How Trump’s Tariffs Are Likely to Affect Canadian Mortgage Rates

March 5, 2018Why I Don’t Think The Bank of Canada Will Over-React to the Latest Inflation Data (As the Bond Market Did)

March 26, 2018 When the Bank of Canada (BoC) met last week, it left its overnight rate unchanged, as expected.

When the Bank of Canada (BoC) met last week, it left its overnight rate unchanged, as expected.

The only real question leading up to this meeting centred on the tone of the Bank’s accompanying statement. Would the BoC convey a hawkish bias out of concern for rising inflationary pressures and tightening labour market conditions, or would it sound more cautious in deference to increased trade uncertainty and the lagging effects of the three rate hikes it had recently made?

The answer to that question matters to anyone keeping an eye on Canadian mortgage rates because when the Bank increases its overnight rate, our variable mortgage rates rise in lock step. Meanwhile, our fixed mortgage rates are priced on Government of Canada (GoC) bond yields and they often fluctuate in response to changes in the BoC’s tone, even if no rate hike actually occurs.

In the lead up to this meeting, our mainstream economist consensus forecast called for two more BoC rate hikes this year (down from three at the start of the year). Regular readers of this blog will recall that I disagreed with that forecast and made the case that the Bank would prove much more cautious for the following five reasons:

- The BoC wants to allow time for the three policy-rate increases that it recently made to work their way into our economy, and BoC Governor Poloz has estimated that it can take anywhere from one to two years for their full impact to be realized.

- The BoC wants to allow time to assess the impact of the sixth round of mortgage rule changes that were implemented on January 1, 2018.

- The BoC wants to allow time for our trade picture to become clearer. The future of NAFTA remains uncertain and isn’t likely to be resolved at least until Mexico’s president election in July. At the same time, while Canada is now temporarily exempt from U.S. President Trump’s new steel and aluminum tariffs, his actions may well trigger a global trade war that could still significantly impact our economy.

- The BoC isn’t overly concerned about the recent uptick in our inflation data. While our inflation gauges have been trending up of late, in January the BoC attributed the run up to “temporary factors” that would dissipate over time, and it expressed confidence that inflation would “remain close to 2% over the projected horizon”.

- The BoC doesn’t want the Loonie to appreciate further. The Bank knows that additional rate rises are likely to push the Loonie higher and this puts it in a difficult position because it needs to take into account the significant impact that the Loonie’s value has on our export sector. The Loonie has hovered around 80 cents versus the Greenback for some time now and this relatively high value has created a headwind for our exporters that would be exacerbated by additional BoC rate hikes, or even by the Bank’s adoption of more hawkish policy-rate language. The BoC continues to hope that increased business investment will offset a slowdown in consumer spending, and our export sector needs to be humming along for that to happen.

With that backdrop in mind, here are the highlights from the BoC’s latest policy statement with my comments in italics:

- On the impact of the BoC’s recent rate hikes: “The Bank continues to monitor the economy’s sensitivity to higher interest rates. Notably, household credit growth has decelerated for three consecutive months”. If household credit growth is now slowing, that provides confirmation that the Bank’s previous rate hikes are achieving their desired impact.

- On the impact of the latest mortgage rule changes: “Strong housing data in late 2017, and softer data at the beginning of this year, indicate some pulling forward of demand ahead of new mortgage guidelines and other policy measures. It will take some time to fully assess the impact of these, as well as recently announced provincial measures, on housing demand and prices.” If the housing data were softer to start the year (and, as per above, if household credit growth is slowing), then the BoC is well positioned to allow time for the full impact of the mortgage rule changes to play out.

- On trade uncertainty: “Trade policy developments are an important and growing source of uncertainty for the global and Canadian outlooks.” When uncertainty is growing, central bankers err on the side of caution.

- On inflation: “Inflation is running close to the 2 per cent target and the Bank’s core measures of inflation have edged up, consistent with an economy operating near capacity. Wage growth has firmed, but remains lower than would be typical in an economy with no labour market slack. Inflation is fluctuating because of temporary factors related to gasoline, electricity, and minimum wages.” The BoC is still not clear on why our wage growth is lower than expected at this point in our economic cycle. That uncertainty makes it more cautious about relying on its historical models when determining the correct policy path. At the same time, the BoC reiterated its observation that our recent uptick in inflation was caused by temporary factors.

- On the Loonie and exports: “In the fourth quarter, GDP growth was slower than expected, largely due to higher imports, while exports made only a partial recovery from their third-quarter decline. The gain in imports mainly reflected stronger business investment, which adds to the economy’s capacity.” What the Bank left out is that the Loonie peaked in the third quarter of last year and remained elevated in the fourth quarter. The resulting drop in exports slowed our economy’s momentum and today the Loonie trades at about the same level against the Greenback that it did then. Also, while the fourth-quarter import rise was due to increased business investment, in real dollar terms that increase was still well below the level that will be needed to offset the lost momentum in consumer spending that is now underway.

In its key closing statement, the BoC tried to keep speculators honest by reminding them that our economy “is expected to warrant higher interest rates over time” but acknowledged that over the near term “continued monetary policy accommodation will likely be needed” and that it “will remain cautious in considering future policy adjustments”.

Bluntly put, the BoC isn’t going to be raising rates for as long as “caution” is its watchword.

The Bottom Line: In its latest policy statement, the BoC observed that its three previous rate hikes and the latest round of mortgage rule changes were achieving their desired effects of slowing our household borrowing rates and cooling our hot housing markets. At the same time, trade uncertainty has become even more elevated.

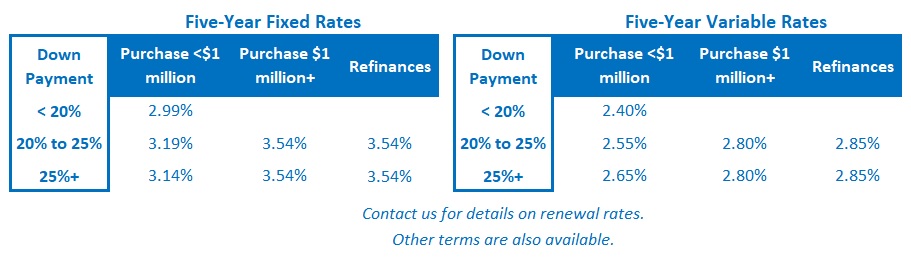

Against that backdrop, the BoC is maintaining a cautious monetary-policy stance, which it can well afford to do because it isn’t overly concerned about the recent “temporary” rise in inflationary pressures. That means that both our fixed and variable mortgage rates should remain at or near their current levels for the foreseeable future and for longer than the consensus continues to forecast.