Q3, but its momentum is expected to slow now that most US consumers have burned through their pandemic savings.

Last week’s sell off in the bond market was also tied to that evolving backdrop.

US Employment Data (for October)

Last Friday we learned that the US economy added 150,000 jobs in October, below the consensus estimate of 180,000 but only because unforeseen automotive strikes temporarily subtracted approximately 33,000 jobs from the total.

The US economy had averaged 258,000 new jobs per month over the previous year, so the October result marked a sharp slowdown, even when adjusted for the strikes.

Average wage growth also declined last month, from 4.3% in September to 4.1% in October on an annualized basis, and there were other signs of slight weakening in the US labour market.

The average workweek fell from 34.4 hours to 34.3 hours, the participation rate fell from 62.8% to 62.7%, the number of Americans working part-time for economic reasons increased by another 220,000, and overall US unemployment increased from 3.8% to 3.9%.

US bond-market investors liked the report because it confirmed that the US labour market momentum is cooling without threatening their soft-landing forecasts.

Canadian Employment Data (for October)

Last Friday Statistics Canada confirmed that our economy added 18,000 new jobs in October, lower than the consensus estimate of 23,000.

Despite those new jobs, our annualized unemployment rate rose from 5.5% in September to 5.7% in October because labour-force expansion outpaced the creation of new jobs.

Average annual wage growth also slowed last month, from 5.0% in September to 4.8% in October.

Our latest employment data confirm that our labour market’s supply and demand are coming closer to balancing out. The slowing pace of average wage growth confirms that labour costs are moderating (albeit only a little thus far, and not by nearly enough to assuage the BoC’s inflation concerns).

Canadian GDP Data (for August)

Last Tuesday Stats Can confirmed that our GDP was essentially unchanged in August, marking our second consecutive flat monthly print. It also expects a flat GDP result for September when the data for that month are finalized. (For reference, the BoC’s most recent Monetary Policy Report had forecast our GDP growth at 0.8% in Q3.)

The weaker-than-expected GDP data bolstered the consensus view that the BoC has finished hiking for this cycle, which makes sense to this blogger. But the data also fueling speculation that rate cuts will now materialize more quickly, which I’m not buying at this point.

Slowing economic growth is a necessary but insufficient condition for returning inflation to the BoC’s 2% target. The dominant theme for central bankers is still that inflation is running too hot, and it will take more than a stall in growth to meaningfully alter that narrative.

The BoC’s Testimony to Parliament’s Standing Committee on Finance

Last week BoC Governor Macklem made some noteworthy, and pointed, comments in his testimony to the Standing Committee on Finance.

He expressed concern that government spending “will be adding more to demand than supply is growing”, urged policymakers to consider the “inflationary impact” of their spending, and reminded them that “it’s going to be easier to get inflation down if monetary and fiscal policy are rowing in the same direction” (which of course implies that he doesn’t think they are doing that at the moment).

In his opening statement to the Finance committee, Governor Macklem highlighted “structural supply shortages in our housing market” as one of the key factors “getting in the way of low inflation”. That concern was also highlighted in the BoC’s most recent Monetary Policy Report when it noted that “rapid population growth” is driving “strong housing demand” and contributing to “a structural lack of housing supply”.

The BoC is normally reluctant to criticize its political masters, at times even frustratingly so. But Governor Macklem wasn’t pulling any punches last week.

That was refreshing to see. Here’s hoping those punches have their intended effect.  The Bottom Line: Government of Canada (GoC) bond yields were dragged lower by their US Treasury equivalents again last week, extending their recent decline. For example, the five-year GoC bond yield has fallen by 0.58% over the past two weeks.

The Bottom Line: Government of Canada (GoC) bond yields were dragged lower by their US Treasury equivalents again last week, extending their recent decline. For example, the five-year GoC bond yield has fallen by 0.58% over the past two weeks.

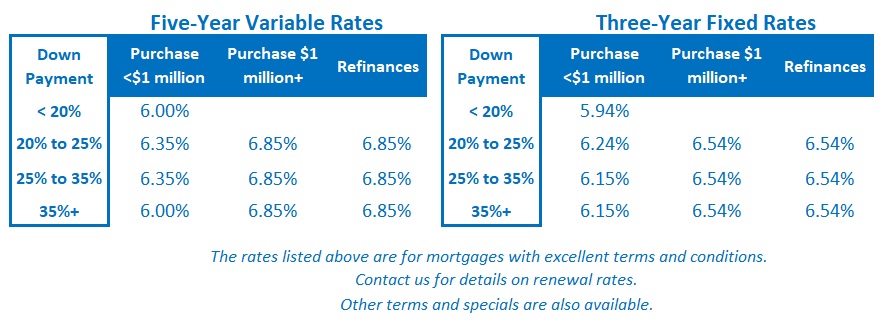

Lenders are starting to cut their fixed rates, but so far not by as much as bond yields have fallen. To cite a familiar refrain, lenders’ rates tend to take the elevator on the way up and the stairs on the way down.

That said, let’s welcome good news wherever we can find it: fixed mortgage rates will be dropping this week.

Variable-rate mortgage rate discounts are holding steady, and given the developments outlined above, it appears increasingly likely that the BoC has made its final hike for this cycle – much to the relief of variable-rate borrowers.