Canadian Inflation Stopped Cooling Last Month

November 21, 2022The Case for Another 0.50% Bank of Canada Rate Hike

December 5, 2022 The term “trigger rate” has been dominating mortgage headlines of late.

The term “trigger rate” has been dominating mortgage headlines of late.

Today’s post will explain how they work, assuage fears that they will trigger a US-style housing meltdown, and outline options for borrowers who are being impacted by them.

(It was a slow week for mortgage-rate news, but my Bottom Line at the end of this post will offer a quick update on where rates currently stand and my take on where they’re likely headed over the near term.)

Let’s start with some quick definitions.

There are two types of variable-rate mortgages:

- An adjustable-rate mortgage (ARM) comes with a payment that rises and falls in response to each Bank of Canada (BoC) policy-rate move.

- A fixed-payment variable-rate mortgage (VRM) holds your payment steady and adjusts the portions that go toward principal and interest each time your rate moves.

When variable mortgage rates rise significantly, borrowers with fixed payments can reach the point where they are no longer covering their interest cost. That rate level is referred to as their trigger rate (because it may trigger a reset of their minimum required payment).

Many Canadians with VRMs have recently hit their trigger rate. Here are some pertinent data from a report released by the BoC last week:

- Variable-rate mortgages (ARMs and VRMs combined) “now account for about one-third of total outstanding mortgage debt, up from about 20% at the end of 2019.” [Sidenote: That spike in popularity during the pandemic might have had something to do with BoC Governor Macklem’s oft repeated promise that Canadians could count on rates staying low for a long time.]

- “About three-quarters of variable-rate mortgages have fixed payments.”

- “Of borrowers with a variable-rate, fixed-payment mortgage [a VRM], we estimate that about 50%—or nearly 13% of all Canadian mortgages—have already reached their trigger rate … [and] this share will rise if banks’ prime rates increase further.”

- If the BoC’s policy rate rises by another 0.50%, the Bank estimates that “an additional 15% of variable-rate mortgages with fixed payments could reach their trigger rate, with the total thereby reaching 65% (or around 17% of all mortgages).”

Ominous warnings that many Canadian VRM borrowers have now reached their trigger rates have led to speculation that we may be heading for a meltdown that will be like the US housing crash of 2008 because mortgage-payment resets figured prominently in that crisis. But a quick comparison of the two situations dispels that concern.

To wit, back in 2008, about 35% of US borrowers opted for adjustable-rate mortgages. These products were typically offered with terms of 25 or 30 years, but they started with 1- or 2-year teaser periods where the borrower’s rate was more deeply discounted. Very unwisely, borrowers were qualified at those low teaser rates, even though they were temporary and even though it could be seen that many of them could not afford the higher payments that would kick in when the teaser period expired.

That underwriting flaw could be concealed when US house prices were rising rapidly because borrowers who couldn’t afford their payment reset at the end of their teaser period could break their mortgage contract before their higher rate kicked in and could refinance into a new mortgage term with a new teaser period. But when US mortgage rates started to rise and US house prices started to drop, those borrowers were no longer able to refinance into new teaser periods. Instead, they were stuck with higher payments they couldn’t afford. That led to widespread defaults, and US house prices crashed.

Canadian lending practices have always been more conservative than their US equivalents, but our regulators also learned well from the US financial crisis. By 2012, they had begun to make changes to reduce the risk that something similar could ever happen here. Among many changes, they enacted a stress-test hurdle rate to ensure that Canadian borrowers could afford higher rates.

Today, every VRM borrower who started with a rate of 1.5% was qualified at a stress-test rate of about 5% (which is just about where rates are now). In other words, the US housing crash was caused in part by qualifying borrowers using short-term teaser rates that were significantly below the regular rate they would have to pay once their initial introductory period expired. In Canada, borrowers have long been qualified using higher stress-test rates to ensure that they can withstand significant payment increases.

To be clear, Canadian borrowers are feeling the pinch right now, and the stress test isn’t perfect. But any predictions that our VRM trigger-rate payment resets are going to lead to a US-style housing meltdown fall apart upon closer examination.

If you have a VRM and have been told that you have reached your trigger rate, or you are nearing that point, here are some tips for your consideration:

- If you have the means, you can voluntarily increase your monthly payment and/or make a lump sum payment to restore your amortization to its original level. In other words, you don’t have to slow your rate of principal repayment unless you want to.

- You can also convert to a fixed-rate term that is equal to or greater than the time remaining on your current contract (albeit at fixed rates that may still be higher than you are currently paying).

- You can voluntarily increase your payment by a small amount to ensure that you are covering all the interest and at least some small amount of principal. Taking such action when you reach your trigger rate may prevent your lender from resetting your minimum payment all the way up to today’s much higher rates.

- Some VRM lenders will allow borrowers who have reached their trigger rate to add any unpaid interest to their mortgage principal if their loan amount does not exceed 80% of the value of their property. If the shortfall is relatively small (as it still is in most cases at today’s rates), borrowers who have a substantial amount of equity in their property won’t have to increase their current minimum payment for a long time yet.

Any variable-rate borrower (ARM or VRM) who has reached a point where they are struggling to make ends meet should call their mortgage broker and/or lender right away. While distressed borrowers may instinctively want to stay quiet about their circumstances, the best time to contact your lender is before you start missing payments, not after.

Lenders will often offer a surprising level of flexibility to borrowers who are upfront about their challenges – especially now when both they and our regulators are keenly aware of the financial strains that are being caused by spiking mortgage rates. The Bottom Line: Government of Canada (GoC) bond yields dropped a little more last week.

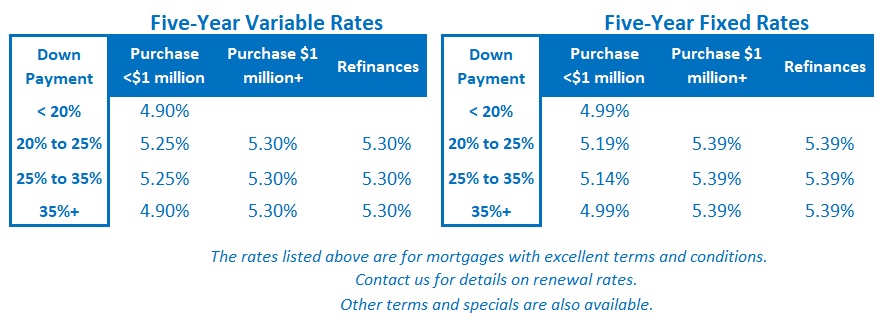

The Bottom Line: Government of Canada (GoC) bond yields dropped a little more last week.

Bond-market investors continue to price in expectations of lower inflation (and rates), riding the downdraft in yields that began when the US inflation data for October came in lower than expected.

That said, the US Federal Reserve and the BoC continue to tell anyone who will listen that inflation still has a long way to drop and that additional rate hikes and financial pain are still needed. Simply put, there is a growing disconnect between market expectations/pricing on the one hand, and central-bank messaging on the other.

For now, short-term momentum is likely to push bond yields, along with the fixed mortgage rates that are priced on them, somewhat lower. But as I explained in last week’s post, I think that our central bankers have every incentive to err on the side of overtightening. Once that view becomes more widely adopted, both yields and rates will head higher again.

Variable-rates were unchanged last week, and the market continues to price in another 0.25% hike by the BoC when it next meets on December 7.

1 Comment

Love your updates, I learn so much from them.

Ramona