The Length of Our Recovery Could Have a Surprising Impact on Your Mortgage

June 1, 2020Beware the Siren Call of HSBC’s 1.99% Five-Year Fixed-Rate Mortgage

June 15, 2020Last week the Canada Mortgage and Housing Corporation (CMHC) announced several changes to its underwriting rules for mortgage-default insurance.

CMHC CEO Evan Siddal was itching to do something. He recently predicted that house prices could drop anywhere from 9% to 18% over the next year and floated the idea of increasing the minimum required down payment from 5% to 10%. (This post explains why I thought that proposal was ill conceived.)

The down-payment decision wasn’t his call, because it falls under the purview of the Ministry of Finance, but tightening CMHC’s own lending policies was a different matter.

The resulting changes surprised market watchers because they will make it harder for borrowers to qualify at a time when our policy makers, including CMHC itself, have flooded our economy with every type of stimulus imaginable in their efforts to counteract the negative economic impacts of the pandemic.

Last week’s announcement may also prove significant in another way.

Up until now, all of the notable mortgage-insurance rule changes have come from the Ministry of Finance and have applied across the board – to CMHC, the crown corporation that dominates the market, and also to Genworth and Canada Guaranty, our two private-sector mortgage-default insurers. (Genworth’s and Canada Guaranty’s default-insurance policies are also ultimately backed by our federal government.)

If this announcement applies only to CMHC, it may mean that it is stepping back from its role as the default-insurance industry’s hegemon. If true, that will open up more competition and ultimately encourage much-needed innovation. (More on that below.)

First, a quick refresher.

Borrowers who are buying a property for less than $1 million with a down payment of less than 20% of the purchase price (called high-ratio borrowers) must qualify and pay for high-ratio mortgage-default insurance.

This insurance protects lenders against loss if a borrower defaults and the property is sold for less than is owed on the mortgage. High-ratio default insurance is expensive to buy, but once it is in place, borrowers gain access to the lowest rates in the market.

Borrowers who are buying a property for less than $1 million and who are putting down 20% or more of the purchase price (called conventional borrowers) can also benefit from mortgage-default insurance, but it is not compulsory.

In these latter cases, the lender will typically buy something called portfolio insurance on the borrower’s behalf (at much lower cost because of the higher down payment). These borrowers don’t have to pay the insurance premium, and they gain access to rates that are typically almost as good as those offered to high-ratio borrowers. In exchange, however, they must qualify under tighter rules. For example, the maximum amortization period allowed on any insured mortgage is 25 years, while the maximum amortization allowed on an uninsured mortgage is 30 years. Thus, conventional borrowers have to make a trade-off between rate and flexibility.

With those differences now clarified, here are the underwriting policy changes that CMHC will apply to all of its insured residential mortgage applications (both high-ratio and conventional) as of July 1, 2020:

- The maximum allowable gross debt service (GDS) ratio will be decreased from 39% to 35%.

- The maximum allowable total debt service (TDS) ratio will be decreased from 44% to 42%. (This post explains how both the GDS and TDS ratios work.)

- The minimum required credit score has been increased from 600 to 680. (Applications with multiple borrowers require that at least one borrower meet this standard.)

- Funds used for down payments can no longer be borrowed (but gifts from immediate family members are still allowed).

Here is my quick take on the potential impact of these changes:

- The GDS/TDS reductions will reduce mortgage borrowing capacities within a range between 10% to 12%.

- Increasing the minimum required credit score is largely symbolic because many lenders already require minimum credit scores of 680 or more.

- Disallowing borrowed funds for down payments is also largely symbolic because most lenders already require that down payments come from a borrower’s own resources (except on very niche products).

Here is where this announcement gets interesting.

Word on the street is that Genworth and Canada Guaranty will mirror CMHC’s credit-score increase and borrowed-funds restriction but that they will not match CMHC’s GDS/TDS ratio reductions.

If that’s true, mortgage brokers and lenders who are working with borrowers who need more flexibility on their income ratios can simply steer their applications to private insurers instead of to CMHC, albeit likely at higher insurance premiums than are being charged to those borrowers today.

That brings me to the silver lining.

Until now, CMHC has been the dominant insurance provider, and at times it has copied, and quickly commoditized new product innovations from its private-market competitors. Over time, this pattern has discouraged creativity in the industry and stifled the evolution of risk-based pricing. (Past examples include stated income policies for self-employed borrowers, policies for new immigrants, and policies for borrowers with lower credit scores.)

As I first wrote in this blog post back in 2010, in an ideal world CMHC would act as a market maker to ensure a minimum level of support for high-ratio borrowers, but it would also cede the leading edge of risk tolerance to Genworth and Canada Guaranty. Doing this would give private insurers the room, and the discretion, to price their highest-risk applications more dynamically in response to market conditions.

If these policy changes are a sign that CMHC is now stepping back from its role as the default-insurance hegemon, then I think that will open the playing field for Genworth and Canada Guaranty to offer innovative ways of ensuring that every willing investment dollar is matched with borrowers who need additional flexibility and who are willing to pay more for the privilege.

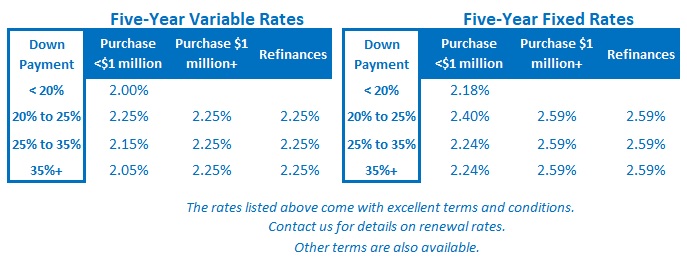

Over the longer term, that would be better for both borrowers and lenders. The Bottom Line: The Bank of Canada held its policy rate steady last week as was universally expected. The Bank’s more optimistic outlook pushed the Government of Canada five-year bond yield up a little, but despite that move, five-year fixed rates dropped and five-year variable-rate discounts widened.

The Bottom Line: The Bank of Canada held its policy rate steady last week as was universally expected. The Bank’s more optimistic outlook pushed the Government of Canada five-year bond yield up a little, but despite that move, five-year fixed rates dropped and five-year variable-rate discounts widened.

I expect that last week’s bond-yield run up will be short lived and that fixed and variable rates will either hold steadily or inch down a little more over the short term.

2 Comments

Love your post Dave ?

In your opinion, which insurer offers more flexibility to self-employed?

Hi Jane,

Both Genworth and Canada Guaranty have good programs for self-employed borrowers.

An experienced mortgage broker can work with the lender to find the best fit for you.

Dave