Euro-Zone Crisis Keeping Canadian Bond Yields and Mortgage Rates Low

February 13, 2012Why Bad News From Beyond Our Borders is Good News for Canadian Mortgage Rates

February 21, 2012Many people think that the differences in how lenders calculate fixed-rat e mortgage penalties are a non-issue now that rates have fallen to ultra-low levels. Nothing could be further from the truth!

e mortgage penalties are a non-issue now that rates have fallen to ultra-low levels. Nothing could be further from the truth!

In actual fact, the relative cost of how penalties are calculated is never more pronounced than when fixed-mortgage rates stay flat or rise slightly over an extended period – exactly the scenario that many experts predict will unfold in the coming years. (To put that in dollar terms, you could be looking at an extra $7,000 in penalty cost on a $250,000 mortgage that is broken two years early.)

Fixed-rate mortgage penalties are almost always calculated based on “the greater of three months interest or interest-rate differential (IRD)”. But there are key differences in the actual rates lenders use to calculate your IRD. In today’s post I will show you how those differences are magnified in a flat or slightly rising interest-rate environment. We’re not talking small potatoes here – today the IRD calculations used by some prominent banks come with a penalty that is more than five times what you would pay at a wide range of other lenders.

Let’s start by assuming you have a current balance of $250,000 on a five-year fixed rate mortgage at 2.59%. We’ll also assume that you are three years into your term (with two years remaining) and that interest rates are the same when you break your mortgage as they were when you first got your loan.

First, we calculate the cost of three month’s interest, which we can quickly determine is $1,619.

Here is the formula we use to arrive at that number:

We then compare this cost to the cost of your IRD penalty, which will almost always be calculated using one of three methods: Standard, Discounted or Posted.

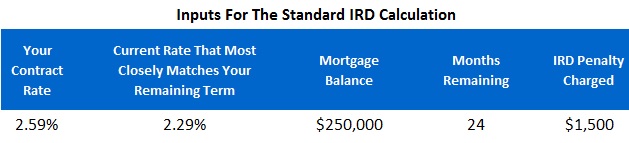

The Standard IRD Penalty

When using a standard IRD penalty calculation, your lender starts by taking the difference between your contract rate (2.59%) and their current rate that most closely matches your remaining term. Since you have two years left on your mortgage, that would be the lender’s two-year fixed rate (we’ll use 2.29%, which is widely available today). The difference between these two rates is 0.30%.

The lender multiplies this difference (0.30%) by your mortgage balance ($250,000) and the time remaining on your mortgage (expressed as the number of months remaining on your mortgage divided by twelve).

And here is a table which explains where each number in the formula came from:

That’s it. If you understand this example, then you have mastered the standard IRD calculation. It is used by a wide range of lenders who compete with each other to offer borrowers the best mortgage rates available.

In this case the cost of three months’ interest ($1,619) is greater than the lender’s Standard IRD calculation ($1,500), so you would have to pay $1,619 to break your mortgage.

But here is where a little knowledge can save you some serious money. Other well-known lenders have tweaked their IRD calculations to skew the interest rates used in their formulas heavily in their favour, and as you will now see, that can have a huge impact on the size of your penalty.

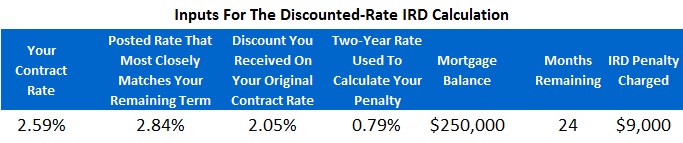

The Discounted Rate IRD Penalty (Used by RBC, BMO, TD, Scotia and National Bank)

When using the Discounted Rate Penalty, the lender takes your contract rate and compares it to the posted rate that most closely matches your remaining term MINUS the original discount you got off of their five-year posted rate (which in this case is 2.05%). Here is the contract wording taken straight from TD’s website. I have underlined the key section:

[Your contract rate will be reduced by] the current interest rate that we can now charge for a mortgage term offered by us with the term closest to your remaining term. The interest rate will be our posted interest rate for the term minus the most recent discount you received.

In other words, this lender will take the discount they gave you off of their five-year posted rate and apply that same discount to the posted two-year rate they use in your penalty calculation. This tweak makes a big difference to the cost of your penalty and is blatantly one-sided because lenders don’t discount shorter-term fixed-rate mortgages nearly as deeply as they do their five-year terms (.30% vs. 2.05% using this same lender’s rate sheet as of today).

The table below shows you the key numbers used to calculate the Discounted Rate IRD penalty:

I know. Ouch.

But fasten your seat belt because other major lenders dig even deeper into your wallet. The Grand Daddy of them all is the Posted Rate IRD Penalty.

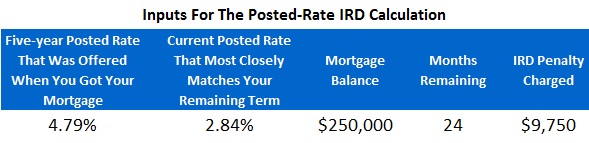

The Posted Rate IRD Penalty (Used by CIBC)

Here is the a breakdown of CIBC’s posted-rate penalty calculation:

In this variation, the lender calculates your IRD penalty using the five-year posted rate that they were offering when you got your mortgage. Here is a sample of the wording used to explain how the penalty is calculated (taken from CIBC’s website). I have underlined the key sections :

The interest rate differential amount is the difference between the Interest on the Prepaid Amount for the remainder of the term at the posted rate at the time you took out the mortgage, and interest on the Prepaid Amount for the Remainder of the Term using a Comparable Posted Rate. Interest is calculated at the interest rate posted by [the lender] for a mortgage product similar to your mortgage product on the date the payout statement is prepared.

Now CIBC’s defence of this tactic is that they substitute posted rates for both your original rate and the rate that most closely matches your remaining term. But as we have already outlined above, this is a terrible trade that no informed person would make because Big Six lenders must make huge discounts to their five-year posted rates to make them competitive with market five-year fixed rates, and those same discounts shrink dramatically on shorter fixed-rate terms.

If we used the same rates in this example that we used in the discounted-rate method outlined above, the posted-rate method would yield the same sized penalty. But CIBC’s posted rates tend to be higher (which they were at the time this post was written), and for that reason, their penalties earn the moniker of “The Grand Daddy of Them All”.

Here is what that tweak to the wording in your contract does to your penalty:

Surprised? Don’t be. These inflated mortgage penalties generate substantial profits for the lenders who use them and when uninformed borrowers choose to negotiate directly with their lender, is it that hard to imagine that some of those lenders would tweak the fine print in their favour?

To be clear, I don’t have a problem with mortgage penalties in principle. When you break a mortgage contract, your lender incurs costs when they unwind agreements related to your loan (these agreements can relate to hedging, servicing, securitization etc.). The penalty charged is supposed to cover these costs while also recouping part of the lender’s lost profit. Fair enough. That’s why they’re called “closed mortgages”. But is it fair for some lenders to use these early terminations as “gotcha” moments?

I don’t think the vast majority of Canadian mortgage borrowers have any idea that there are significant differences in the way fixed-rate mortgage penalties are calculated, and the largest Canadian lenders, who have milked that lack of awareness to their advantage for years, have been in no hurry to explain it to them.

I don’t think the vast majority of Canadian mortgage borrowers have any idea that there are significant differences in the way fixed-rate mortgage penalties are calculated, and the largest Canadian lenders, who have milked that lack of awareness to their advantage for years, have been in no hurry to explain it to them.

While our federal government has repeatedly acknowledged the public’s pain and frustration over these unfair practices (which can easily be referenced with a Google search for “Canadian mortgage penalties”), it has been frustratingly slow in forcing lenders to provide more transparent disclosure.

In the meantime, a conscientious and well informed independent mortgage planner should be able to explain how penalties are charged by any lender they are recommending.

Forewarned is forearmed.

24 Comments

David:

Great post. One edit for you … you seem to have plugged the IRD formula in with the 3-month penalty info (as well as where it does belong). Regardless, thanks, I’m going to link to it from my pages.

Gord

Thanks for the catch Gord. I have made that change.

Dave

Great post. I was a little confused by the difference between the discounted and posted methods. I must have missed something becasue it seems like they should be the same. If the 2-year rate in the posted method is 3.29%, then wouldn’t the 2-year rate in the discounted method be 3.29%-1.95% = 1.34%? However, you used 1.60%. Are the 2-year rates used for these 2 methods different somehow?

Hi Michael,

Thanks for your email and happy to clarify.

In the discounted-rate example, the lender takes the borrower’s contract rate and substracts the difference between it and their current posted two-year rate (2.99%) minus the same discount that was given off of the original five-year rate (1.95%).

In the posted-rate example, the lender takes the difference between the original five-year posted rate and the current two-year posted rate.

These are subtle differences that depend on whether the lender’s calculate IRD using posted or discounted rates, but in both cases, the tweaks have the same overall effect, which is to aritifically inflate the size of the penalty charged.

Best,

Dave

Absoultely correct to be wary of the people who state that with rates so low, penalties aren’t a concern.

That’s what people heard whent hey were taking five-year fixeds at ~5% in 2007 or so, and what people heard when they were taking five-year fixeds at 3.8% in 2010 or so.

Anyone going for a 10-year mortgage should be very wary of IRD implications should they need to break their mortgage before t6he sixth year.

Great post!

hi Dave

Thanks for doing this! I was going to craft a similar chart for my team but yours is superb and far more detailed in number of examples! Thanks for digging out the wording from the charge terms. The last example is nothing short of shocking that they would use the posted rate from 3 years ago. They would be putting that money back out there at then current rates, so that number is so irrelevant- no wonder clients are confused. Even those who deal with this daily have difficulty understanding some of this reasoning.

Dave

What a great explaination! I have passed this information on to persons I know currently working on mortgage deals.

I can not believe this type of contract is legal, it is blowing my mind.

I am currently dealing with an issue with a bank that has the discount rate IDR penalty worked into my mortgage. They are making us jump through hoops to try and port the mortgage and then have this crazy huge penalty for breaking the mortgage. Last year we were told the penalty would be 16, 000 and most recently over 20, 000 (it looks like it could be up to 25, 000 I have their worksheet). Ouch, right!! Three months interest equals under $3000.00.

They say my original dicount was 2.3% I am not sure how they got this discount number. We are closest to a 3yr term right now, and we originally signed a 5yr so we wouldn’t have received a discounted rate for a 3yr from a 5yr to begin with. If you would be able to explain how this works it would be super! I plan to ask the bank directly after they reply to my recent inquiry- they really do not like explaining how the calculation is done and I don’t wonder why.

My mortgage specialist that set up the mortgage in the first place has left the bank because of all the “unethical underwriting” and is now working as a mortgage broker.

Thank you so much

Respectfully,

T

Hi Tera,

I think that the 2.3% discount the lender is referring to was the difference between their five-year rate posted rate and your five-year contract rate at the time of funding.

Your lender is now applying that same discount to their three-year posted rate, even though the gap between three posted and contract rates is much, much smaller.

FYI – penalties are a big source of profit for the Big Six banks. It’s just too bad that they don’t do a fairer job of informing their clients about the terms and conditions in the mortgage contracts they are signing. Realistically though, our regulators need to step in to protect consumers because this practice will continue for as long as the Banks are allowed to get away with it.

Best,

Dave

Hi Dave, thank you so much for your time and this article to begin with.

I think I understand what is happening now but I understand HOW it is allowed to happen even less!!

Technically speaking they aren’t even adding (or rather multiplying) apples to apples.

Current buy out is almost $24, 000.00

We are not asking out of our mortgage for a lesser interest rate, which is what the IRD was supposed to protect the banks from. We are trying to move to our dream property and port our mortgage.

The trouble we are running into is that, although we can more than quailify for it, even just on half of our income, and we have about 33% down, its an issue with them not mortgaging any of the land. So they really have us in a trap if they won’t do a port AND they have this penalty that is pretty much impossible to overcome if they don’t port it.

There is an appraisal getting done to determine a maxium lending amount on the property but they are even dragging their feet on that and costing us all our financing condition time. I am just sick about it, I have wanted a property like this my whole life and I feel it slipping through my hands.

I hope more people get informed so they know what they are dealing with, I really believe they would not choose these mortgages, that have IMO unethical underwriting, if they truely understood what they were getting into. I personally will boycott the Big Six Banks (as soon as I can) and will encourage others to do the same. If the “regulators” will not regulate maybe a lack of business will encourage these banks to changes their ways.

My current penalty is 750% more than 3 months interest

Thank you again for your response

T

Excellent article Dave. I was just on the RBC website before reading your article and was very surprised to see that they calculate the IRD using the “Discounted Rate IRD Penalty” method you describe. Before reading your article, I thought it might be an error because there is simply no logic to it. The “Standard IR Penalty” is certainly reasonable since, as you point out, it essentially recovers a bank’s interest loss in re-lending the money but I’m amazed that the banks have been allowed to re-define the IRD in these arbitrary ways! This may be a case of not enough people being aware of how unreasonable these bank procedures are so the banks have been able to get away with it. I’m so outraged here that I’m planning on approaching the media about this. I’d like to hear an official from a bank try to explain the logic behind their IRD definitions. I remember a while back there was a lot of attention on unreasonable bank transaction charges and I think the banks relented to some degree.

Thanks for your comment Dan. I agree that not enough people are aware of the way that bank’s calculate their IRD penalties – and nothing disinfects better than a little sunlight!

Thank you very much David! It’s very helpful.

Very well summarized David.

I am shocked and don’t agree with the calculation method the banks are using. I was under the mistaken assumption that if I renegotiate a new closed mortgage before the end with the same lender at a lower rate, that they would calculate the penalty on the difference between my old and new rate. They gave me an unreasonable penalty (no calculation details) while in the same email asking me to give then a chance to compete for a new rate. Seriously delusional if they think I’m going to stay, if I’m paying full penalty as if I’m leaving.

Keep this up, we need more people like you.

Thanks Mario. And sorry to hear that you aren’t able to refinance down to a lower rate.

Dave

Thanks David. This is very useful info. It’s really surprising banks don’t have to openly publish the formulas they are using for this. I couldn’t find them anywhere.

Follow-up question, what happens to these calculations if the interest rates increase after you sign your mortgage? For example, I’m shopping for a 2.19% fixed rate 5 year mortgage right now. How would you calculate the penalty in 3 years if interest rates have increased by then? For the standard IRD, would it be zero given the result of the calculation is negative (and therefore would be charged 3 month interest instead)?

Many thanks.

Hi Edouard,

Prepayment penalties are calculated when payouts statements are ordered based on the rates available at that time.

If rates rise between now and then, the IRD penalty amount will shrink. If they rise to a level where the IRD penalty is zero, then the penalty owed would revert to three months’ interest.

Best,

Dave

Great article, found it very helpful.

I fear I am in trouble, where might I find the information on the CIBC website for terminating early?

I pulled my mortgage docs and it’s all greek to me. We have to sell due to separation, and I am trying to educate myself as much as I can.

Thank you.

Hi Cindy,

Sorry to hear about your situation. CIBC will provide you with a penalty quote if you call their mortgage customer service line.

Best,

Dave

Great post. Thank you very much. We have had to break our mortgage due to selling the house. Our penalty is $15, 000. My credit union couldnt ecplain how they came to this number. Grrrrrr

Hi Richard,

Thank you for your note and sorry to hear that your lender could not readily explain their penalty calculation.

In such circumstances I suggest that you escalate your file to a manager. Somebody should be able to walk you through it!

Best regards,

Dave

I loved this article! It FINALLY explained to me WHY my mortgage penalty amount was such a shock to me and every broker I’ve been shopping with. I was uninformed and got a horrid CIBC 5 year mortgage 3 years ago. So frustrating!

Anyhow, at least now I understand what’s going on with this 23,575.00 penalty!!!!

Thank you!

Such a thorough explanation! I was doing some research on fixed rate penalties, and this was very well explained. Thanks

Thank you David!!

This is how I explain the penalty differences my clients when they are deciding between a variable or fixed mortgage for their home. I really appreciate the illustration, as we know – clients don’t believe it till they see it!

An awesome tool to steer first time home buyers in the variable rate direction if they have plans of breaking their mortgage early.