How Low Will the US Fed Go This Wednesday?

September 16, 2024A Mortgage Stress-Test Change at Last

September 30, 2024 What a week for Canadian mortgage news.

What a week for Canadian mortgage news.

In the span of only five days, we saw Canadian inflation return to the Bank of Canada’s (BoC) 2% target, the US Federal Reserve slash its policy rate by 0.50%, and our federal government announced sweeping changes to its mortgage default-insurance policies.

Here is an update on what transpired, together with my take on the implications for our mortgage rates and housing markets:

Canadian Inflation Returns to Target

Last Tuesday Statistics Canada confirmed that our Consumer Price Index (CPI) fell from 2.5% in July to 2% in August. All the Bank of Canada’s (BoC) key core-inflation gauges continued to cool last month.

Mortgage interest costs contributed the most to our inflation. With mortgage interest costs excluded, our CPI was just 0.9% in August (as per economist Ben Rabidoux).

In its July Monetary Policy Report the BoC forecast a return to target in Q4 2025. Our CPI’s return to 2% has happened much faster than expected. At this point, with prices sharply cooling and clear signs of slowing economic momentum, the Bank is now squarely focused on downside risk.

Our policy rate currently stands at 4.25%, and by the Bank’s own estimate, it will restrain our economic growth until it falls into a range between 2.5% and 3%.

With inflation no longer necessitating restrictive rates, the BoC should be in a hurry to ease off on its monetary-policy brake That increases the odds of a 0.50% cut at its next meeting on Oct 23.

Speaking of which …

The US Federal Reserve Reduces Its Policy Rate by 0.50%

Last Wednesday, the US Federal Reserve started its long-awaited rate-cut cycle with a 0.50% decrease.

While this outsized move came as a surprise to some, it probably shouldn’t have. The Fed has started six of its last seven rate-cut cycles with a 0.50% drop.

In its policy statement, the Fed cited “greater confidence that inflation is moving sustainably toward 2 percent over the longer run” but also acknowledged that “the economic outlook is uncertain”.

At his accompanying press conference, Fed Chair Jerome Powell said the big move was primarily intended to staunch any further weakening in the US employment market.

The Fed’s board members now forecast, on average, another 0.50% drop in the Fed’s policy rate over the remainder of 2024, another 1% reduction in 2025, and a 0.50% drop in 2026. Interestingly, that total reduction of 2.5% exceeds the 2% drop that the bond-market investors are currently pricing in for the BoC.

US Treasury yields didn’t move much immediately following the Fed’s announcement. While that was somewhat surprising, the odds say they will still move lower. Economist David Rosenberg recently noted that “historically, only half of the bond rally has occurred by the time the first cut arrives”.

Changes to Mortgage-Default Insurance Rules

In a surprise move last week, our federal government announced the following rule changes for default-insured mortgages, to take effect on December 15, 2024:

- The maximum purchase price for borrowers with down payments of less than 20% will increase from $1 million to $1.5 million.

- The maximum amortization period for first-time home buyers with down payments of less than 20% will increase from 25 years to 30 years.

- The maximum amortization period for anyone purchasing a newly built owner-occupied home (or condo) with down payments of less than 20% will increase from 25 to 30 years.

These announcements came out of left field.

There had been industry lobbying for an increase in the maximum purchase price on default-insured mortgages to $1.25 million (which didn’t seem unreasonable given that average house prices have increased by about 75% since the original $1 million cap was introduced). But the move to $1.5 million was an over-compensation. That limit is more than double the average Canadian house price.

The decision to allow increased amortizations to default-insured first-time buyers and purchase of new-construction properties will provide some near-term benefits.

Eligible buyers will see their affordability increase by about 10%, developers sitting on unsold units should see an uptick in demand, and lenders will now be able to offload more of their default risk to Canadian taxpayers at a time when that risk is increasing.

But these are no panaceas.

The fundamental disconnect that is underpinning our housing crisis remains. We still have too much demand chasing too little supply.

Making it easier to take on debt doesn’t fix that problem. These mortgage rule changes can fairly claim to make housing more affordable for some over the short term, but only by making them even less affordable to others over the long term.

Politically speaking, these changes may engender a bump in the polls or help stave off a no-confidence vote. But practically speaking, all they will really do is increase debt now and house prices over time.

Mortgage Selection Advice

Last week’s Canadian CPI and US Fed developments reinforce my previous assessment of our current mortgage-rate backdrop (so I will reiterate what I have written in several recent posts).

Variable rates are likely to fall substantially from their current levels. In my opinion, that justifies paying the upfront premium they still command. If the BoC cuts by another 1.25% (or more), variable rates will outperform all of today’s available fixed-rate options.

With that said, there are no guarantees that economic events will progress as expected.

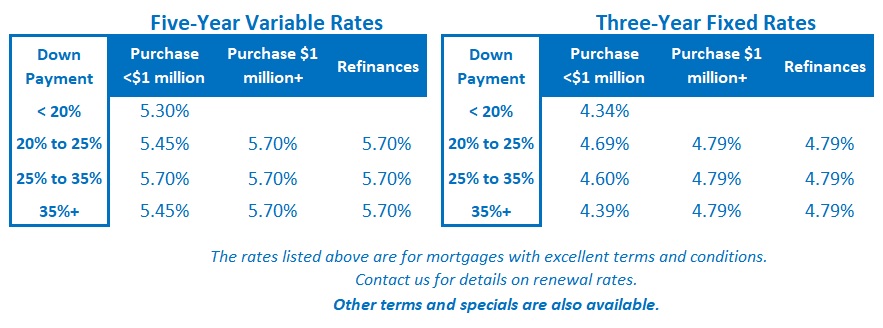

If you prefer the stability of a fixed mortgage rate, I think you are well advised to consider three-year fixed rates today. While five-year terms still come with the lowest fixed rates on offer, I worry that five years is too long to lock in at this point in our interest-rate cycle. The premiums on one- and two-year fixed rates are still too onerous.

Anyone considering fixed-rate options should also pay extra attention to the terms and conditions in their mortgage contract. They vary widely among lenders and can have a surprising impact on the overall cost of your loan, especially if mortgage rates drop significantly during your term.

If you want to learn more about this topic, my post entitled What’s in the Fine Print is a good place to start. It provides a detailed summary of the terms and conditions to watch out for and links to other posts that dive deeper into the most important ones. The Bottom Line: Government of Canada bond yields were range bound last week, and our fixed mortgage rates held steady.

The Bottom Line: Government of Canada bond yields were range bound last week, and our fixed mortgage rates held steady.

Bond-market investors are pricing in a more aggressive rate-cut timetable for the BoC. That should keep GoC bond yields, as well as our fixed mortgage rates, trending lower.

Variable-rate mortgage discounts were unchanged last week.

Variable-rate borrowers should continue to expect further rate cuts ahead. If the BoC successfully executes a soft landing, where it returns inflation to target without triggering a recession, then it will likely reduce its policy rate by another 1.25% (which is about what the bond market is currently pricing in).

Conversely, if the BoC has left its policy rate too high for too long and that triggers a recession, the Bank will be compelled to reduce its policy rate below its neutral-rate range to help stimulate a recovery. That would mean cuts of 1.75% or more (and this is the outcome that appears increasingly likely from this blogger’s desk).