What the Latest Consumer Price Index Means for Mortgage Rates

February 24, 2014How the Latest Canadian and U.S. Employment Data Are Likely to Impact Our Mortgage Rates

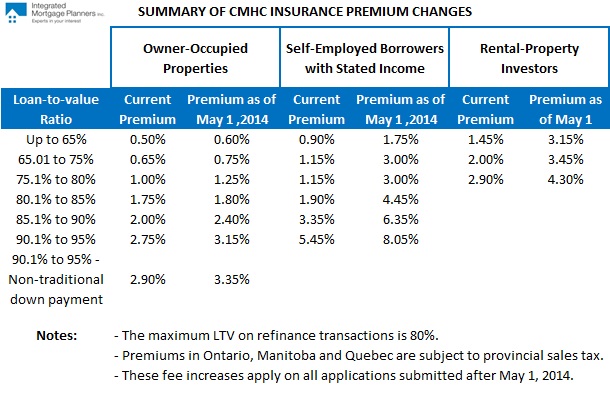

March 10, 2014Last Friday Canada Mortgage and Housing Corporation (CMHC) announced that it will increase its mortgage-default insurance premiums, effective May 1, 2014. Current premiums will remain in effect on all mortgage applications that are submitted before this date, even in cases where the transaction closes well after the changeover deadline.

Bluntly put, the impact on the average borrower will be negligible.

To highlight what the typical impact of this change might look like with an example, let’s assume that a borrower is purchasing a $400,000 property with a $40,000 down payment, that the property will be used as his/her principal residence, and that he/she can qualify for financing using traditional underwriting guidelines:

- This deal has a loan-to-value of 90%, which means that our borrower’s high-ratio insurance premium will rise from 2.00% to 2.40% after May 1.

- In dollar terms, that extra 0.40% premium will increase the cost of insuring this borrower’s $360,000 mortgage from $7,200 to $8,640.

- If our borrower chooses to roll the default-insurance premium into the mortgage balance, as almost all borrowers do, the monthly payment on his/her five-year fixed-rate mortgage with a 25-year amortization and a rate of 3.09% would be increased by $6.88/month.

The chart below summarizes all of the coming changes to CMHC’s insurance premiums:

Here are five key points of note relating to this announcement:

- CMHC justified these fee increases as being necessary in the face of higher capital funding requirements, particularly when insuring investment properties and mortgages for self-employed borrowers who can’t qualify under traditional underwriting guidelines. The more capital an insurer has to set aside for its insurance portfolio, the higher its costs. CMHC is simply raising its premiums to pass these higher costs on to consumers.

- Interestingly, in late 2013 the two private companies that compete with CMHC, Genworth and Canada Guaranty, met with the federal government to argue that their mortgage-default insurance premiums need to be increased for that very reason. But the two smaller private players needed CMHC to make the first move because it is by far the largest default-insurance provider in the Canadian market. To no one’s surprise, Genworth announced almost immediately that it will match CMHC’s fee increases across the board and Canada Guaranty is expected to follow shortly.

- These default-insurance fee increases impact all lenders equally, unlike other recent CMHC policy changes. For example, when CMHC changed the costs and policies associated with its bulk mortgage-insurance programs last year, it created a funding-cost disadvantage for monoline lenders. That’s because monoline lenders, who specialize only in mortgages, rely heavily on bulk insurance programs to securitize their low-ratio mortgages, whereas balance-sheet lenders have access to a diverse array of alternative funding solutions that they can shift volume to if bulk insurance mechanisms become less attractive. As a mortgage originator who works with every type of lender, I was glad to see CMHC make a change that didn’t tilt the playing field further in favour of one group of lenders, to the detriment of others.

- Several lenders offer slightly lower rates to high-ratio borrowers because once mortgages are insured against default, they are cheaper to securitize. This discount is usually five basis points and using the example above, an interest rate of 3.04% instead of the more typical 3.09% would save our high-ratio borrower $9/month. Thus, in today’s market, the incremental increases to the cost of high-ratio mortgage insurance that take effect after May 1 can actually be more than offset by the currently available additional rate discount that several lenders offer to high-ratio borrowers. (While borrowers who make a down payment of 20% or more pay a rate of 3.09% instead of the 3.04%, they still enjoy a far cheaper overall borrowing cost because they avoid the thousands of dollars in mortgage-default insurance premiums that accompany high-ratio rate discounts.)

- By substantially raising the cost of insuring mortgages for rental property investors and for self-employed borrowers who can’t qualify under traditional underwriting guidelines, CMHC is effectively pushing this business back into the non-prime lending realm. This move will be applauded by alternative lenders and by others who feel that CMHC offers its insurance backing, and by association, the ultra-low rates that accompany it, to too broad a swath of Canadian borrowers. Put another way, perhaps not every mortgage deserves a taxpayer-subsidized rate discount, and CMHC’s more draconian fee increases pay homage to that belief.

Five-year Government of Canada (GoC) bond yields fell by six basis points last week, closing at 1.63% on Friday. Borrowers who are putting down at least 20% on the purchase of a new home should be able to find a five-year fixed rate in the 3.09% range and borrowers who are putting down less than 20% can now find five-year fixed rates for as low as 3.04% (albeit with more limited terms and conditions and the added cost of high-ratio mortgage insurance).

Five-year variable-rate mortgages are offered at rates as low as prime minus 0.65%, which works out to 2.35% using today’s prime rate of 3.00%. Several Big Five banks lowered their posted rates to 4.99% last week so a drop in the Mortgage Qualifying Rate (MQR), which is used to underwrite variable-rate applications, should be right around the corner.

The Bottom Line: Mortgage-default insurance just got a little more expensive for the typical Canadian high-ratio borrower. Nonetheless, these cost increases are justified and should not produce any material impact on our real estate markets. To put our soon-to-be slightly more expensive high-ratio mortgage programs in perspective, consider that they still enable Canadians to buy principal residences with leverage ratios of up to 19 to 1, and at far cheaper rates than any conceivable alternative.

2 Comments

Dave,

So will it generally become harder to finance rental properties ( esp non- legal ones) as of May 1, 2014.

i.e should we be nudging potential investors to step up sooner?

Thanks..

anne

Hi Anne,

It will be harder in the sense that it will be more expensive (because the mortgage-default fees will be higher). If you have potential investors looking to buy, they should certainly be made aware of the May 1 deadline for new applications.

Best,

Dave