Why the Bank of Canada Will Cut Again This Week

January 27, 2025Canadian Mortgage-Rate Advice: Trade War Edition

February 10, 2025

The Bank of Canada (BoC) reduced its policy rate by another 0.25% last Wednesday. Variable-rate mortgage rates decreased by the same amount shortly thereafter.

The Bank’s accompanying policy statement, press conference and Monetary Policy Report (MPR) highlighted encouraging inflation trends, noted signs of life in our housing market, and downplayed the significance of the widening gap between the Canadian and US policy rates.

The BoC’s analysis of our current economic backdrop contained mostly good news for anyone keeping an eye on Canadian mortgage rates. But the threat of US tariffs hung over the Bank’s forecasts like the sword of Damocles. This weekend, that sword finally fell.

On Saturday, in clear contravention of the USMCA agreement that Trump himself negotiated, the US President announced a 25% tariff on all Canadian imports, with the exception of energy imports, which will be taxed at 10%. He also hit Mexico with 25% tariffs and China with 10% tariffs.

Prime Minister Trudeau had Canada’s response ready, and just like that, we find ourselves in the middle of a full-blown trade war with no modern precedent.

In today’s post I will provide highlights from the BoC’s most recent communications, but only briefly. I will instead focus on how the trade war will impact Canadian mortgage rates, how it may ultimately play out, and how Canada might emerge from this turmoil in better shape than before.

To begin, here are my five key takeaways from the BoC’s meeting last Wednesday:

- In addition to cutting its policy rate by another 0.25%, to 3.00%, the Bank announced that it will end quantitative tightening (QT). Without going into too much detail, the end of QT removes a small but steady source of upward pressure on our bond yields.

- The Bank assessed that there were “no signs that inflation pressures are broad based”, that “inflation expectations have normalized”, and that while shelter prices “remain elevated”, they are “easing slowly”. Now that price stability has been restored, the Bank has increased flexibility to respond to this trade shock.

- The Bank noted that “spending has begun to increase on housing and on goods and services that are sensitive to interest rates.” It predicted that its policy-rate cuts will support “solid income growth and increases in household wealth from rising house prices.”

- The Bank estimated that while “the spread between US and Canadian policy rates has increased … this has had only a modest impact [of about 1%] on the Canada-US exchange rate.” It also noted that while the Loonie has weakened against the Greenback, it “has remained more stable against a basket of other currencies”.

- The Bank warned that tariffs are a “major uncertainty” because they “reduce GDP and push up prices, and on a net basis, put upward pressure on inflation.”

In isolation, the BoC’s assessment of our current economic conditions supports the view that its policy rate has room to fall further. With inflation now largely contained, the Bank can provide monetary-policy stimulus if it is needed to buffer against slowing economic momentum.

Bond-market investors also pushed Government of Canada (GoC) bond yields sharply lower late last week. In normal circumstances, lenders would respond by lowering the fixed mortgage rates that are priced on them. But that hasn’t happened yet, and there is precedent to suggest that mortgage rates might not decrease by the same proportion this time around.

When oil prices crashed in late 2014, GoC bond yields plunged by about 1%, but our fixed mortgage rates fell by much less than that. Lenders cited higher funding costs tied to increased risk premiums. At the same time, heightened economic uncertainty made lenders less motivated to chase new business with aggressive pricing.

When the BoC enacted two 0.25% policy rate cuts in 2015 to help offset the ongoing oil-price shock, lenders only passed on two cuts of 0.15% to their variable-rate borrowers. They cited the same factors as justification.

Simply put, while bad economic news typically leads to lower mortgage rates, really bad economic news changes the dynamic. At some point lenders become more focused on the return of their capital instead of the return on their capital.

Here are some additional trade-war thoughts as events are unfolding:

The BoC’s policy rate path …

I think the tariff war will make the Bank more dovish over the near term. Its policy rate currently stands at 3%, and by the BoC’s own estimate it won’t be at a stimulative level until it is lowered to at least 2%. If the tariff war drags out, a policy rate of 1.5% would not be a stretch.

That said, the BoC noted that it must balance the economic weakness caused by US tariffs against the rising inflation pressures that will be caused by our counter-tariffs.

In a worst-case scenario, Canadian businesses unaffected directly by those counter-tariffs may decide to opportunistically raise their prices, in the same way that some did during COVID.

That would cause inflation pressures to broaden and might compel the BoC to hike its policy rate in response. (This is an important point for anyone who is inclined to think that variable mortgage rates are now a one-sided bet.)

The Impact on the US economy …

There is no doubt that this tariff war will hurt Canada more than the US. We rely more on them than they do on us. But even if the economic shock experienced in the US is smaller, its impact is still likely to be significant:

- US inflation hasn’t yet moderated to the extent that Canadian inflation has, and that makes the US economy more sensitive to new tariff-related price increases.

- US stocks have been on a tear over the past two years. Many of them are currently priced for perfection, not a trade war.

- The US federal government’s budget deficit is already 6% of GDP, a level that is typically only reached during recessions. That gaping deficit, which is the highest in the G7, leaves much less room for additional stimulus spending to offset trade-war headwinds. (By comparison, our current federal budget deficit is approximately 1.6% of our GDP, which is currently the lowest in the G7.)

- President Trump didn’t just pick a fight with Canada. He has also raised the costs of imports from Mexico and China (so far).

Trump is right to be concerned about fentanyl, and we should be too …

I was baffled to hear President Trump call out Canada and Mexico in the same breath when it comes to fentanyl. Statistically, the US seizes less in a year at the Canadian border than it seizes in an afternoon at the Mexican border.

But then I watched this US interview of Sam Cooper, a Canadian journalist who has done exhaustive study of the fentanyl trade. He explains in detail how drug gangs have laundered their fentanyl proceeds through our financial system and our housing markets.

To be clear, I don’t think Trump’s tariffs were the appropriate US response, but he is right to sound the alarm on fentanyl on Canada’s role in the fentanyl trade.

Canada’s Wei Ji moment …

In Chinese, the phrase Wei Ji refers to both crisis and opportunity.

If our economy must withstand 25% US tariffs, why not offset that by removing inter-provincial trade barriers that are equivalent to an average tariff of 21%?

The BoC estimates that doing this would increase our GDP by at least 2%, more than it estimates we stand to lose from US tariffs. Reducing trade barriers would also encourage domestic specialization and address our “productivity problem”, which BoC Deputy Governor Carolyn Rogers highlighted in a speech last year.

Our politicians have long paid lip-service to removing trade barriers, but with very little follow through. If our current circumstances compel them to do more now, Canadians will be better for it.

I read recently about polls showing that Canadians have become apathetic about our national identity. The presentation of an outside threat has the potential to change that in a hurry.

President Trump’s crass comments about Canada becoming the 51st state are a reminder that we cannot take our sovereignty for granted. He seems to think he can cripple us into submission. I think his threats will instead renew our sense of patriotism.

From struggle will come strength. The Bottom Line: GoC bond yields plunged last week, but lenders may be slow to respond with decreases to their fixed mortgage rates. At times like this, investors demand higher risk premiums, and that increases lender funding costs.

The Bottom Line: GoC bond yields plunged last week, but lenders may be slow to respond with decreases to their fixed mortgage rates. At times like this, investors demand higher risk premiums, and that increases lender funding costs.

Lenders may also become more cautious about extending credit when there is so much uncertainty about the magnitude and duration of the economic shock that is pushing bond yields lower.

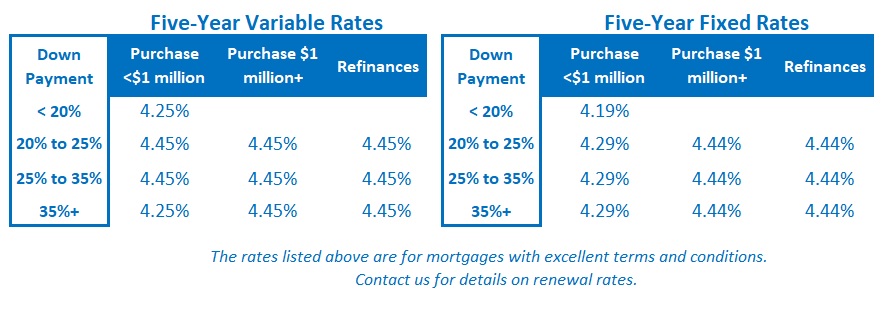

The BoC’s most recent rate cut means that five-year variable mortgage rates now match their fixed-rate equivalents for the first time since November 2024 (see chart above).

I expect the BoC to continue with rate cuts to buffer against the trade shock. But if price pressures broaden out because our retaliatory tariffs cause opportunistic companies to enact non-tariff related price increases, it is not inconceivable that the BoC would reverse course and hike rates.