Canadian Inflation Perks Up, But More Rate Cuts Should Still Be on the Way

February 24, 2025Here Comes the Next Bank of Canada Rate Cut

March 10, 2025

Last week Statistics Canada provided a final look at how our economy was evolving in the pre-Trump era.

It confirmed that our GDP increased by 2.6% on an annualized basis in Q4 2024, well above the consensus forecast of 1.8%. It also revised its initial estimate for annualized GDP growth in Q3 from 1% up to 2.2%.

The improvement in our economic momentum at the end of 2024 was broad-based.

Increases in consumer spending, residential investment, and business investment were primarily attributed to normalizing interest rates and, to a lesser degree, to our federal government’s temporary sales tax holiday.

The spike in our export sales was chalked up to US buyers accelerating their purchasers to front-run Trump’s expected tariffs.

Even our GDP-per-capita, which measures whether the average Canadian is better or worse off, at last got a much-needed lift.

Stats Can’s latest report confirmed that our per-capita GDP increased by 0.2% on a quarter-over-quarter basis in Q4, only its second increase over the past seven quarters.

When an upside surprise of this magnitude arrives on the heels of a hotter-than-expected inflation report, bond-market investors would normally respond by pushing up bond yields.

But that didn’t happen last week. Most of my readers already know why.

When US President Trump wasn’t busy revoking the US security guarantee provided to Ukraine in exchange for its surrender of its nuclear weapons back in 1994, he was announcing that he would slap more tariffs on Canada and Mexico – in direct contravention of the USMCA agreement, which he himself negotiated.

Just the threat of tariffs is enough to make Canadian consumers and businesses more cautious with their spending and investment. If more tariffs kick in, our export sales to the US will decrease.

Over time, that will spur negative knock-on effects across our broader economy. The bond market sees what is coming clearly. That is why bond yields have not risen in response to the recent strong data.

Mortgage Selection Advice for Now

I expect further significant BoC rate cuts ahead. I summarized my reasons in last week’s post and will recap them here:

- The powerful negative impacts from a US trade war are now the BoC’s primary concern.

- The BoC knows that its monetary-policy tools are best suited to cooling inflation (as opposed to counteracting deflation, which is now a looming risk).

- The Bank’s policy rate is currently 3%, at the upper end of its neutral range, and it won’t be stimulating economic growth until it hits 2%. I think the Bank will continue cutting until it gets closer to that level.

- A policy rate of 2% would also be consistent with the BoC’s past playbook. The Bank has reduced its policy rate to 2% or lower in each of its five most recent rate-cut cycles.

- An increasing number of mortgage borrowers will have to renew their mortgages with ultra-low pandemic rates in 2025. More BoC rate cuts will help reduce the payment shocks those renewers will face.

- Inflation expectations have now effectively normalized. That increases the BoC’s flexibility to become more accommodative.

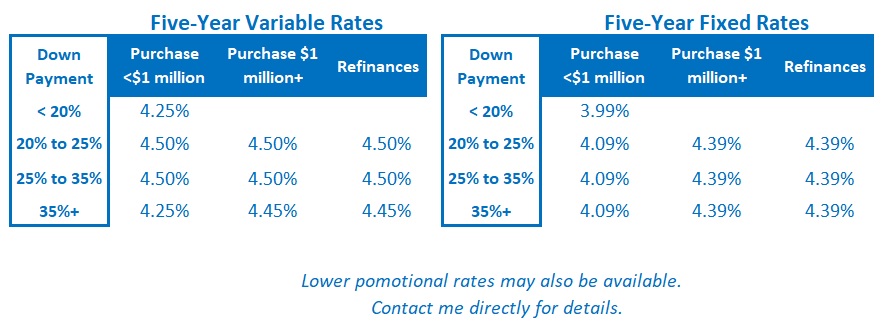

Today’s fixed and variable mortgage rates are now roughly equal.

If, as I expect, the BoC continues to cut its policy rate, variable rates will soon fall below any of today’s available fixed-rate options.

I continue to expect variable rates to produce the lowest total borrowing cost over their full term. But anyone considering a variable rate today must be willing and able to accept the inherent risk that circumstances may not play out as expected.

For borrowers who prefer the stability of a fixed rate, I think terms of between three and five years remain the best options.

The rates available within that range have now fallen below their long-term averages, whereas shorter terms of one and two years still come with higher rates that I don’t think are worth paying.  The Bottom Line: GoC bond yields continued to decline last week, which creates potential room for another round of reductions to fixed mortgage rates.

The Bottom Line: GoC bond yields continued to decline last week, which creates potential room for another round of reductions to fixed mortgage rates.

When bond yields are dropping in anticipation of an economic shock, in this case from Trump’s threatened tariffs, lender risk premiums also increase. For that reason, I still think the next move in fixed rates will be lower, but further rate reductions may take longer than normal to materialize.

The BoC’s next meeting will be on March 12. The bond-futures market is assigning about 50% odds that the Bank will cut by another 0.25% on that day.

I think that cut will happen, and if I’m right, variable mortgage rates will continue to drop over the near term.