Happy Family Day

February 16, 2021Fixed Mortgage Rates Rise on Inflation Fears – But Are These Concerns Warranted?

March 1, 2021The five-year Government of Canada (GoC) bond yield surged higher last week, and that means that our five-year fixed mortgage rates are on the way up.

In fact, I’m surprised they haven’t risen already.

In today’s post I’ll explain what is pushing rates higher and offer advice on how borrowers who are currently in the market for a mortgage can navigate the current environment.

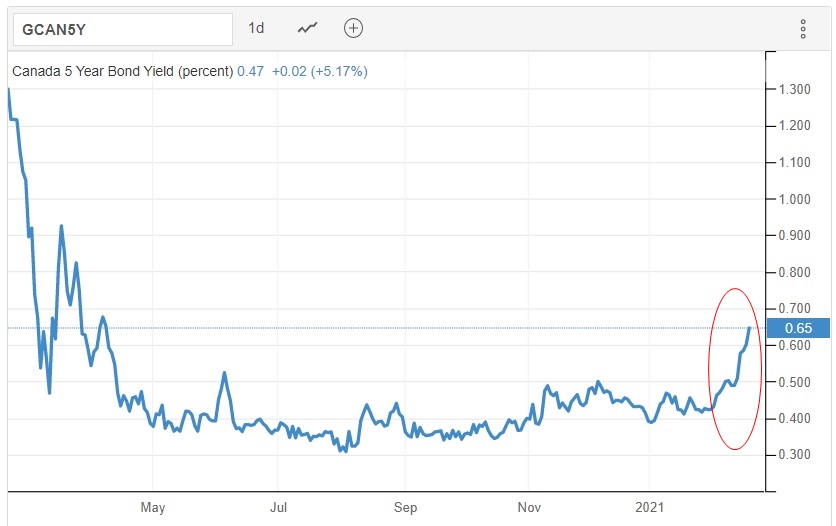

Let’s start with a chart showing the path of the five-year GoC bond yield since the start of the pandemic.

As you can see, this bond yield had been hovering in the 0.30% to 0.50% range until last week when it shot up to 0.65% (note the red circle). That increase has lowered gross lending spreads (and, by association, lender profit margins) to well below their normal levels.

As you can see, this bond yield had been hovering in the 0.30% to 0.50% range until last week when it shot up to 0.65% (note the red circle). That increase has lowered gross lending spreads (and, by association, lender profit margins) to well below their normal levels.

The only thing that has been holding lenders back is stiff competition – no one wants to be the first to move higher.

Regardless, the dam will break very soon.

The current surge in bond yields is really a US story, with GoC bond yields taken along for the ride because they have moved almost in lockstep with their US Treasury equivalents for years now.

Simply put, the recent run-up is a response to the growing consensus belief that US inflationary pressures will rise more quickly than previously expected.

Here is a summary of the factors underpinning that view:

- The Biden administration recently announced a massive $1.9 trillion pandemic relief package, which will include direct payments to citizens of up to $1,400, an increase in the federal minimum wage to $15/hr by 2025, an extension to existing pandemic assistance programs, and additional funding to states that will be directed toward a wide range of impacted groups.

- COVID infection rates are dropping, and the US has already vaccinated 60 million Americans. (By comparison, 1.5 million Canadians have been vaccinated thus far.) The US federal government predicts that the US will reach herd immunity by November. (Surprisingly, despite our much lower vaccination rates, our federal government continues to promise that we will reach that level by September.)

- Because the US experienced fewer lockdowns, albeit at the expense of higher infection and death rates, its economy has experienced less scarring. Investors now believe that the end of the US pandemic is in sight, and when that happens, the consensus expects the US economy to experience a boom that will be similar to the one that occurred in the Roaring Twenties when the Spanish flu ended.

- US inflation, as measured by their US Consumer Price Index (CPI), has risen from 0.10% in May to 1.4% in January. It is also virtually guaranteed to rise higher in the months ahead because the CPI is based on price changes over the recent 12 months, and the sharp price drops that occurred last April and May will soon roll out of the CPI calculation. When that happens, more normal prices will take their place, causing the CPI to rise higher still (and the same phenomenon will occur in Canada). The US Federal Reserve and the Bank of Canada (BoC) have both repeatedly said that they will look past this short-term anomaly and that it should not be interpreted as a signal that inflationary pressures will rise sustainably – but good luck convincing investors who are already primed for that outcome.

- Last September the Fed announced a shift in monetary policy toward average inflation targeting (AIT). Under this policy, the Fed will seek to achieve an average inflation rate of 2% over time, and that means that it will allow an extended period of below-target inflation to be followed by an extended period of above-target inflation. Put more simply, AIT is a signal that the Fed will let inflation run hot for a period of time after the US economy recovers, and that has heightened investor concern about future US inflation, which, in turn, has increased the premiums that investors demand for longer-term US bonds.

- Fed Chair Powell continues to speak in the most dovish tones imaginable, repeating words like “patience”, saying that his main concern was “falling short” with monetary policy, and that the recovery period is a “long way” from over. At this point it’s hard to imagine how he could sound more dovish, unless he showed up at his next presser in a bird suit and started cooing.

For my part, I continue to believe that the current run-up in bond yields will be temporary, and it is worth remembering that nothing goes up or down in a straight line. Here is the GoC five-year bond yield chart again, but this time over a longer time horizon. Note the repeated short-term

run-ups over the last 10+ years as the yield dropped from 4.11% to 0.65%.

Regular readers of this post will already be familiar with my detailed counterarguments to the prevailing view that inflation will soon run rampant. Here is a recap of my thoughts, with links to posts I have written for those who are interested in more detail:

Regular readers of this post will already be familiar with my detailed counterarguments to the prevailing view that inflation will soon run rampant. Here is a recap of my thoughts, with links to posts I have written for those who are interested in more detail:

- The Roaring Twenties argument is full of false assumptions.

- Both the US and Canadian economies have seen their employment momentum stall out and that, not inflation, tops the Fed’s and BoC’s worry lists.

- The US and Canadian economic output gaps (which measure the gaps between their actual outputs and their maximum potential outputs) are still the widest they have been since the depths of the Great Recession in 2008. Inflationary pressures won’t rise sustainably until those gaps come close to closing.

- The short-term inflation spike caused by the rolling off of last year’s sharp price declines will create a lot of market noise, but that’s all it will be. We may also see an inflation spike when the pandemic ends and when high-touch service businesses are brought back online, but I think that too will only produce a short-term sugar-high for our economies. Once the initial demand surge passes, the behavioural changes that formed during the pandemic and which engendered more frugal habits will continue to reduce consumption from pre-pandemic levels.

- The rise of COVID variants has the potential to either cause a third wave or engender enough fear of a third wave to hurt confidence and keep consumers and businesses cautious.

- Pandemic aside, longer-term factors such as technological advances, high debt levels and aging demographics will continue to assert downward pressure on inflation for the foreseeable future.

- Specific to Canada, our federal government’s vaccination timetable, which recently turned the BoC more optimistic, still seems wildly out of touch with reality.

Despite some ominous warnings in the mainstream media, a small increase in five-year fixed mortgage rates won’t have much real impact except, of course, pinching the pockets of anyone who has to secure financing during the (I think) short time when that increase will apply.

Today’s borrowers have to qualify at the current stress test rate of 4.79%, so an increase in real rates won’t have any impact on the amount they can actually borrow. Also, anyone who is about to renew an existing five-year fixed-rate term will still be able to lock in a rate that is lower than what they have been paying (because five years ago, five-year fixed rates were priced in the mid-2% range).

If you’re in the market for a mortgage today, the usual tips apply.

If you will want a fixed rate, which is likely, lock in a pre-approval to guard against rising rate risks. If your mortgage is up for renewal in the next 120 days, the same advice applies – lock in a new live-deal rate ASAP.

I wouldn’t suggest that borrowers who are more comfortable with a fixed rate switch to variable in reaction to a small increase in their fixed-rate options, but if we see multiple fixed-rate increases in the months ahead, the relative appeal of variable rates will rise.

While fixed mortgage rates are subject to the vagaries of the bond market and its investors, variable mortgage rates are priced on the BoC’s policy rate, and as such, are only moved by its steady hand.

The Bank has long said that it won’t raise its policy rate until sometime in 2023, and more recently, it has even speculated that another rate cut is possible. On a related note, the BoC won’t likely move its policy rate before the Fed moves, to avoid pushing the Loonie higher against the Greenback. And the Fed’s latest dot plot forecast suggests that it may not raise again until 2024.

If I’m right, and any fixed-rate increases prove temporary, variable rates will also be able to be converted to lower fixed rates farther down the road (as this post explains).

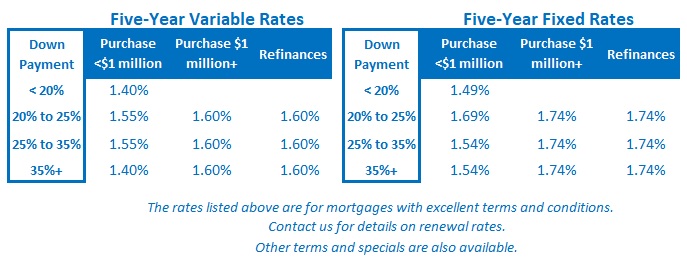

To be clear, there are a lot of moving parts that will determine what happens with the pandemic, with the ensuing economic recovery, and with interest rates. While no one should sound too certain about what the future will hold, my research and my gut both agree that the consensus is over-estimating future inflation. The Bottom Line: It is very likely that fixed-mortgage rates will rise this week, by anywhere from 0.10% to 0.25%. Meanwhile, the BoC’s policy rate that our variable mortgage rates are priced on isn’t expected to move higher until sometime in 2023 (at the earliest).

The Bottom Line: It is very likely that fixed-mortgage rates will rise this week, by anywhere from 0.10% to 0.25%. Meanwhile, the BoC’s policy rate that our variable mortgage rates are priced on isn’t expected to move higher until sometime in 2023 (at the earliest).

1 Comment

Excellent as always, David! Thank you