Why CMHC’s Latest Move is Good for Variable-Rate Borrowers

August 12, 2013More Thoughts on the U.S. Fed’s Taper and How It Will Affect Canadian Mortgage Rates

August 26, 2013 Bond yields spiked again last week, largely because of new U.S. economic data which indicates that the U.S. recovery may be gaining strength. For example, weekly U.S. jobless claims fell to a six-year low of 320,000 and confidence among home builders reached its highest level in eight years.

Bond yields spiked again last week, largely because of new U.S. economic data which indicates that the U.S. recovery may be gaining strength. For example, weekly U.S. jobless claims fell to a six-year low of 320,000 and confidence among home builders reached its highest level in eight years.

The U.S. Fed has tied the tapering of its massive quantitative easing (QE) programs primarily to the improvement of the U.S. employment picture so any positive bump in the employment data, however short-term and volatile, continues to trigger a powerful investor reaction.

Because the Fed has also made clear its belief that a continued rebound in housing markets across the country is critical to the overall U.S. economic recovery, more confident home builders also stoke fears that the Fed will take its foot off the cheap-money gas pedal sooner rather than later.

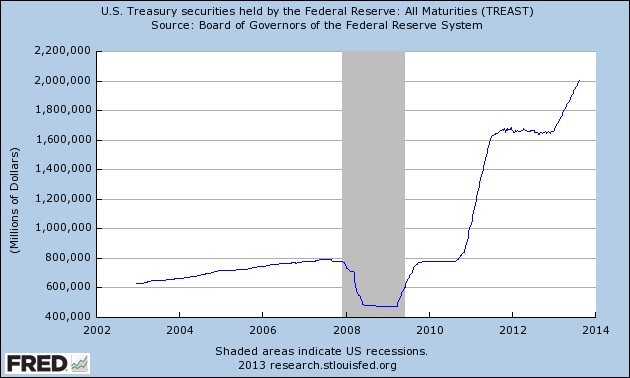

This is the other side of the Faustian bargain that the Fed entered into when it decided to engage in massive and unprecedented levels of money printing . (See chart.) Since November 2, 2008, the start of the Fed’s first modern-day QE prog ram, bad U.S. economic news has been good news for investors because it meant that the Fed would continue, and even intensify, its QE programs to counteract that negative economic momentum. Now we are seeing the inevitable flipside of this bargain take shape – a situation where improving U.S. economic data become a signal that the Fed will start to withdraw (taper) its QE programs.

ram, bad U.S. economic news has been good news for investors because it meant that the Fed would continue, and even intensify, its QE programs to counteract that negative economic momentum. Now we are seeing the inevitable flipside of this bargain take shape – a situation where improving U.S. economic data become a signal that the Fed will start to withdraw (taper) its QE programs.

For a market that many believe has been operating in a state of suspended animation, where higher equity valuations and ultra-low bond yields are driven almost entirely by the Fed’s QE programs, this is a very scary thought. Understandably so. Investors rightly fear what will happen to valuations everywhere when the wealth-creating magic of the Fed’s printing presses is withdrawn.

The Fed isn’t some bit player at the table that can just quietly cash in its chips and head home. When it exits the market , even slowly, there will be a huge vacuum left in its wake – and investors know it. That is the essence of the QE conundrum the Fed faces: If the Fed requires sustainable economic momentum before withdrawing QE, doesn’t the recognition of that very momentum sow the seeds of its own demise because as it gathers strength, it hastens the arrival of QE’s day of reckoning?

For example, who wants to own U.S. treasuries at today’s yields when everyone and his dog expects bond prices to collapse as soon as the Fed starts tapering and takes its finger off of the yield curve? Right on cue, foreign investors have already started pulling out of the U.S. treasury market in droves. If treasury yields continue to spike, a future rise in U.S. mortgage rates will inevitably follow. If the Fed is determined to keep mortgage rates low enough to support a continued housing recovery, won’t it then have to buy more U.S treasuries to offset this capital flight?

The circular effects of positive economic momentum heightening tapering fears, only to have those fears kill the very momentum that created them, first became clear when Ben Bernanke warned about tapering on June 19th (which I wrote about at the time). After adopting a more positive outlook on the state of the U.S. recovery, Mr. Bernanke said that the Fed would begin to slow its QE programs if the recovery continued to progress. Bond yields spiked, equity markets tanked, and since expressing surprise at the market’s reaction, Mr. Bernanke has been beating a hasty retreat from his initial tapering stance ever since. When the experts describe ending QE as being easy as putting toothpaste back in its tube, this is what they are talking about. The Fed, unlike any other player, simply cannot exit the market quietly. It won’t happen. (See chart!)

So what does this mean for Canadian mortgage borrowers? The uncertain future of QE means that there is a lot of fear in the market, so if you’re looking for a five-year fixed rate, you’re probably still in for a bumpy ride.

Government of Canada (GoC) five-year bond yields spiked sixteen basis points last week, closing at 1.96% on Friday. Several lenders have raised their five-year fixed rates in response and I expect others to follow over the next several days. If you are active in the real estate market, you are well advised to lock in a 120-day pre-approval @ 3.39% while you still can.

Conversely, if you’re comfortable with floating rate risk, I think the variable rate continues to have more appeal. That’s because the Fed has said that it won’t even think about raising its short-term policy rate until it completely unwinds its QE programs. I don’t think that will be any time soon, and given the tight linkage between U.S. and Canadian monetary policies, that also means that the Bank of Canada’s overnight rate shouldn’t be moving higher until the Fed completely unwinds its QE programs.

Five-year variable rates are still available with discounts as deep as prime minus 0.55% (which works out to 2.45% using today’s prime rate). The gap between market five-year fixed and variable rates has once again widened, and it now stands at approximately 1%. As the relative discount you get for taking on the risk of future variable-rate increases continues to grow, this option only becomes that much more compelling.

The Bottom Line: GoC bond yields rose higher last week, largely as a result of the more positive tone in some recent U.S. economic data. Despite this, for the reasons outlined above, I still believe that the Fed will take a very long time to taper its QE programs. If I’m right, that will be especially good news for variable-rate mortgage borrowers.

1 Comment

Three contestants are slashed to just two.It Dannii Minogue birthday tonight, but something tells me her celebrations are about to be cut short right now.She looking pretty coy, grinning from ear to ear with the knowledge Brothers Three have never been in the bottom two before.The first contestant safe is 15 year old Marlisa, so her and Ronan jump off the stage.The next safe is.

Toms Skor norge http://ibdp.org.br/images/upload/tomsskoronline/