Will the Bank of Canada Hike This Week?

June 5, 2023Five Key Mortgage-Rate Related Thoughts

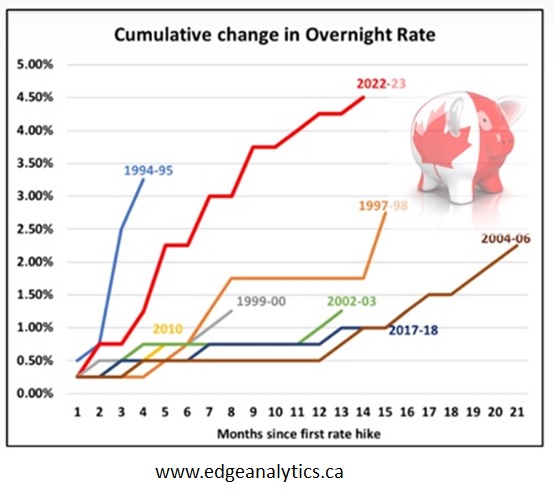

June 19, 2023 Last week the Bank of Canada (BoC) surprised financial markets by raising its policy rate by another 0.25%. That means Canadian homeowners who have variable-rate mortgages and/or home-equity lines-of-credit will soon see their rates rise by the same amount.

Last week the Bank of Canada (BoC) surprised financial markets by raising its policy rate by another 0.25%. That means Canadian homeowners who have variable-rate mortgages and/or home-equity lines-of-credit will soon see their rates rise by the same amount.

Bond-market investors had priced in a hike at the BoC’s next meeting, in July, but the Bank decided not to wait until then.

In its policy statement, it determined that “monetary policy was not sufficiently restrictive”. And in his speech the following day, BoC Deputy Governor Paul Beaudry justified the decision by explaining that “excess demand in the Canadian economy is more persistent than we thought, and … increases the risk that the decline in inflation could stall.”

While it had always left the door open to making additional hikes if they were deemed necessary, the timing of the Bank’s latest move and its justification left many market watchers shaking their heads.

In January, the BoC said that it would take “an accumulation of evidence” to move it off the sidelines. In the end, it moved after only two policy-rate meetings.

The Bank is focusing on four key elements: 1) the evolution of excess demand, 2) inflation expectations, 3) wage growth and 4) corporate pricing behaviour.

Here is a look at each in more detail:

- Excess Demand: The BoC observed that demand was “surprisingly strong and broad based”. But it did not acknowledge that a significant portion of that extra demand is attributed to the rapid drawdown of pandemic-related savings. That temporary boost is expected to dissipate sometime later this year, and well before last week’s rate hike begins to have much impact (because rate hikes kick in with a lag and then last for about two years).

- Inflation Expectations: Both consumer and business inflation expectations remain elevated, and that wasn’t helped by the news that our Consumer Price Index (CPI) ticked up from 4.3% in March to 4.4% in April. Here the Bank may know something that we don’t, because while the latest consumer and business expectation surveys won’t be released until July, Stephen Brown, Deputy Chief Economist with Capital Economics, confirmed that the Bank already has those results in hand (more on that later in this post).

- Wage Growth: Our overall nominal wage growth continues to run at about 5% on an annualized basis, and the BoC has warned that inflation won’t return to target for as long as that is the case (at least not without a significant increase in productivity, which has been steadily declining for some time). But real wage growth, which nets out inflation from nominal wage growth, is below 1% and still lower than it was pre-pandemic. That means the purchasing power of the average worker is barely increasing. Or, put another way, it means that wage growth is not able to stoke much excess demand. There are also signs that our employment momentum is slowing. Job vacancies have steadily decreased over the last two quarters, our labour force growth is now outstripping our pace of hiring, and hot off the press, last Friday we learned that our economy just lost an estimated 17,200 jobs in May. Those details all portend slowing wage growth ahead.

- Corporate Pricing Behaviour: Companies will charge what the market will bear, but it is only the finite savings buffer referred to above that has allowed consumers to absorb higher prices without reducing their spending, and that buffer is rapidly diminishing. Profit margins will thin out fast when there is less demand to go around.

If the BoC is supposed to skate to where the puck is going when it sets its monetary policy, why is it citing lagging indicators, which only tell us where the puck has been, to justify another round of tightening that won’t even exert much bite until a year or two from now?

I think the decision to hike is based on two critical and related objectives: 1) to keep the lid on inflation expectations and 2) to slow our real-estate price momentum.

Inflation only increased from 4.3% in March to 4.4% in April, but that was the first month-over-month increase since inflation peaked in June of 2022. Much of the public won’t look past the headlines announcing that inflation is back on the rise.

Responding with another rate hike garners its own headlines and helps to keep inflation expectations anchored.

Perhaps more importantly in the here-and-now, last week’s rate hike will also sap momentum from our recently reinvigorated real-estate markets. The Bank probably didn’t want to wait any longer to do that.

Real-estate was supposed to cool off for a while after the BoC enacted its sharpest series of rate hikes in modern times. But the BoC’s decision to pause back in January gave it a surprising boost. Once buyers knew that rates would stop rising, they jumped back into the market, causing a return to too much real-estate demand chasing too little supply.

Then the US banking crisis caused bond yields to plunge, and our fixed mortgage rates were pulled along for the ride, dropping by 0.50% or more. Bidding wars came back, and prices were once again on the rise.

In its policy statement, the BoC noted that “buyers were returning to the housing market, even as supply remained tight” and that there had been “unexpected” strength in goods spending, “particularly the demand for interest-rate-sensitive goods, like furniture and appliances”, which are highly correlated with home purchases.

The sharp real-estate rebound has a profound impact on consumer inflation expectations. Economist Stephen Brown recently noted that when he wrote, “the Bank’s research shows that consumer inflation expectations are heavily influenced by house prices”.

While the Bank’s most recent rate hike did raise variable mortgage rates by another 0.25%, the biggest impact was on fixed rates, which is what just about every borrower I work with is choosing these days. In a very short period, three-, four-, and five-year fixed rates have increased by 0.50%+. That brings them near to their previous cycle peaks. For now, that’s probably right where the BoC wants them.

The tailwind from the US banking crisis has now been completely snuffed out, rate cut bets have been forgotten, and prospective home buyers are back to worrying how high near-term mortgage rates could potentially go.

For the BoC, right now, that is mission accomplished.

So, what do you do if you’re in the market for a mortgage today?

When the US banking crisis drove down our bond yields, it created a benefit for newly minted fixed-rate borrowers at a cost to existing variable-rate borrowers – because lower fixed rates undermined the BoC’s efforts to slow demand and therefore delayed the onset of variable-rate cuts.

Fixed rates have also made a lot of sense lately for other reasons.

They are based on bond yields that had been priced on the assumption that the BoC and the Fed would start cutting their policy rates in the fall (even though BoC Governor Macklem had publicly kyboshed that notion). Anyone who locked in a fixed rate when the bond market was betting on near-term rate cuts is sitting pretty at this point.

Today’s fixed mortgage rates now reflect the higher-for-longer view. For now, the bond market has capitulated to the BoC.

Interestingly, each BoC rate hike increases the risk of over-tightening. With that comes the probability that it will have to cut sooner, and by more than it would have otherwise, when the accumulated economic slowing eventually causes it to reverse course. (Although that is a theoretically valid argument, it will be tough for borrowers to let it change their decision making now that variable rates are even higher and the bond market thinks that additional hikes are not just possible, but probable.)

For now, I continue to believe that the safest pick for anyone who is currently in the market for a mortgage, and who wants to aim for the middle of the fairway, is a three-year fixed rate.

Anyone making that choice today must accept the risk that they will be paying an above-market rate in the latter part of their term. But that is a trade-off most borrowers will make when the alternatives are even longer terms (which exacerbate that risk) or variable rates and shorter-term fixed rates (which seem to be rising inexorably).

The Bottom Line: Government of Canada (GoC) bond yields surged higher again last week, and lenders responded by announcing another round of increases to their fixed mortgage rates.

The recent spike in GoC bond yields now has them priced on the assumption that the BoC is likely to hike its policy rates again before the year is out. In turn, that surge introduces the possibility of some near-term give-back (as is often the case after a big move). That should hold fixed mortgage rates steady at their new, higher levels for the time being.

Variable-rate discounts were unchanged last week, but the BoC’s surprise 0.25% hike last Wednesday means that variable-rate borrowers will soon see their borrowing cost rise by the same amount.