The Slam Dunk Mortgage Option Right Now (and a Warning about HELOCs)

April 6, 2020Is the Bank of Canada’s Firehose Working?

April 20, 2020Last week we learned that our economy lost slightly more than 1 million jobs in March.

Over that same period, another 1.3 million Canadians, who were technically still employed, earned no income and a further 800,000 Canadians worked less than half of their normal hours.

The March employment plunge more than doubled the consensus forecast of 500,000 jobs lost, and it marked our economy’s worst month, by far, since we started keeping records in 1976. (By way of comparison, our second worst month for job losses was 129,000 in January 2009.)

As the significant economic impacts of the lockdown begin to take form, now seems like a good time to speculate on how lenders will adapt their mortgage lending policies to the new reality.

Changes are already afoot.

Several lenders have already effectively stopped approving borrowers who are commissioned employees or in some cases, self-employed, until their post-lockdown incomes are clarified.

One major bank recently announced that it will no longer allow borrowers to use funds from an existing home equity line of credit (HELOC) for the down payment on an investment property unless they have other cash/investments to meet the minimum required down payment of 20%. I expect others to follow.

Before I offer my predictions of what may be coming next, let’s look at the two main factors that will determine how cautious lenders will become in the near future: house prices and job losses.

Nothing impacts mortgage arrears and defaults like job losses.

Rising interest rates and high debt levels have been a concern for years now, but borrowers who have maintained their incomes have typically been able to find a lender to consolidate their debt and give them more time to get back on track (albeit often at higher interest rates).

Without income, however, borrowers have no options – and there are a lot of homeowners among the 3.1 million Canadians who have either lost their jobs or seen their incomes significantly reduced. If a large cohort of borrowers hits the wall at the same time, some will have no choice but to sell their properties, and if that happens, a surge of listings could lead to a sharp drop in real-estate prices.

I’m not predicting this as an imminent outcome. But more than 500,000 Canadians have already applied and been approved for deferred mortgage payments, and against that backdrop, I can guarantee lenders are worried enough to be taking a hard look at their underwriting policies.

There is an emerging narrative that argues that our real-estate values aren’t as vulnerable to these job losses as people might think because, according to Statistics Canada, most of the losses occurred in “less secure, lower quality jobs“ held by people who are less likely to own homes.

I disagree with that view.

It’s certainly true that not all of the 3.1 million Canadians whose incomes have been impacted by the current crisis are homeowners. But the others are renters, and many of them can no longer pay their rent.

The owners of the properties they live in still have bills to pay, and in many cases, their associated mortgages are now under duress as a result of lost rental income. Many property investors are highly leveraged these days and are therefore not well prepared to withstand an income shock. That heightens the risk that landlords will be forced to put their properties on the market.

Although some markets still seem to have plenty of pent up demand, if and when prices fall, other borrowers who could have previously refinanced with a non-prime or private lender will no longer have enough equity in their property to do so. This makes vulnerable loans stickier for lenders than they normally would be.

Lenders lie awake at night worrying about a worst-case scenario where a sharp drop in house prices puts borrowers under water (meaning that the mortgage principal is more than the house is worth). When that happens in the U.S., many homeowners simply walk away from their properties and mail the keys to their lender (creating what our industry refers to as “jingle mail”).

This practice hasn’t been nearly as common in Canada, where we have historically tended to stick out the downturns and continue paying our mortgages. But that said, we’ve never experienced job losses like this before.

Remember our second worst month for job losses in January 2009? At the time, economists were quoted in this CBC article referring to the result as “horrible” and “shockingly poor.” Last month’s report was arguably twenty times worse. Our economy is now being severely stress-tested in real time.

With that clearly in mind, here are some changes that we may see come down the lending pipeline, along with some suggestions on how you can best navigate through them:

Increased rigour around income confirmation – If you’re applying for a mortgage, the lender will thoroughly vet your application to confirm whether you’ve suffered any change to your income as a result of COVID-19.

What you can do about it: If you aren’t sure how a lender will handle your income, and there can be flexibility in some cases, discuss it at the pre-approval stage and insist on a financing condition when you make an offer to purchase a property. Then, provide your income documentation immediately after your deal is approved and while your financing condition remains in effect.

Appraisals not supporting property values – If property prices start to fall (and to be clear, we aren’t there yet), the risk that a property won’t appraise for what a borrower has offered to pay will rise. In such cases, the lender will base their approval on the lower appraised value, and the borrower must make up the difference. That might not be possible for borrowers who are stretching to meet minimum down-payment requirements.

What you can do about it: Include a financing condition when you make your offer to purchase. Noticing a theme here?

HELOCs in the cross hairs – I think the recent restriction on using a HELOC for down-payment funds may only be the beginning of HELOC changes. As I explained in last week’s post, HELOCs are demand loans that the lender can call or alter anytime they deem appropriate. Lenders can easily remove unused HELOC limits or require borrowers to convert their existing HELOC balances from interest-only payments to amortizing payments (which would almost double the payment amount) if the situation warrants.

What you can do about it: Don’t wait until it’s pouring rain to reach for your umbrella.

Reduced loan amounts for refinances – Right now mortgage refinances top out at 80% of a property’s value, in large part because they can’t be insured against default. If property values experience a material decline, lenders may cut back loan-to-value maximums and require more of any equity buffer.

What you can do about it: Nothing. The only real question is whether our policy makers will decide to once again allow refinances to be insured against default. If that happens, forget everything I just said.

I am not writing this post to alarm anyone.

Our policy makers have rolled out massive stimulus programs to help cushion the blow for many Canadians. They have also primed lending pumps with unprecedented levels of monetary policy largesse. Once people are back to work and the economy is running normally again, lenders will not want for anything.

Here is a reminder of what awaits them (which you can read about in detail in this previous post):

- A Bank of Canada (BoC) policy rate at 0.25% and the lowest Government of Canada bond yields in history (both of which have substantially reduced lender borrowing costs)

- Cash-rich balance sheets

- Reduced capital requirements

- Expanded access to the Canada Mortgage Bond program (which provides their cheapest funding source)

- Reduced risk premiums thanks to BoC guaranteed market liquidity

- No pressure from OSFI (their regulator) on deferred mortgage payments

Most importantly, this crisis has an end date, and while we don’t know what it is yet, when we get there our economy will ramp back up and many of the impacted jobs will be restored (although certainly not all of them, and some more quickly than others).

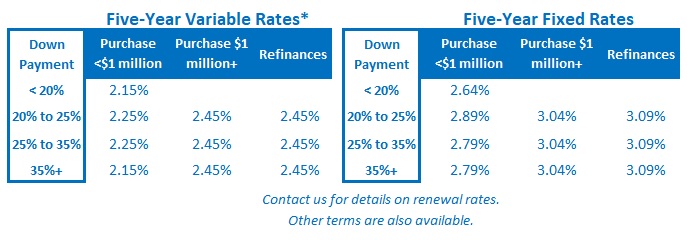

This too shall pass. The Bottom Line: Mortgage rates held steady last week. Five-year fixed rates are available in a range around 3% and five-year variable rates are offered at around prime (which works out to 2.45% today).

The Bottom Line: Mortgage rates held steady last week. Five-year fixed rates are available in a range around 3% and five-year variable rates are offered at around prime (which works out to 2.45% today).

Last month’s employment data were the worst on record and ended up twice as bad as the consensus expected. While our fate is not sealed, our economy’s near-term future is uncertain, and lenders are going to tread cautiously, perhaps with changes like the ones outlined above. Different lenders will have different appetites, so maybe now more than ever, it will pay to shop around.

Forewarned is forearmed.

6 Comments

thanks

Awesome article Dave.. Watching with keen eyes as to how this plays out.

Thanks Neil.

Thanks Dave.

Very useful.

Thanks Paul.

Excellent article Dave!