Canadian Fixed Mortgage Rates (Finally) Falling

November 6, 2023More Good News for Canadian Fixed Mortgage Rates

November 20, 2023 Bond yields, and the fixed mortgage rates that are priced on them, have been on a roller coaster lately.

Bond yields, and the fixed mortgage rates that are priced on them, have been on a roller coaster lately.

After surging higher over the summer months, medium-term US Treasury and Government of Canada (GoC) bond yields fell by about 0.50% after the US Federal Reserve (Fed) and the Bank of Canada (BoC) decided to hold their policy rates steady at their most recent meetings.

That rally (which caused bonds yields to drop) was based on the now widespread belief that neither central bank will raise their rates again this cycle.

Thus far, the most competitive fixed mortgage rates have fallen by only about 0.20%. For reasons that I will explain, that may be it for the time being.

The drop in bond yields was problematic for the Fed and the BoC because it lowers associated borrowing costs, thereby undermining our central banker’s efforts to tighten financial conditions.

In a speech last Thursday, US Fed Chair Powell used a few carefully chosen words to stop the rally in its tracks.

When speaking about the current backdrop, he said the Fed is “not confident” that US monetary policy is “sufficiently restrictive”. He warned that the Fed “will not hesitate” to hike rates again if needed.

Bond yields promptly swung the other way, rising by about 0.15% to retrace some of their recent decline.

The tug of war between central bankers and bond-market investors will play out over the next few quarters.

The central bankers want financial conditions to remain tight so that inflation will continue to cool. Many bond market investors believe that a sharper-than-expected slowdown will force the Fed and the BoC to start cutting rates whether they want to or not.

While most people now believe that the Fed and the BoC have stopped raising, views on when rate cuts will begin still differ widely.

The BoC’s most recent Survey of Canadian Market Participants confirmed that, on average, they expect the Bank to start cutting next April. The Fed futures market is pricing in the first Fed cut next June.

Conversely, the BoC and the Fed continue to insist that inflation will have to return to target before they will consider rate cuts. They are projecting that it will take much longer than the middle of 2024 for that to happen. (The BoC projects that it will take until 2025, and the Fed isn’t forecasting a return to 2% until 2026.)

Canadian mortgage borrowers should expect the current bond-market volatility to continue until the rate-cut expectations of the various stakeholders become more aligned.

Advice for Now

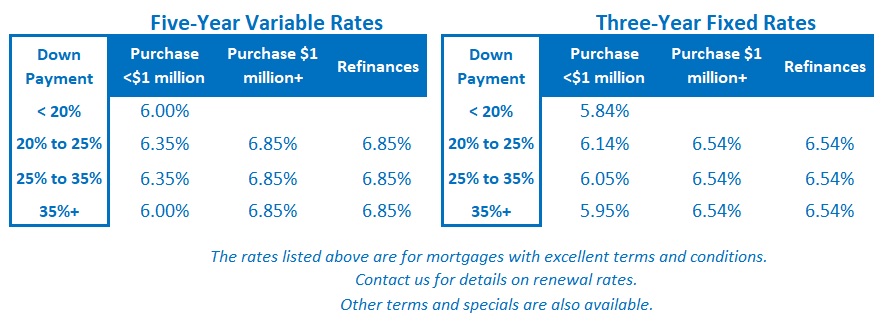

If I were in the market for a mortgage today, I would be choosing between a three-year fixed rate and a five-year variable rate.

A fixed-rate three-year term offers conservative borrowers the best balance of cost and risk among today’s fixed-rate options. Borrowers must pay a premium of about 0.35% over five-year fixed rates, but in exchange, they can come back to the market two years sooner. Three years should be ample time for the higher rates to cool inflation.

One- or two-year fixed-rate premiums are still much higher. The shorter the term, the greater the risk of having to renew before rates have fallen enough to leave borrowers better off in aggregate.

If you can tolerate the inherent uncertainty in variable-rate risk, and if you are prepared to be patient, today’s variable rates aren’t likely to increase much from their current levels, if at all. They will also put you in a position to benefit immediately when the BoC finally starts cutting.

Simply put, I think the odds of producing the lowest total borrowing cost favour the five-year variable rate. But three-year fixed-rate borrowers will sleep better until inflation cools sufficiently and mortgage rates begin to fall.  The Bottom Line: GoC bond yields moved about 0.20% higher last week, retracing some of their recent declines.

The Bottom Line: GoC bond yields moved about 0.20% higher last week, retracing some of their recent declines.

Some lenders dropped their fixed rates last week by about 0.20%. Last week’s reversal in yields means they’re probably done for the time being. That said, some laggard lenders have still not announced any drop in their fixed mortgage rates in response to the earlier decline in bond yields. (I’m looking at you, Big Six Banks.)

Five-year variable-rate discounts were unchanged last week. More BoC rate hikes appear increasingly unlikely, but rate cuts are probably still a ways off.