Inflation Rises Again, But Not the Component That Matters Most

November 22, 2021Five Key Updates for Mortgage Rates Last Week

December 6, 2021It was shaping up to be a quiet week for mortgage rates until it was announced on Friday that a newly identified Omicron coronavirus variant was spreading quickly across Africa, Europe, and Australia.

Omicron appears to be both more contagious and more resistant to vaccines. Epidemiologists estimate that it will take two to four weeks of testing before we will have a reliable assessment, but investors didn’t wait. They responded to the news by piling into safe-haven assets and delaying their bets on rate-hike timing.

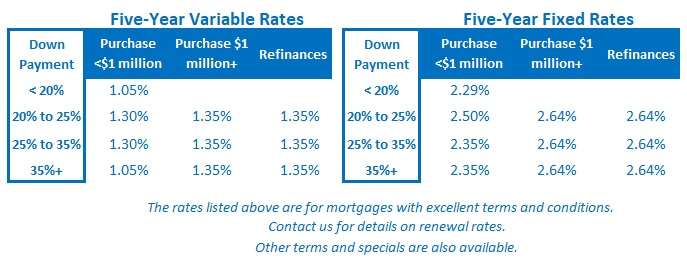

That drove bond yields lower, and the five-year Government of Canada (GoC) bond yield, which our five-year fixed mortgage rates are priced on, plunged by 0.16% (which is a significant drop).

Friday’s news was, first and foremost, a reminder that the pandemic is a global crisis still very much with us.

North Americans have slowly been returning to normal life under the widely held assumption that the worst of COVID is behind us, but global vaccination rates are nowhere near the levels needed to eliminate the risk that new variants, such as Omicron, will spawn and spread before being detected.

It pains me to reiterate this, but we are still in the middle innings of this crisis. If Omicron is as contagious and vaccine resistant as feared, we may not have seen the last of travel bans, school closures and lockdowns.

The prospect of all of this unfolding will likely kill the bond-yield rally that has been pushing our fixed mortgage rates higher, and if we do take another step back, the Bank of Canada will likely delay its rate-hike timing, which means our variable mortgage rates will stay lower for longer.

But that would be a thin silver lining in an otherwise very dark cloud.

Our policy makers will have much less dry powder to offset the next round of economic shocks.

Governments have already taken on vast amounts of debt from doling out eye-watering levels of stimulus, and central banks have already pumped massive amounts of liquidity into the global financial system, keeping interest rates pinned to the floor.

The incremental benefits of these measures may already be outweighed by the rising risks that negative side-effects like asset bubbles will pop and destabilize the financial system. That is especially true because policy makers need to keep increasing the magnitude of each new round of stimulus to replicate the impact of the last round.

Simply put, in addition to being vaccine resistant, Omicron’s economic impacts may prove to be stimulus resistant.

From a mortgage-rate perspective, while the market’s initial reaction was to drive bond yields lower, another COVID outbreak would exacerbate supply-chain bottlenecks, labour shortages, and likely prolong the current inflation spike.

Here’s hoping we’ll be done learning the Greek alphabet soon. The Bottom Line: Bond yields lost their upward bias in a hurry on Friday after the Omicron news broke, and that should, at the very least, staunch the steady rise in fixed mortgage rates for the time being.

The Bottom Line: Bond yields lost their upward bias in a hurry on Friday after the Omicron news broke, and that should, at the very least, staunch the steady rise in fixed mortgage rates for the time being.

The market is also betting, at least initially, that another global outbreak will delay central bank rate hikes and any associated rise in variable mortgage rates.