How Much Higher Will Canadian Mortgage Rates Go?

October 29, 2018Is the Bank of Canada Bullish on Pot?

November 12, 2018 Last Tuesday senior Bank of Canada (BoC) officials spoke to the House of Commons Finance Committee and reiterated the Bank’s intention to continue raising its policy rate over the near term.

Last Tuesday senior Bank of Canada (BoC) officials spoke to the House of Commons Finance Committee and reiterated the Bank’s intention to continue raising its policy rate over the near term.

BoC Governor Poloz assessed that our current policy rate of 1.75% “remains stimulative” and that it will need to rise to between 2.5% and 3.5% in order to keep inflation close to 2.0% (which I detailed in last week’s post). Both he and BoC Deputy Governor Wilkins sounded upbeat about our current economic momentum, and they expressed confidence in our economy’s ability to handle additional rate hikes.

While Governor Poloz restated that the Bank would be guided by the incoming data and would not operate on a predetermined path, he left little doubt that the BoC expects to keep raising rates over the near term. Interestingly, the data may test the veracity of that claim in short order.

Last Friday, Statistics Canada released the latest employment statistics, for October, and here are the highlights:

- Our economy added a total of 11,200 new jobs last month, less than the 15,000 new jobs the consensus had forecast.

- Despite adding more full-time jobs, which tend to be higher paying than part-time jobs, our average year-over-year wage growth slowed for the fifth consecutive month, this time to 1.9% (see chart on right). Wages are no longer keeping pace with inflation, which came in at 2.2% year-over-year in September, and that means that the purchasing power of the average wage is shrinking.

- Our overall unemployment rate fell to 5.8%, matching its lowest level in more than 40 years, but our participation rate, which measures the percentage of working-age Canadians who are either working or actively looking for work fell from 65.4% to 65.2%. That means that the unemployment rate fell because more people gave up looking for work and not because our labour market tightened further.

If the BoC is really going to be guided by the incoming data, last month’s fall in average wage growth should give it cause for pause. While it is true that wage growth tends to lag other economic data during recoveries, our current recovery has been ten+ years in the making, and sluggish income growth has confounded our policy makers for years now. (This anomaly also has been evident in most of the world’s other developed economies over the same period.)

Last week we got a look at the latest U.S. employment data as well. The U.S. economy added 25% more jobs than the consensus had expected (250,000 actual vs. 200,000 forecast), and average year-over-year wage growth accelerated to 3.1%, marking its fastest pace in almost ten years. It could be that the BoC is using the U.S employment data as a bellwether for Canada because if rising U.S. labour costs stoke higher U.S. inflation, we will import it over time. But our two economies are operating on very different trajectories at the moment, and our current momentum should give the BoC more time to work with …

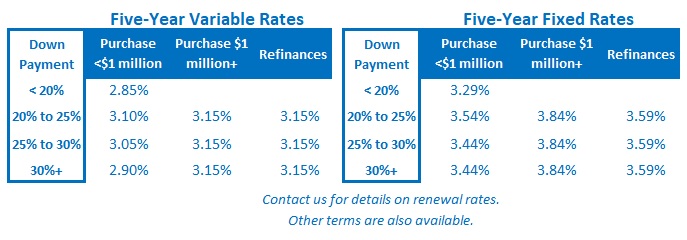

if it really is data dependent. The Bottom Line: Last week the BoC reiterated its expectation that additional rate hikes will likely be needed in order to keep inflation near its 2% target. Government of Canada bond yields moved higher in anticipation of that outcome, and several lenders raised their fixed mortgage rates in response. That said, if the Bank is truly data dependent, our latest employment data should give it pause because average wage growth continues to decelerate and our falling participation rate confirms that we still have untapped labour available on the sidelines.

The Bottom Line: Last week the BoC reiterated its expectation that additional rate hikes will likely be needed in order to keep inflation near its 2% target. Government of Canada bond yields moved higher in anticipation of that outcome, and several lenders raised their fixed mortgage rates in response. That said, if the Bank is truly data dependent, our latest employment data should give it pause because average wage growth continues to decelerate and our falling participation rate confirms that we still have untapped labour available on the sidelines.