The Bank of Canada Holds Steady, But More Cuts Should Still Be on the Way

April 21, 2025 Last week was mercifully quiet for news affecting Canadian mortgage rates.

Last week was mercifully quiet for news affecting Canadian mortgage rates.

Today’s post offers a detailed look at the mortgage-selection advice I am offering to borrowers I am currently working with.

Those conversations usually start with borrowers saying that they are hearing rates are likely to move lower in the coming months and asking how that expectation might impact their choice of mortgage product.

I start my response by explaining where that view comes from.

When the mainstream media talk about rates dropping, they are typically referring to Bank of Canada (BoC) policy-rate cuts.

Right now, the bond-futures market, which is where bond-market investors essentially place bets on where the BoC’s policy rate is headed, is pricing in two more 0.25% cuts by the Bank in 2025.

If those cuts materialize, variable mortgage rates will drop by the same amount (because they are priced using lender prime rates, which move in lockstep with the BoC’s policy rate).

For my part, I think the Bank will end up cutting by more.

To summarize a consistent theme in several of my recent blog posts, I think our economy is in for some tough sledding and that the BoC will be compelled to cut its policy rate to a stimulative level before the dust settles.

Bond market investors currently expect the BoC’s policy rate to bottom out at 2.25% (down from 2.75% today). But by the Bank’s own estimate, it won’t start stimulating demand until it hits 2%.

Not coincidentally, the BoC’s policy rate has dropped to 2% or lower in each of its past rate-cut cycles, stretching back more than twenty-five years.

So, should borrowers just choose a variable-rate mortgage today and let the good times roll?

Not so fast.

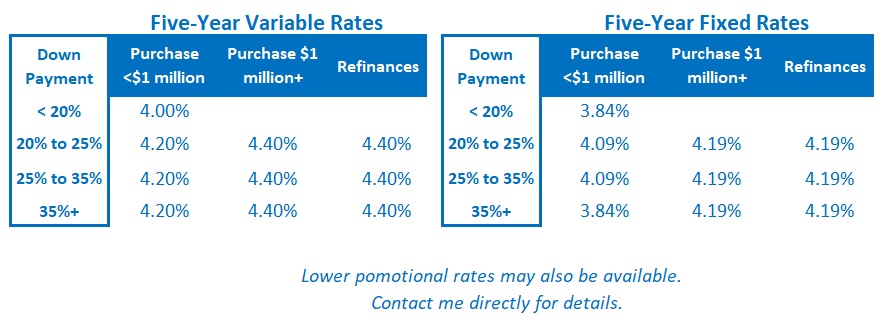

Today, variable rates are higher than fixed rates.

That means anyone choosing a variable-rate mortgage now will have to accept a higher rate on the bet that the rate will drop if the market expectations are met. And if the BoC enacts only two more 0.25% cuts, variable rates will then be roughly equal to today’s fixed rates.

What happens after that?

Variable-rate terms are typically for five years. While most analysis focuses on where rates are headed over the short term, the average cost of a variable rate over its full term is all that really matters.

In my opinion, and as I have been writing in my blog for some time now, variable mortgage rates are likely to prove cheaper when compared to today’s fixed-rate options over their full terms

But now that our mortgage rates have fallen back to within their long-term average ranges, the potential for additional variable-rate saving is likely to be smaller and perhaps not as compelling to borrowers who instinctively prioritize payment stability over cost minimization.

The main worry of borrowers who are leaning toward fixed rates today is that rates will continue to fall after they lock in. But some additional insight can help assuage that concern.

For starters, if a lender reduces its rates between the date of approval and five business days prior to their closing date, the borrower is entitled to receive the lower rate. (While five business days is the standard, some lenders will allow rate drops in as few as two business days prior to closing.)

Therefore, there is no need to hold off on securing an approval once an Offer to Purchase has been accepted and once borrowers have finished shopping around, especially since securing an approval also protects borrowers from any subsequent rate increases.

The most important detail for potential fixed-rate borrowers to understand is that, unlike variable rates, fixed mortgage rates are not directly linked to the BoC’s policy rate. Instead, they are priced on Government of Canada (GoC) bond yields.

GoC bond yields fluctuate constantly. Their levels are determined by thousands of investors, large and small, buying and selling those bonds based on their assessments of what the future looks like. As such, the two 0.25% BoC rate cuts that the market anticipates this year are already reflected in GoC bond yields at their current levels and, by association, in today’s fixed rates.

In other words, fixed-rate borrowers don’t need to wait to benefit from the BoC rate cuts which are widely expected to materialize because those cuts have already been priced in.

Simply put, if you’re reading a headline in the newspaper or hearing talk about lower rates from friends and family, it’s yesterday’s news. If fixed mortgage rates fall below their current levels, it will be because new information comes to light, which bond market investors haven’t accounted for yet.

Broadly speaking, if a fluctuating mortgage rate won’t put you under worrying financial pressure and if you are comfortable with the inherent uncertainty of a variable rate, I think the variable rate will likely prove to be the cheapest option. But variable rate options are best used as a long-term strategy, not as a market-timing play for borrowers betting that they will identify just the right time to convert to a lower fixed-rate mortgage.

The conversion rates offered by lenders are not normally as competitive as those offered to new customers. Also, nobody rings a bell to signal the perfect time to lock in. In my experience, borrowers who convert from variable to fixed mid-term typically end up locking in fixed rates that are higher than those that were available when they originally secured their financing.

Alternatively, if you instinctively prefer the stability of a fixed rate, your options have improved markedly of late.

Fixed rates have now fallen back to below their long-term averages. That reduces the risk that locking in now will cost you an arm and a leg. To put that in concrete terms, on a $300,000 mortgage with a five-year term, I think today’s variable-rate options will probably save you the equivalent of a few fancy dinners out on the town but not the cost of your next family vacation.

If rates do fall by more than expected the cost to break and refinance some fixed-rate mortgages can work out to be less than the available interest-rate saving. But not always. There are significant differences in the ways that lenders calculate their fixed-rate mortgage penalties. You can find more detail on that topic in this post.

To be clear, there is no such thing as one-size fits all mortgage advice.

For example, I tend to advise first-time home buyers who are taking on all the costs associated with home ownership to lean heavily toward the stability of a fixed rate, regardless of their risk tolerance. Fixed rates are a form of cash-flow insurance, and they are always a wise choice if demands on cash flow are being stretched to a new level.

The thoughts I have shared in today’s post constitute my general assessment of the current mortgage-rate landscape. If you are interested in a more technical comparison of pros and cons of fixed- vs variable rate-options, you can find that here. The Bottom Line: GoC bond yields were range bound last week.

The Bottom Line: GoC bond yields were range bound last week.

Some lenders pushed up their fixed rates a little in response to the previous bond-yield run up, but the best available fixed rates are still holding for now.

Variable-rate discounts have narrowed of late as credit spreads have widened, but they held steady last week.

Bond-market investors continue to price in two more 0.25% cuts by the BoC in 2025. But I continue to believe that the Bank will cut by 0.75%, or very possibly more, before the year is out.