A Smorgasbord of Good News for Canadian Mortgage Borrowers

September 23, 2024Bond Yields Take a U-Turn. Are Canadian Fixed Mortgage Rates Next?

October 7, 2024

Last week the Office of the Superintendent of Financial Institutions (OSFI), our banking regulator, announced that it will no longer require any renewing mortgage borrowers to pass the stress test if they want to switch lenders at renewal.

This change will take effect on November 21, 2024.

Thus far, only high-ratio insured borrowers have been exempted. According to OSFI, that is because they paid for mortgage-default insurance (which is required when you make a down payment of less than 20%).

The current stress-test policy requires uninsured borrowers who want to switch lenders at renewal to qualify at a rate that is 2% above their actual rate.

This rule has been in place since 2017. Over that time, it has unfairly limited options for the most stretched uninsured renewing borrowers. Many of them were forced to renew at above-market rates (notwithstanding OSFI’s insistence that it could find no evidence of this).

On the one hand, I applaud this change. The unfairness of requiring borrowers to pass a tougher test to switch lenders at renewal was anti-competitive, and worse, regressive.

But on the other hand, it was frustrating to hear OSFI’s Superintendent, Peter Routledge, acknowledge that the existing policy “wasn’t fair”, that lenders taking on non-stress tested borrowers at renewal involved “reasonable risk-taking”, and that “there isn’t reckless underwriting in straight switches”.

All the points he cited have been made repeatedly by industry stakeholders (including this blogger).

OSFI’s repeated refusal to amend its stress-test renewal policy has negatively impacted Canadians for years. The justifications used when the change was finally made merely reinforced the hypocrisy of its previous inaction.

Our Latest Economic Data

Last Friday, Statistics Canada provided its latest update on our GDP (these estimates are released with a lag because it takes time to compile the data).

Stats Can estimated that our GDP increased by 0.2% month-over-month in July. That result was above the consensus forecast of no growth, but it followed no growth in June, and Stats Can is forecasting no growth again in August.

Our GDP is now tracking between 1% to 1.5% (annualized) in Q3. That is well below the Bank of Canada’s (BoC) most recent forecast of 2.8%.

Bond market investors now slightly favour a 0.50% cut by the Bank at its next meeting.

Mortgage Selection Advice for Today

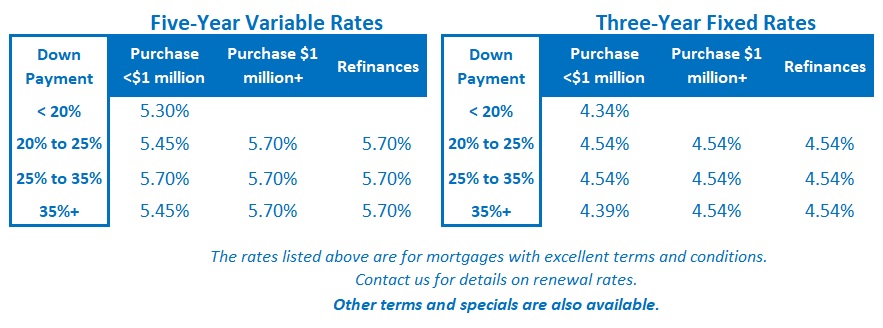

I believe that variable rates will fall substantially from their current levels. In my opinion, that justifies paying the upfront premium they still command over most fixed-rate alternatives.

If the BoC cuts by a total of 1.25% that bond-market investors are now pricing in, variable rates will likely produce the lowest borrowing cost. With that said, there is no guarantee that events will play out as currently expected.

More conservative borrowers who prefer the stability of a fixed mortgage rate are well advised to consider terms of three years or less. While four- and five-year fixed-rate terms still come with the lowest rates on offer, I worry that locking in for those terms will lead to regret later, based on where we are at this point in our interest-rate cycle.

Anyone considering fixed-rate options should also pay extra attention to the terms and conditions in their mortgage contract. They vary widely among lenders and can have a surprising impact on the overall cost of your loan, especially if mortgage rates drop significantly during your term.

If you want to learn more about this topic, my post entitled What’s in the Fine Print is a good place to start. It provides a detailed summary of the terms and conditions to watch out for and links to other posts that dive deeper into the most important ones.. The Bottom Line: Government of Canada bond yields finished the week about where they started.

The Bottom Line: Government of Canada bond yields finished the week about where they started.

For now, bond yields, and the fixed mortgage rates that are priced on them, remain range bound. But I continue to expect them to trend lower in the months ahead.

Five-year variable-rate discounts were unchanged last week. Several additional BoC rate cuts are expected over the relatively near term, and the bond market is now pricing in a 0.50% cut by the Bank at its next meeting on October 23.