Last updated on November 7, 2017

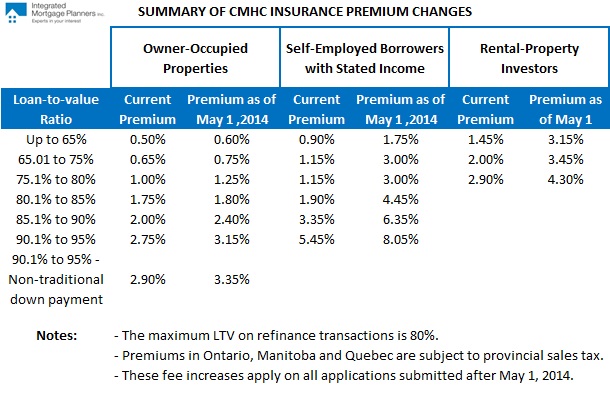

Last Friday Canada Mortgage and Housing Corporation (CMHC) announced that it will increase its mortgage-default insurance premiums, effective May 1, 2014. Current premiums will remain in effect on all mortgage applications that are submitted before this date, even in cases where the transaction closes well after the changeover deadline. Bluntly put, the impact on the average borrower will be negligible. To highlight what the typical impact of this change might look like with an example, let’s assume that a borrower is purchasing a $400,000 property with a $40,000 down payment, that the property will be used as his/her principal residence, and that he/she can qualify for financing using traditional underwriting guidelines: This deal has a loan-to-value of 90%, which means that our borrower’s high-ratio insurance premium will rise […]