Why the Bank of Canada Will Be Cautious in 2018 (And It Isn’t Just Because of the January Employment Data)

February 12, 2018How Trump’s Tariffs Are Likely to Affect Canadian Mortgage Rates

March 5, 2018 Our January inflation data have provided the latest fuel for the ongoing debate about when the Bank of Canada (BoC) will next raise its overnight rate.

Our January inflation data have provided the latest fuel for the ongoing debate about when the Bank of Canada (BoC) will next raise its overnight rate.

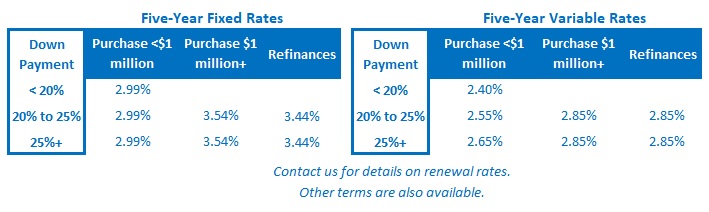

This debate should be of interest to both fixed and variable-rate mortgage borrowers because bank prime rates, which our variable-rate mortgages are priced on, move in lockstep with the Bank’s overnight rate, and our fixed mortgage rates typically rise in anticipation of additional overnight rate increases.

Overall inflation, as measured by the Consumer Price Index (CPI), came in at 1.7%. This was higher than the consensus forecast of 1.4% – but a decrease from 1.9% in December.

The consensus read of the latest inflation data, which showed only a modest uptick of one of the BoC’s key sub-measures of inflation (more on that below), was that this slight change is not likely to alter the Bank’s plan to raise its overnight rate at some point this summer. I continue to disagree with this view and believe that the Bank will once again prove more cautious than our mainstream economists are forecasting.

For starters, while the BoC has repeatedly said that it will be heavily data dependent when setting its future monetary policy, in last month’s policy statement the Bank predicted that “temporary factors” will cause inflation “to fluctuate over the near term” but that it will “remain close to 2% over the projected horizon”. That’s central banker speak for “don’t read too much into the near-term inflation data because we think it will hover at right around target for the next three years”.

The most obvious “temporary factor” that impacted the January inflation data was the minimum-wage hike in Ontario. Sure enough, overall inflation jumped from 1.5% to 1.8% in Ontario, and most notably at the sector-specific level, restaurant prices rose by 4.9% and housekeeping services surged higher by 9.9%. The BoC will rightly “look through” this policy-induced labour-cost increase because its impact on prices is non-recurring (and is not confirmation of cyclically rising wage pressures).

Bluntly put, unless our inflation data were to spike precipitously (which it didn’t last month) and essentially force the BoC to raise its overnight rate, I think the Bank will hold off on raising its policy rate for some time yet.

Here are five reasons why I say that:

- The BoC continues to reiterate its cautious approach at every turn. The Bank recently reminded us that its monetary policy will be “asymmetric” because it will “respond more aggressively to negative shocks than to positive shocks”. BoC Deputy Governor Wilkens recently observed that “even if inflation were closer to the middle of the range … caution might still be in order”, and in its latest monetary-policy statement the Bank said that it is putting “greater weight on the downside risks” in our current environment.

- BoC Governor Poloz estimated that it can take anywhere from one to two years for policy-rate hikes to realize their full economic impact. The Bank has hiked rates three times in the past nine months and I think it will now adopt a wait-and-see approach, especially given its concern that “higher household debt has likely heightened the sensitivity of spending to interest rate increases”.

- The sixth round of mortgage rule changes was just implemented on January 1, 2018 and, here again, I think the BoC want to allow time to assess their impact.

- Our policy makers still don’t know how the NAFTA negotiations will unfold, and it now looks as though the final outcome may not become clear until after Mexico’s presidential election in July. I just can’t see the BoC raising rates further while so much NAFTA uncertainty remains.

- Additional rate hikes will push the already lofty Loonie higher. Today the Loonie trades at 79 cents against the Greenback and that’s probably already too rich for the BoC’s liking. The additional rate rises forecast by the consensus would push the Loonie higher still.

Now let’s close with a look at what happened to the Bank of Canada’s four main gauges of inflation in January (with brief definitions added in italics where needed).

CPI-Overall was unchanged for the month at 1.7% and remains below its recent peak of 2.1% in October 2017 and its target of 2%. (Core CPI, which strips out more volatile price inputs like food and energy, was also unchanged at 1.2% last month.)

CPI-Overall was unchanged for the month at 1.7% and remains below its recent peak of 2.1% in October 2017 and its target of 2%. (Core CPI, which strips out more volatile price inputs like food and energy, was also unchanged at 1.2% last month.)

CPI-Trim held steady at 1.8% for the third straight month.

CPI-Trim held steady at 1.8% for the third straight month.

CPI-trim is defined as “a measure of core inflation that excludes CPI components whose rates of change in a given month are located in the tails of the distribution of price changes”. In other words, if a specific component of the CPI moves dramatically in a given month, that spike is treated as a one-off and the affected item is excluded from the CPI-trim measure. So if Ontario’s minimum wage hike causes hourly wages to go through the roof, CPI-trim will ensure that it doesn’t lead us to misinterpretations about a broader change in underlying inflation.

CPI-Median also held steady at 1.9% for the third straight month.

CPI-Median also held steady at 1.9% for the third straight month.

Overall CPI tracks changes in the price of a wide variety of items – but some prices move up or down more than others. CPI-median filters out item-specific volatility as CPI-trim does – but in a different way. CPI-median plots the monthly percentage change in the price of each CPI item on a scale and uses the price change of the item at the mid-point of that scale as the CPI-median.

CPI-Common increased from 1.6% in December to 1.8% in January. Recently this measure has been the most volatile and has now risen from 1.4% over the past six months.

CPI-Common increased from 1.6% in December to 1.8% in January. Recently this measure has been the most volatile and has now risen from 1.4% over the past six months.

CPI-common is defined as “a measure of core inflation that tracks common price changes across categories in the CPI basket”. Of the three new gauges, this one is the most complicated to explain. In essence it tries to identify and measure the changes in price movements that are related to changes in overall aggregate demand rather than to sector-specific changes.

The Bottom Line: The latest inflation data showed little change over the month of January with the biggest impact coming from Ontario’s one-time increase to its minimum wage. Against that backdrop, I expect the BoC to maintain its wait-and-see approach for some time. If I’m right, that will help keep both our fixed and variable rates from rising much beyond their current levels for longer than the consensus is forecasting.