Canadian Mortgage Rates Are Finally Starting to Fall

April 27, 2020Will Record Job Losses Lead to Negative Bond Yields?

May 11, 2020I have been fielding a lot of calls lately from fixed-rate borrowers who are wondering if they could save money by breaking their current mortgage and switching to a lower rate.

Today’s post will walk you through some examples of borrowers who would, and wouldn’t, save money doing this in the current environment.

Evaluating whether now is a good time to break your mortgage boils down to five key factors:

- Current rate

- Current mortgage balance

- Remaining term and amortization

- Penalty to break (which can vary significantly) + any associated transaction costs

- The best available rate you are eligible for today

I will illustrate how this works by making some assumptions using the criteria outlined above.

- Current rate

We’ll run scenarios assuming that you have three different rates on your current mortgage: 3.25%, 3.00% and 2.75%.

- Current mortgage balance

We’ll assume that two years ago you secured a $400,000 mortgage and that your current balance is now down to $378,000.

- Remaining term and amortization period

We’ll assume that you are two years into your five-year term and that your original amortization of 25 years is down to 23 years.

- Penalty to break + associated transaction costs

Fixed-rate mortgage penalties are calculated by taking the greater of three months’ interest or the interest-rate differential (IRD).

In theory, IRD is supposed to calculate the difference between your contract rate and the lender’s current rate that most closely matches the time remaining on your mortgage, but lenders use different inputs to their IRD formulas, and that causes them to vary dramatically.

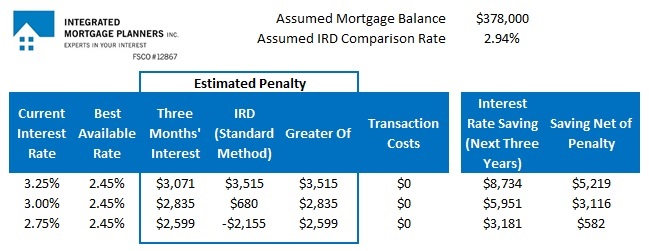

In the first example we’ll assume that your lender uses the fairest method for calculating IRD, which I refer to as the Standard Method in my detailed post on the topic. We’ll also assume that your new lender has a promotion that will pick up the transaction costs associated with switching (which typically run about $1,000).

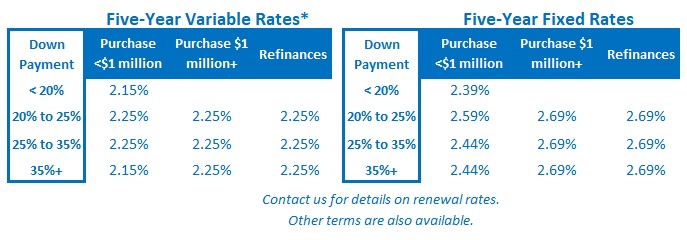

- The best five-year fixed rate available today

These scenarios will be based on the assumption that your property is currently valued at less than $1 million and that your current mortgage balance does not exceed 75% of the value of your property (and we’ll assume that you aren’t consolidating any outside debt). In this example, my best available five-year fixed rate is 2.45%. (Variable rates are lower today, and for as long as that is the case, they will save you even more.)

Here is a summary of the cost to break your mortgage, the interest-rate saving you would realize, and your net saving after costs are factored in.

The chart above shows that borrowers with rates of 3.25% or 3.00% and three years left on their current mortgage could realize a significant saving if they switched to a lower mortgage rate today.

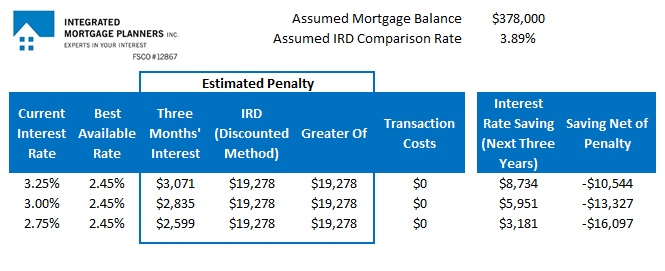

In the next scenario, we’ll use all of the same assumptions but this time assume that the lender’s IRD penalty is calculated using the Discounted Method that I outline in my detailed post on how fixed-rate mortgage penalties are calculated. (Don’t let the name fool you – there is nothing discounted about it!)

This is the IRD formula that is most commonly used by the Big Six banks. For anyone wanting to replicate my Discounted Rate penalty calculations in this example, I used TD’s posted five-year fixed rate of 5.59% on May 3, 2018 and TD’s three-year posted rate of 3.89% on May 3, 2020.

Unfortunately, the Big Six banks’ significantly higher penalties far exceed any potential interest-rate saving currently available, so borrowers faced with an IRD penalty that is based on the Discounted Rate method (or the Posted rate method favoured by CIBC, which is even higher) aren’t able to take advantage of falling mortgage rates. This is an excellent example of why looking beyond the rate you are being offered and reading the fine print in mortgage documents is so important.

Here are a few final thoughts for your consideration.

In the examples above, I have shown the saving that can be realized over the remainder of your current five-year term (which we assumed was three years in our examples). But there is an additional benefit as well. Any borrower who switches to a new five-year fixed rate today will also be trading the three years remaining on their current mortgage at a higher rate for a full five years of rate protection at the lower rate on their new mortgage.

Also, if you are happy to continue making the same monthly payments you are accustomed to, I recommend doing so. This will allow the monthly savings you are realizing to reduce the remaining principal on your mortgage, a real benefit when it is time to renew.

Lastly, lenders will often give you the option to roll up to $3,000 of your penalty into your new mortgage. In many cases that means that you won’t actually have to put up any cash to complete the transaction.

The example above was necessarily specific to one borrower’s situation. If you want to run the numbers based on your current circumstances, this post will also walk you through the basic steps to follow.

Alternatively, feel free to contact me so that we can walk through the numbers together.

The Bottom Line: Last week the Bank of Canada’s aggressive monetary-policy interventions continued to reduce financial market risk premiums. Against that backdrop, five-year fixed mortgage rates dropped once again, and five-year variable rate discounts widened a little as well. Looking ahead, gross lending spreads remain elevated so there is still room for both fixed and variable mortgage rates to fall further.

6 Comments

Great post Dave!!

Thanks.

Excellent illustration

Thanks!

David,

I have question about your IRD discounted method calculation. Can you tell me more how you arrive to $19,278 for all of the three rates ?

Hi Vicente,

This post I wrote explains how mortgage penalties are calculated in detail (I also linked to it in the post):

https://www.integratedmortgageplanners.com/buyer-beware/what-every-canadian-borrower-needs-to-know-about-fixed-rate-mortgage-penalties-april-27-2015/

The penalty you reference was calculated by using the Discounted method I outline.

FYI – I used TD’s posted five-year fixed rate of 5.59% on May 3, 2018 and TD’s three-year posted rate of 3.89% on May 3, 2020.

Best,

Dave