Canadian Mortgage Rates Are Rising – Should Variable-Rate Borrowers Lock In?

July 4, 2017Canadian Variable Mortgage Rates Rise for the First Time in Over Seven Years. What’s Next?

July 17, 2017 The latest Canadian employment data handily beat consensus estimates once again, and the futures market is now assigning a 96% probability that the Bank of Canada (BoC) will raise its overnight rate by 0.25% when it meets this Wednesday.

The latest Canadian employment data handily beat consensus estimates once again, and the futures market is now assigning a 96% probability that the Bank of Canada (BoC) will raise its overnight rate by 0.25% when it meets this Wednesday.

Not to be outdone, the latest U.S. employment headline number also beat expectations and investors are now assigning 97% odds that the U.S. Federal Reserve will raise its policy rate by another 0.25% at its next meeting later this month.

Let’s start by taking a quick look at the latest employment report highlights for both countries:

Canadian Employment Report Highlights (for June)

- The Canadian economy added an estimated 45,300 new jobs in June, which far exceeded the consensus forecast of 10,000 new jobs for the month.

- Our unemployment rate fell to 6.5% at the same time that our participation rate, which measures the percentage of working-age citizens who are either employed or who are actively looking for work, increased from 65.8% to 65.9%. These days, it is a rare month when unemployment falls at the same time as the labour force expands.

- Full-time employment rose again, this time by 8,100 new jobs, and that’s on top of the 77,000 surge in full-time jobs we saw last month. Part-time employment increased by 37,100 new jobs.

- Average hours worked rose by 0.4%, rebounding from a 0.1% drop last month. This is an encouraging statistic when job growth is strong because it means that the newly created jobs aren’t pulling hours away from those who are already employed.

- Our manufacturing sector added another 2,900 new jobs in June, on top of the 25,000 new jobs that it created in May. That momentum now appears vulnerable though, because job growth in the manufacturing sector is highly correlated to exchange-rate movements and the Loonie has soared of late, hitting a ten-month high against the Greenback last week.

- Average wages were flat last month, after falling by 0.1% in May. That statistic continues to be the fly in the ointment of otherwise solid employment reports. Labour costs typically lag other economic indicators, so slow-to-get-going wage growth doesn’t come as a total surprise. But the current lag has lasted longer than we have seen in past cycles, and the lack of a wage response increases the probability that other factors, like productivity enhancements, are keeping labour costs down. On that note, our productivity has surged over the past twelve months (see chart below), and if that trend continues our inflation rates will be less affected by tightening labour market conditions.

U.S. Employment Highlights (for June)

- The U.S. economy added an estimated 222,000 new jobs in June, beating the consensus forecast of 180,000 new jobs for the month, and the initial estimates for April and May were revised upwards by another 47,000 jobs as well.

- Overall unemployment rose from 4.3% to 4.4%, but that was because the U.S. participation rate increased from 62.7% to 62.8% as more Americans entered the workforce.

- Average hours worked rose by .4% last month, reversing the 0.2% decline that we saw in May. Average hourly earnings rose by 0.2% last month, which wasn’t bad, but just as in Canada, average U.S. wages are barely keeping pace with inflation. That means that many U.S. consumers aren’t seeing any expansion in their purchasing power and that is important because U.S. consumer spending accounts for more than two-thirds of overall U.S. GDP.

- Economist David Rosenberg had a great insight into the details in the latest U.S. employment data. He noted that the 25- to 54-year-old cohort, which is the prime working age segment, lost 21,000 jobs in June on top of the 92,000 jobs that it lost in May. So U.S. job creation is weakest in the age category that contributes the most to consumer spending. (As an offset, those aged 16 to 19 added 203,000 new jobs last month and workers aged 55+ added another 178,000 new jobs.)

Financial markets expect that the latest Canadian and U.S. employment reports will embolden the BoC and the Fed to follow through on their planned policy-rate rises. The unknown at this point is how our respective economies will respond to this monetary-policy tightening.

The BoC rate rise will be the first in more than seven years, and if the Loonie continues its rise in response, that will intensify a headwind for our export-manufacturing sector, which has only recently shown signs of recovery.

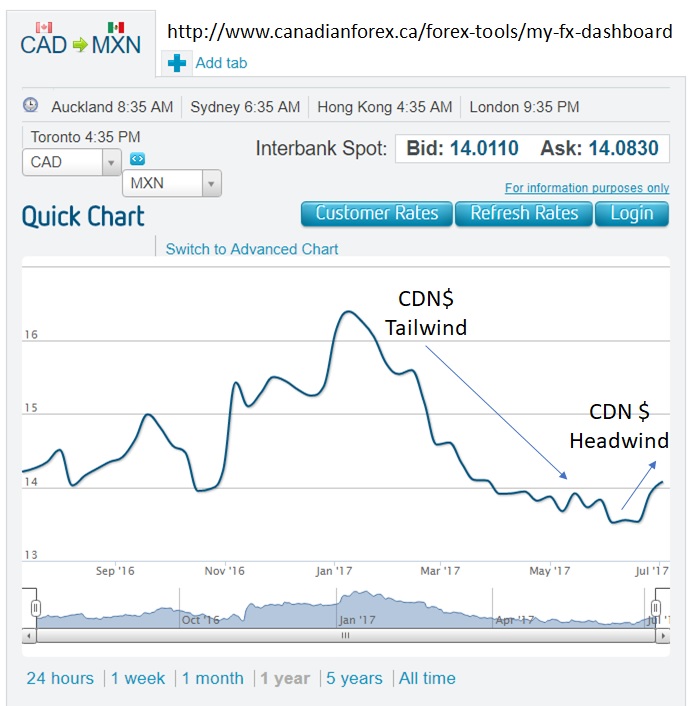

We talk a lot about the Canada/U.S. exchange rate but perhaps the Canada/Mexico exchange rate should be getting more attention. After all, our exporters compete with Mexican equivalents for U.S. import demand and we are both members of NAFTA.

The chart on the right shows that the Canadian dollar fell against the peso over the first half of 2017, giving our exporters a boost, but that trend has recently reversed.

It will take time for the impacts of this reversal to show up in the economic data, but when they do, they will be negative, and additional BoC rate increases after July will exacerbate their magnitude.

Five-year GoC bond yields rose by seven basis points last week, closing at 1.47% on Friday. Five-year fixed-rate mortgages are still available at rates as low as 2.39% for high-ratio buyers (but probably not for much longer), and at rates as low as 2.54% for low-ratio buyers, depending on the size of their down payment and the purchase price of the property. Meanwhile, borrowers who are looking to refinance should be able to find five-year fixed rates in the 2.79% to 2.84% range.

Five-year variable-rate mortgages are largely unchanged so far and are still available at rates as low as prime minus 0.80% (1.90% today) for high-ratio buyers, and at rates as low as prime minus 0.70% (2.00% today) for low-ratio buyers, again depending on the size of their down payment and the purchase price of the property. Borrowers who are looking to refinance should be able to find five-year variable rates around the prime minus 0.40% to 0.60% range, which works out to between 2.10% and 2.30% using today’s prime rate of 2.70%.

The Bottom Line: Variable-rate borrowers can expect to see their prime rate rise from 2.70% to 2.95% when the BoC meets this Wednesday. While rate predictions never come with guarantees, I continue to believe that existing variable-rate borrowers who exercise their option to convert to fixed rates today will pay more than those who ride it out. Meanwhile, fixed mortgage rates have risen by about .20% in the lead up to this week’s meeting, and the market’s reaction to the BoC statement that accompanies its policy-rate increase will determine which direction they go from here.