Bond Yields Plunge in Response to New Outbreak Threat

November 29, 2021Five BoC Rate Hikes Next Year? Don’t Think So

December 13, 2021Last week had five important updates that have implications for our mortgage rates, spanning from Omicron to the latest employment and GDP data.

In this week’s post we’ll go around the horn to touch on each.

- The Latest on Omicron

There is still a lot on uncertainty surrounding the Omicron variant and its potential economic impacts, but we did learn more last week.

First off, while it was initially hoped that Omicron could be contained, because it appeared to be caught relatively early, it has since been detected across the globe, including in Canada and the US.

While Omicron’s typical symptoms do appear to be milder, epidemiologists estimate that it may also be three times more likely to reinfect. That will allow it to spread much more quickly and will increase the likelihood that it will eventually become the dominant variant (which, for now at least, is still Delta).

Omicron’s emergence is likely to be further accelerated by holiday-related travel, waning immunity from older vaccinations, and in colder climates, by people congregating more frequently indoors.

Thus far, Omicron’s main economic effect has been to increase uncertainty about how governments will respond, but it is also reasonable to expect that it will increase consumer caution and reduce spending.

The key question that scientists still need more time to answer is how effective our existing vaccines will be against Omicron. Their best guess thus far is that they are relatively less effective at reducing overall Omicron infection rates (because this variant is much more contagious) but are still very helpful in reducing the severity of its symptoms.

- Powell’s Inflation Pivot

Last Tuesday US Federal Reserve Chair Jerome Powell told the US Senate banking committee that it is time to stop referring to US inflation as “transitory”, and that the Fed may taper its quantitative easing (QE) programs more quickly than originally planned.

This hawkish turn surprised bond-market investors who had priced in a more dovish Fed tilt after the Omicron news broke. They responded by raising their bet on the number of Fed rate hikes next year from two to three.

Until now, Powell has always emphasized that the Fed’s tapering plans would not be directly linked to the timing of its rate hikes, which would have to pass “a different and more stringent test”, but his surprise pivot on inflation now makes that assurance less certain.

Powell has been under increased pressure to acknowledge that current US inflation is more persistent and severe than expected. (It hit 6.2% in October, marking its highest level in more than three decades.)

Last week’s pivot was a capitulation much like the Bank of Canada’s (BoC) shift at its last meeting (which I wrote about here).

Our central bankers are clearly worried about losing credibility regarding the consensus narrative that they have, until very recently, argued against.

- US Employment Disappoints

The US economy added only 210,000 new jobs in November, well short of the consensus forecast of 573,000.

The most concerning details in the data were the big shortages in the COVID-affected sectors that will be further impacted by Omicron in the months ahead. For example, the leisure and hospitality sector added only 23,000 new jobs last month and is still an estimated 1.3 million jobs below its pre-COVID level. The US retail sector shed 20,000 jobs, and that is surprising at the onset of the holiday shopping season.

Average US wages rose by 0.26% last month and have now risen by 4.8% on a year-over-year basis, but that number was below the consensus estimate and is inconsistent with the mainstream narrative that US wages are significantly breaking out.

The US participation rate rose sharply last month to 61.8%. That marks its highest level since March 2020 and unsurprisingly corresponds with the end of the US government’s COVID-related emergency benefit payments. If that encouraging trend continues and more Americans return to work, that will reduce the unmet demand for labour and should help ease US wage-growth (and inflation) pressure.

- Canadian Employment Growth Rolls On

Statistics Canada confirmed that the Canadian economy added another 154,000 new jobs last month, far above the consensus estimate of 40,000, and our unemployment rate fell from 6.7% to 6.0%.

A bump in new hires wasn’t unexpected after our federal government announced that it would end its COVID-related emergency unemployment benefit payments in late October, but the magnitude of last month’s surge was a surprise.

Our overall average hours worked has now recovered to its pre-pandemic level although our goods-producing sector remains below that threshold (-3.6%).

Canadian average wages have now risen by 5.2% over the past two years (after adjustments for changes in employment composition and tenure). That growth rate almost matched our inflation rate over the same period, so Canadian labour costs haven’t put any material upward pressure on overall prices thus far.

- Canadian GDP Data Confounds

Stats Can also confirmed that our GDP increased by 1.3% in Q3 (or by 5.2% on an annualized basis). That result handily beat the consensus estimate of 3% (annualized), but market reactions were tempered by the substantial downward revision of our Q2 GDP decline from -1.1% to -3.2%.

To put our GDP growth into a broader perspective, consider that on its current trajectory, it won’t recover to its pre-pandemic level until sometime in 2022 and won’t reach its previous long-term trend line until sometime in 2023.

Simply put, our GDP data aren’t consistent with our employment data. Our economy is hiring more people to produce less output, and this shows up in our labour productivity, which declined by 1.5% in Q3. That is not a good sign for the competitive positioning or overall health of our economy.

Now to the key question for readers of this post. How will the above factors impact the BoC policy-rate announcement this Wednesday?

Strong employment growth and a strong rebound in GDP in Q3 have the consensus thinking that the Bank will move up its rate-hike timetable and turn more hawkish. But the uncertainty surrounding Omicron and the impacts of flooding in southern BC advocate caution.

I expect these factors to roughly balance out and to keep the BoC on a “steady-as-she-goes” path for the balance of the year.

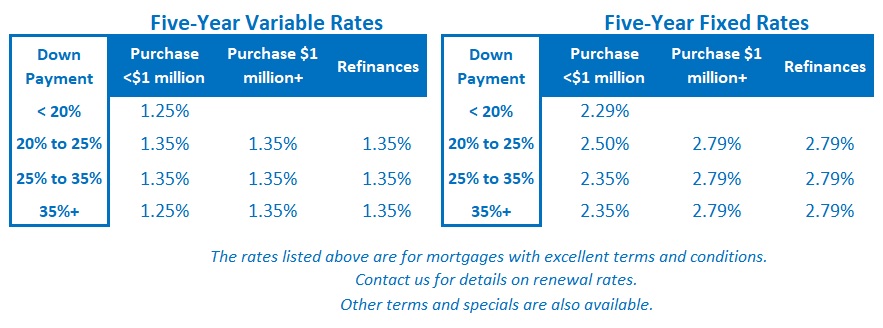

I’ll check back next week after we’ve heard what the Bank has to say. The Bottom Line: Some five-year fixed rates rose by 0.10% last week, and some variable-rate discounts also shrank by that same amount.

The Bottom Line: Some five-year fixed rates rose by 0.10% last week, and some variable-rate discounts also shrank by that same amount.

The five-year Government of Canada (GoC) bond yield, which our five-year fixed rates are priced on, finished the week lower than where it started, so last week’s market rate increases may have been caused by a rise in other lender-funding costs.

The near-term future for mortgage rates is now highly uncertain.

My best guess is that both bond yields and fixed rates will hold steady in response to a cautiously optimistic policy-rate announcement by the BoC this Wednesday. But fair warning. Central bankers have been changing their tune of late, and consequently, I am now less confident in that view.

2 Comments

Hello David,

Always enjoyed reading your analysis. I am a consistent reader of your blog, keep up the good work!

I thought you might be interested in this article

https://www.businessinsider.com/when-will-supply-shortages-end-inflation-cool-shipping-crisis-manufacturers-2021-12

Thanks for your note and for the link Mourad. I will check it out!

Best regards,

Dave