Top Five Recent Posts About Mortgage Rates and Inflation

February 21, 2023Finally Some Good News for Canadian Variable-Rate Mortgage Borrowers

March 6, 2023Last week Statistics Canada confirmed that our Consumer Price Index (CPI) fell from 6.3% in December to 5.9% in January on a year-over-year (YoY) basis.

That result was lower than the consensus forecast of 6.1%, but the downside surprise didn’t prevent the Government of Canada (GoC) bond yields, on which our fixed mortgage rates are priced, from finishing the week higher.

To help understand why the bond market zigged when we would have intuitively expected it to zag, let’s start with a closer look at our inflation data.

The main reason our headline CPI dropped last month was because of base effects. Here is Stats Can’s definition of how base effects work:

A base-year effect refers to the impact that price movements from 12 months earlier have on the current month’s headline consumer inflation. When a large 1-month upward price change in the base month stops influencing or falls out of the 12-month price movement, this has a downward effect on headline CPI in the current month. Conversely, a large 1-month downward price change in the base month creates upward pressure on the current month’s 12-month figure.

Thirteen months ago, in January 2022, our CPI rose by 0.9% in a single month. That base number just fell out of our most recent CPI data set and was replaced by our January 2023 CPI, which was 0.5%. This base effect pushed our overall CPI lower, but only because inflation went from white hot in January 2022 to only red hot in January 2023. (Base effects are expected to have a similar impact over the next several months.)

While a lower overall CPI result was welcome news, a month-over-month (MoM) increase of 0.5% is still concerning to both the Bank of Canada (BoC) and bond-market investors.

Our latest MoM CPI data also stood in stark contrast to our December result, which came in at 0.6%. That dramatic snapback in prices cast doubt on the budding narrative that inflation would return to target in short order. Now the higher-for-longer view is starting to predominate.

Here are some other noteworthy excerpts from the most recent inflation data:

- Lower gas prices were the largest contributor to our MoM CPI decrease in December. They were also the largest contributor to our MoM CPI increase in January.

- Our overall CPI drops from 5.9% to 5.4% if higher mortgage interest costs are excluded.

- If we also exclude food and energy price changes, the YoY result drops to 4.9%.

- Our core CPI, which strips out the most volatile inputs to our headline CPI, fell from 5.4% to 5.0%.

- The BoC’s two other key measures of core inflation also fell last month. CPI-trim dropped from 5.3% to 5.1% YoY, and CPI-median fell from 5.2% to 5.0%.

The latest CPI results confirmed that our inflation data are trending in the right direction but are also a reminder that we still have a long way to go before the Bank’s 2% inflation target will be within sight.

While GoC bond yields didn’t move much in response to our own CPI data on Tuesday, they were pushed sharply higher later in the week when US Treasury yields surged in response to the latest US inflation data. (GoC bond yields tend to move in lockstep with their US equivalents.)

On Friday we learned that the US personal consumption expenditures (PCE) index, which is the US Federal Reserve’s preferred inflation gauge, increased by 0.6% MoM, up from 0.2% in December, and by 5.4% YoY, compared with 5.3% in December.

The latest inflation data on both sides of the 49th parallel add credibility to BoC and Fed warnings that rates will likely need to stay higher for longer than financial markets have been pricing in thus far. Last week’s bond-yield surge confirms that investors are working their way around to that view (at least for now).

Inflation is still proving sticky and that isn’t going to change while most of our economic data are still coming in stronger than expected. To understand why that’s happening and to estimate how long it will continue, let’s zero in on what’s different this time around.

If we compare our current backdrop to something that is more typical at this point in the economic cycle, the most glaring difference is the large amount of excess cash sitting on the balance sheet of the average household today.

That cash, which built up during the pandemic, is giving many consumers a buffer that allows them to maintain spending even while absorbing higher prices and borrowing costs. That cash won’t last forever, but thus far it has underpinned a lot of our stronger-than-expected momentum.

Our economic data will likely start to trend in a more traditional way when those cash reserves dissipate, but until then, maybe we shouldn’t be all that surprised to see more upside surprises. The Bottom Line: GoC bond yields surged higher last week in sympathy with their US Treasury equivalents. That upward momentum in the bond market will continue to foster the same result in our fixed-mortgage rates over the near term.

The Bottom Line: GoC bond yields surged higher last week in sympathy with their US Treasury equivalents. That upward momentum in the bond market will continue to foster the same result in our fixed-mortgage rates over the near term.

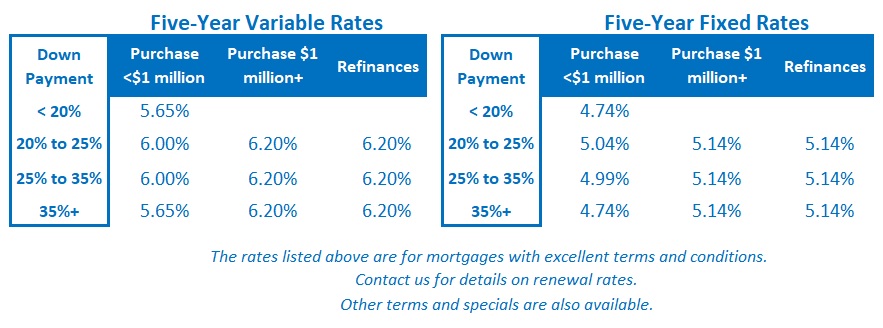

Five-year variable-rate discounts were unchanged last week. The bond market is no longer expecting BoC rate cuts in the latter part of this year and is instead pricing in one more quarter-point hike before the year is out.

I think the BoC is more likely to hold its policy rate steady for the rest of 2023. And, while I do expect the Bank to drop its policy rate at some point in 2024, I think the cuts will materialize more slowly than generally expected because the BoC will continue to err on the side of overtightening.