10 Key Points About Deferred Mortgage Payment Programs #COVID-19

March 20, 2020The Bank of Canada Cuts Again and Policy Makers Get Creative

March 30, 2020The COVID-19 crisis added more tumult to the Canadian mortgage market last week.

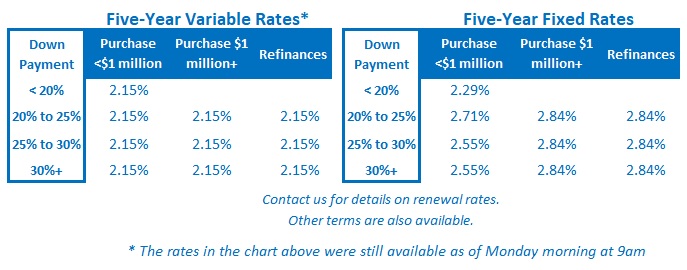

Lenders raised both their fixed and variable mortgage rates, to the surprise of many borrowers.

Here are the main reasons why:

- Government of Canada (GoC) bond yields, which our fixed mortgage rates are priced on, have moved higher. For example, the five-year GoC bond yield opened last week at 0.49% before surging to 0.93% by Wednesday afternoon. That fact alone explains why five-year fixed rates moved higher.

- Lenders are adding premiums to their mortgage rates to respond to either the reality or the threat of increased funding costs. This explains why variable-rate discounts are shrinking.

- Borrowers have been calling their lenders in droves to inquire about mortgage relief. (Please read my post about Deferred Mortgage Payment programs before contacting your lender.) Concerns about spiking arrears and default rates are tempering lender appetites for new business.

While last week’s bond-yield surge might come as a surprise, it is consistent with past periods of extreme market volatility. Bonds are highly liquid, which means they can be sold quickly when portfolio managers need to raise cash in a hurry – to satisfy redemption requests, meet margin requirements, cover shorts, and/or rebalance portfolios.

There are, however, a few reasons why I think the current bond yield run-up will be short lived.

First, liquidity-driven bond yield run-ups don’t typically last very long.

Second, interest rates always fall during recessions (and there is little doubt that we are at the start of one now).

Third, GoC bond yields are still attractive, on a relative basis, when compared to the equivalent yields offered by most other G10 countries. (And there is still lots of demand for sovereign debt.)

What we are seeing right now is a perfect storm for a short-term run-up in mortgage rates. Here is my advice to four different groups of mortgage borrowers on how to manage through it:

Existing Variable-Rate Borrowers

If you have an existing variable-rate mortgage, I recommend staying put for the time being. Lenders have already dropped their prime rates to 2.95%, and adjustable-rate borrowers should see their payments reduced no later than April 1.

The Bank of Canada (BoC) may well cut its policy rate again, and if lenders continue to pass on those additional cuts (which isn’t guaranteed), your rate will go lower still.

For now, enjoy the cumulative 1.00% rate drop that March brought. Anyone looking to convert to a fixed rate can bank a little saving while waiting for GoC bond yields and fixed mortgage rates to settle back down.

Existing Fixed-Rate Borrowers

There was a brief window when fixed-rate borrowers could break their current mortgages and lock in rates between 2.34% and 2.54%. That opened up some potential saving for existing borrowers with current rates in the 3% range, depending on the fixed-rate penalty charged by their current lender and on the time remaining on their current mortgage.

That ship sailed fast, and if you missed it, my advice is to stay the course and allow time for the bond market to find its level and for lender fears about mass defaults to subside.

We’re also headed into the spring real estate market, and under normal circumstances, that’s a time when rate competition intensifies.

New/Renewing Borrowers

If you’re in the market for a new mortgage today and didn’t lock in before the most recent rate run-up, I recommend prioritizing flexibility above all else.

Variable-rate mortgages come with the ability to convert to a fixed rate at any time, with penalties of only three months’ interest to break them. That combination of features gives you a lot of flexibility if rates fall materially after your deal closes.

Interestingly, while shorter-term fixed rates allow you to reset your rate sooner, they are higher than five-year fixed rates today. When you do the math, five-year rates can often end up costing you less – even if you break them early (because you save more in interest than you pay in penalty). In addition, lenders may offer a reduced penalty if you remain with them.

An experienced mortgage broker can help you crunch the numbers based on whatever timelines you choose.

Stretched Borrowers

If you have significant debt outside of your mortgage and are increasingly worried about making ends meet, instead of focusing on rate movements I recommend that you refinance your mortgage while you still can if doing so will leave you in a stronger cashflow position.

Lender appetites for debt consolidation loans will dry up quickly if mortgage arrears and default rates start to spike, and that could make them harder to come by and/or lead to significant premiums being added to the rates offered on refinance transactions.

There is an old adage about a banker lending you an umbrella when the sun is shining and then asking for it back as soon as it starts to rain. Don’t wait for the rain. The Bottom Line: The still rapidly evolving COVID-19 crisis is stoking extreme financial-market volatility.

The Bottom Line: The still rapidly evolving COVID-19 crisis is stoking extreme financial-market volatility.

Last week’s surge in fixed mortgage rates was caused by a sell-off in GoC bonds that was likely triggered by short-term liquidity demands. If that assessment is correct, it is reasonable to expect bond yields (and fixed mortgage rates) to resume their downward slope once financial markets stop freaking out.

The BoC is also likely to continue cutting its policy rate, which our variable-rate mortgages are priced on, although there is no guarantee that lenders will pass on any additional BoC discounts.

Against the current backdrop, maintaining flexibility is the key.

3 Comments

As of this morning, Bonds are already back down to the 0.6 range. So you’re already proven true on that. We’ll see what follows for rates!

Dave Larock rocks!! There is no better place to stay informed than right here and Dave proves that week in and week out.When you read his weekly commentary you know what I mean. You are right again Dave as BOC just lowered rates another 0.5 percent.

Thanks for all the awesome information you provide free to the people! The world needs more professionals like you.

Cheers

Thanks for your note Ed.

Best,

Dave