How Will Canadian Mortgage Rates Be Impacted by the Fed’s New Rate-Hike Timetable?

June 21, 2021Why the US Employment Data Are Key for Canadian Mortgage Rates

July 5, 2021Last week was a slow one on the mortgage news front, so this post will be shorter than normal.

The key question on everyone’s mind was how financial markets would react to the US Federal Reserve’s slightly more hawkish tilt. Spoiler alert: Not much.

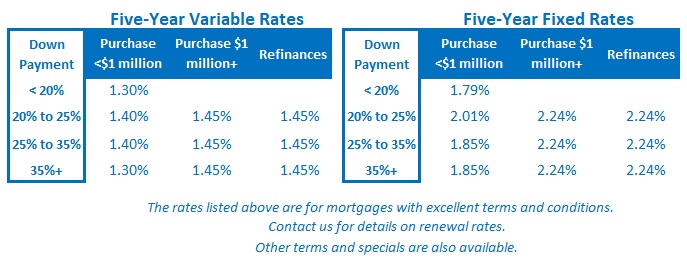

If you’re keeping an eye on mortgage rates, it should be noted that the five-year Government of Canada (GoC) bond yield that our five-year fixed mortgage rates are priced on is now back to 1.00%, which is about the level where our lenders last chose to raise. This yield will need to continue moving higher before they start announcing another round of increases, but in the meantime, a 20-basis-point rise over the last two weeks is a noteworthy development (see chart).

Over the near term I expect our GoC bond yields to continue to move in lockstep with their US equivalents, and with that in mind, this Friday’s US employment report is one to watch.

The Fed recently reiterated its commitment to maintain its ultra-accommodative monetary policies until the US employment recovery is complete. The US economy is still at least 10 million jobs shy of its pre-pandemic level, and it will take a string of monthly job gains in the 1 million+ range before that goal is realistically within reach.

The US reopening phase is now well underway and thus far, the related employment data have disappointed.

Most notably, American workers have been hesitant to return to low-paying, high-contact jobs, in part because they have had to care for quarantining dependents, but likely also because they remain eligible for generous COVID-related unemployment benefits. Those federally sponsored programs are set to expire in September, and some US state governors have curtailed them early to get their local economies moving again.

At the same time, some US employers are raising wages to lure workers back. If they are compelled to continue doing that, higher labour costs could fuel a broad rise in prices, but if workers return en masse when their COVID-specific unemployment benefits run out, labour costs will likely stabilize. There is much debate about how this will play out, and the outcome will have knock-on effects that could impact our mortgage rates later this year.

I will close this week’s post on a personal note.

I am writing this on Sunday afternoon, after having just received my second vaccine dose.

My first shot came from Pfizer, but recent supply shortages meant that I had to switch to Moderna for my second. After researching the efficacy of mixing different mRNA vaccines, I decided that I was comfortable proceeding with that option.

The process itself was efficient, the staff were friendly, and I am relieved that in fourteen days I will enjoy all the protection of being fully vaccinated. The Bottom Line: Fixed and variable mortgage rates held steady last week.

The Bottom Line: Fixed and variable mortgage rates held steady last week.

The five-year GoC bond yield has been on an upswing of late. Given that it continues to follow the five-year US treasury yield, this Friday’s US employment report will likely determine whether its next leg is up or down. (My sense is that US employment growth will continue to disappoint, at least until COVD-related unemployment benefits expire.)