Our regulators are right to be concerned about our record-high household debt levels, and more specifically, about the continued rise in Canadian mortgage debt outstanding.

Our regulators are right to be concerned about our record-high household debt levels, and more specifically, about the continued rise in Canadian mortgage debt outstanding.

With mortgage rates at record lows, everyone can afford to borrow more, and when ultra-cheap borrowing costs are combined with housing markets where there is much more demand than supply, prices rise quickly. Over time, rising prices and rising mortgage debt levels feed each other in a self-reinforcing cycle, especially in places like Vancouver and Toronto, where demand has outpaced supply for some time. The longer this continues, the greater the risk that borrowers will not be able to afford their mortgages at renewal.

To their credit, the majority of borrowers I work with are well aware of the risk that mortgage rates could be higher when they renew, and as part of our discussions, we often stress test their prospective loan to assess the cost of having to renew at a higher rate. To that end, in today’s post I’ll provide an example of what this analysis looks like in our current rate environment.

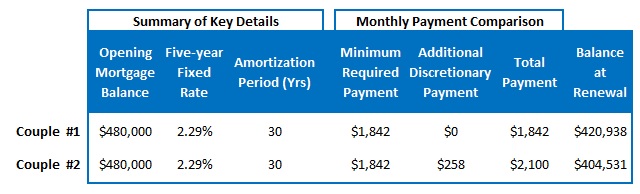

For starters, let’s assume that two separate couples are buying a property for $600,000 with a 20% down payment. (While I deal with Canadians from coast to coast, I originate most of my business in the Toronto area, so I’m using a purchase price and down payment that are typical of the first-time buyers that I work with.) This purchase would require a mortgage of $480,000, and if we assume a five-year fixed-rate at 2.29% that is amortized over 30 years, this loan would come with a minimum monthly payment of $1,842.

Now let’s assume that these couples adopt two different strategies when making their mortgage payments. Couple #1 makes only their minimum contractual payment over the first five years, while Couple #2 schedules an ongoing additional monthly payment, which lowers their effective amortization period from 30 years down to 25 years. To do that in this case, Couple #2 would need to schedule an ongoing additional monthly payment of $258, thereby increasing their total mortgage payment from $1,842 to $2,100.

Here is a summary of the key inputs we’ll be using, along with a comparison of the monthly payments and the balance outstanding at renewal:

Notice that by adding $258 to their regular monthly payment, Couple #2 will have knocked another $16,000 off their mortgage balance at renewal. If you’re worried about the risk of rates rising in the future, this is an effective way to address that concern over your first mortgage term (and you have the option to cancel that additional $258 monthly payment any time, because you are making it on a discretionary basis).

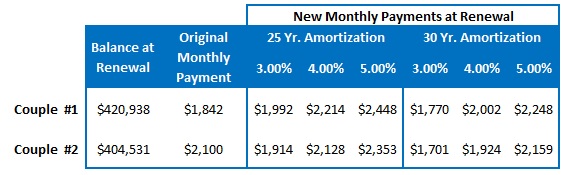

The table below summarizes what would happen to your monthly payment if rates were to rise to 3%, 4% or 5% at renewal:

Notice that I have shown the new payments using both 25- and 30-year amortization periods. If you start with a 30-year amortization during your original five-year term and you leave everything ‘as is’ at renewal, your next five-year term will start with a 25-year amortization. But, if rates rise to the point where making your monthly payment becomes too onerous, you would have the option of extending your amortization back to 30 years instead. (The legal costs to do this would be about $1,000.)

To be clear, extending your amortization period means that it will take you an extra five years to pay off your loan if you make only the minimum payment. But even if you do this, you will still have the flexibility to use your discretionary prepayment allowances to lower your effective amortization back down if and when your circumstances change. This is just one of many examples of how the intelligent structuring of a mortgage can reduce financial stress and provide vital flexibility when it is needed.

Now let’s see how the two scenarios work out under different rate-rise scenarios:

Rates rise to 3.00% – In this first renewal-rate scenario, rates rise .71% from their initial 2.29% level.

Couple #1, who made only the minimum payment over the first five years, would face a $150 increase at renewal, which would raise their new payment to $1,992. Meanwhile, Couple #2, who made an additional $258 discretionary payment each month, would face a $72 increase at renewal, which would raise their new payment to $1,914. While this would technically be an increase over Couple #2’s original mortgage payment, that extra $72 would still be less than the additional $258 payment that they were used to making over the first five years (and they could shrink their additional payment by $72 to absorb that increase when setting up their new mortgage payments at renewal).

If Couple #1 decided to extend their amortization from 25 years back to 30 years, their new monthly payment would drop to $1,770, which is $72 less than their original payment. If Couple #2 did the same, their new monthly payment would be $1,701, which works out to $131 less than their original payment.

Rates rise to 4.00% – In the second renewal-rate scenario, rates rise 1.71% from their initial 2.29% level.

Couple #1 would face a $372 increase at renewal that would raise their new monthly payment to $2,214. Meanwhile, Couple #2 would face a $286 increase at renewal that would raise their new monthly payment to $2,128, although when you add in the $258 additional monthly payment that they would by now be used to making, that increase really only works out to an extra $28/month.

If Couple #1 decided to extend their amortization from 25 years back to 30 years, their new monthly payment would drop to $2,002, or $160 more than their original payment, and if Couple #2 did the same their new monthly payment would drop to $1,924, or $82 more than their original payment (but again, still less than the combined payment of $2,100 that they had become used to making).

Rates rise to 5.00% – In the third renewal-rate scenario, rates rise 2.71% from their initial 2.29% level.

Couple #1 would face a $606 increase at renewal, which would raise their new monthly payment to $2,448. Meanwhile, Couple #2 would face a $511 increase at renewal, which would raise their new monthly payment to $2,353, although when you add in the $258 additional monthly payment that they would by now be used to making, that increase nets out at $253/month.

A more than doubling of rates in five years would be a dramatic increase, and if Couple #1 decided to extend their amortization from 25 years back to 30 years to help mitigate this payment shock, their new monthly payment would drop to $2,248, or $406 more than their original payment. If Couple #2 did the same, their new monthly payment would drop to be $2,159, or $317 more than their original payment (but only $59 more than the combined $2,100 that they had become used to making).

Here are some final thoughts on the scenarios outlined above:

- These borrowers got off to a good start by making a 20% down payment, which allowed them to avoid paying for high-ratio mortgage insurance and gave them the flexibility to use a 30-year amortization when setting their original monthly payment. (Borrowers who are putting down less than 20% are limited to a maximum amortization of 25 years.) Having said that, the advantages of making extra discretionary payments and using these strategies would be even greater for someone with a lower down payment.

- Even if you only make your minimum payment each month, you are shrinking the size of your mortgage over time. This will create a natural buffer against a modest rise in mortgage rates. As seen in the examples above, a not insignificant rise in five-year fixed rates from 2.29% to 3.00% results in a manageable increase of only about $150/month.

- That said, topping up your monthly payment with an additional payment creates a much larger buffer against the risk of rising rates at renewal. In Scenario 2, the borrowers made an extra $258 payment each month and this knocked an additional $16,000 off their balance at renewal. More importantly, that extra $258 got them used to making higher payments before future rate increases made it necessary. To wit, even if five-year fixed rates more than doubled to 5% at renewal, these borrowers would be looking at an increase of only $253 if they renewed using a 25-year amortization, and only a $59 increase if they re-extended their amortization to 30 years.

- It takes some discipline to make that extra $258 payment each month, but I have found that many of the borrowers that I work with do successfully execute this strategy. My observation was reinforced last week by John Webster, Scotiabank’s Head of Lending, who said that Canadians “are in as quick a hurry as possible to pay down their mortgage. So even if they take a longer amortization, then they’ll do bi-weekly payments and…we still have big pay downs every year…I would say that most of my competitors worry about the fact that the portfolio runs off too quickly, not the other phenomenon.”

- First-time buyers have another built-in buffer against the risk of higher mortgage rates. Most young people can reasonably expect their incomes to rise over the next five years as they become more established in their careers. While the combination of higher incomes and lower mortgage balances at renewal certainly doesn’t eliminate future interest-rate risk, these factors do combine to provide powerful mitigants.

Five-year Government of Canada bond yields were flat last week, closing at 0.62% on Friday. Five-year fixed-rate mortgages are available in the 2.29% to 2.39% range, depending on the terms and conditions that are important to you, and five-year fixed-rate pre-approvals are offered at about 2.49%.

Five-year variable-rate mortgages are available in the prime minus 0.40% to prime minus 0.50% range, which translates into rates of 2.20% to 2.30% using today’s prime rate of 2.70%.

The Bottom Line: Most of the experts that I read regularly believe that today’s ultra-low interest rates are the by-product of long-term trends that are unlikely to reverse course in the near future. That said, borrowers are right to plan for higher rates at renewal and the scenarios outlined above provide an example of how to explore this risk in detail. Bluntly put, if you want to ensure that you stay within your means, you are well advised to wait until you have a down payment of at least 20% of the purchase price and to leave enough room in your budget to pay more than the minimum required each month.

3 Comments

Great analysis. I can see that the discussions are still about rates rising in the next year or so.. Which makes me want to break and lock into a longer than 5 year fixed rate.

Great article but what kind of loss do you think there would be on the house over 10 years if in the first 5 years interest rates return the the normal average? And if the value of the house drops and your payment increases, how good of an investment is this really? Is that sustainable?

Hi Andrew,

No way to know at this point. For one thing, it depends on the which market you are referring to. The mortgage rule changes may slow demand to the point where prices stop rising as quickly in hot markets but that doesn’t necessary mean that they will fall.

Time will tell!

Dave