Happy Holidays

December 23, 2024Employment Surges Higher. Will Mortgage Rates Follow

January 13, 2025 Happy New Year and welcome back.

Happy New Year and welcome back.

I hope everyone enjoyed some relaxing time over the holidays.

As has become tradition for this blog, I will start the new year with a look ahead at what we may have in store for 2025.

But before we begin, let’s do a quick review of how my predictions for 2024 turned out:

2024 Prediction #1: The Bank of Canada (BoC) will substantially reduce its policy rate in 2024.

Excerpt: “I believe that weaker-than-expected economic data will compel the BoC to beat a hasty retreat back to a neutral policy-rate position, and I think we’ll return there before the end of 2024.”

The BoC’s policy rate fell to 3.25% by the end of 2024, which is widely considered to be the top end of its neutral range. But I’m only giving myself half a checkmark for this one because I thought the BoC was going to start cutting in early 2024, but they took longer to materialize.

2024 Prediction #2: Our fixed rates will drop in 2024, but not by nearly as much as our variable rates.

Excerpt: “… our current fixed mortgage rates have already priced in substantial rate cuts by the US Federal Reserve and the BoC in 2024 – and that reduces the potential for further decreases.”

By my count, fixed rates dropped by about 1.25% in 2024 and variable rates fell between 1.5% and 2% (depending on the loan-to value ratio). I’ll take half a checkmark here because while variable rates did decrease by more last year, that decline didn’t outpace the reduction in fixed rates to the extent that I expected.

2024 Prediction #3: Canadian real-estate markets may prove more responsive than US real-estate markets.

Excerpt: “If you’re looking past the economic slowdown to come, consider that while the Canadian real-estate markets are currently more vulnerable to price corrections, our shorter mortgage terms (and portability features) increase the likelihood that they will respond more quickly to market changes.”

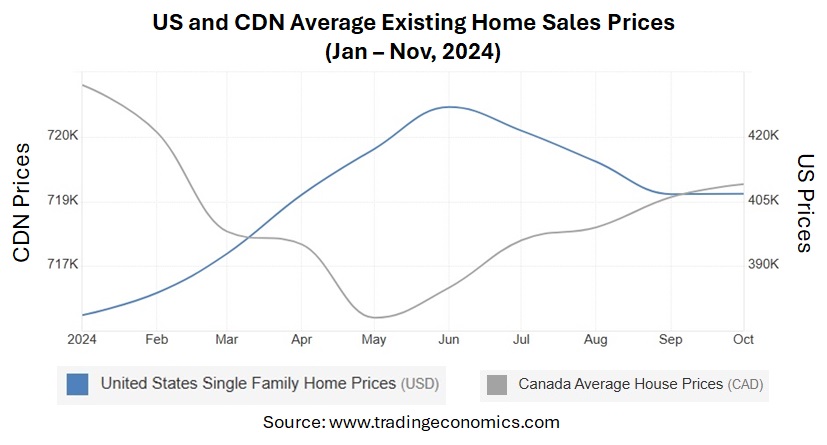

Let’s look at a chart of average US and CDN existing homes sales prices over the first eleven months of 2024 to evaluate this call: On first pass, this prediction was incorrect. US existing home sales prices finished the year higher than where they started, and average Canadian prices were lower.

On first pass, this prediction was incorrect. US existing home sales prices finished the year higher than where they started, and average Canadian prices were lower.

That said, US prices fell over the second half of 2024 and the sclerotic nature of the US housing resale market has been widely noted. US homeowners haven’t wanted to refinance or move because that would mean giving up their pandemic-low mortgage rates, which many of them have locked in for as long as thirty years (and US mortgages aren’t portable.)

On the other hand, while average Canadian house prices finished 2024 lower than where they started, they demonstrated clear upward momentum in the second half of the year. Most market watchers expect average prices to keep rising in 2025.

I’ll take an “X” for this one, but with a small caveat.

While I didn’t get the timing right, I still think that our much more rapid rate resets will cause Canadian residential real-estate prices to recover more quickly than average US prices.

With my look at last year’s predictions now completed, here are my three mortgage and real-estate predictions for 2025:

(All predictions guaranteed to come true or your money back – with a reminder that this blog is free.)

2025 Prediction #1: The BoC will substantially reduce its policy rate in 2025.

I’m going to start off by restating one of my predictions from last year, which I will support with several key points from my recent posts.

The BoC has indicated that it plans to slow the pace of its rate cuts going forward, and bond market investors are currently pricing in a further 0.50% reduction in 2025. That would lower the Bank’s policy rate from 3.25% to 2.75%.

I think the Bank will end up cutting by at least another 1.00%.

To explain, I need to get technical for a moment.

The BoC estimates that its policy rate is in a neutral range when it stands between 2.25% and 3.25%. (Reminder that the neutral-rate range is defined as the level where the Bank’s policy rate is neither restricting nor stimulating demand.)

But the Bank considers a neutral policy rate to be appropriate when “the output gap is closed, inflation is at target and there are no shocks pushing the economy around.” (Reminder that the output gap measures the gap between our economy’s actual output and its maximum potential output, and it is a key gauge of inflation pressure.)

Inflation is now back to target, but our output gap is wide and getting wider, and there are further threats to the Canadian economy from US president-elect Donald Trump’s stated policies. Against that backdrop, I think a policy rate below 2.25% will be appropriate some time in 2025.

There are additional signs pointing to weaker momentum ahead.

Our GDP has been boosted by record levels of immigration, which have already slowed sharply. Our GDP has declined on a per-capita basis for six consecutive quarters, which means the average Canadian has seen their wealth steadily decline over that period.

The BoC’s latest communications indicating that the pace of cuts may slow does mean that more 0.50% reductions are probably off the table, but it doesn’t mean that further reductions won’t be forthcoming. (The Bank’s dovish language was also likely aimed at staunching a further decline in the Loonie.)

If the BoC is going to skate where the puck is going, it will need to lower its policy rate to a stimulative level. That means a decline of at least another 1.0% from here.

Lastly, if you agree with Mark Twain that history doesn’t repeat itself but often rhymes, consider that the BoC’s policy rate has bottomed out at no higher than 2% over its last five rate-cut cycles (hat tip to economist David Rosenberg for that stat).

2025 Prediction #2: Our fixed mortgage rates won’t decrease much more (if at all) this year.

I confess that this is very much a contrarian call because most forecasters predict that our fixed mortgage rates will head lower in 2025.

For starters, our fixed rates are priced on Government of Canada (GoC) bond yields, and their movements largely follow the movements of their US Treasury equivalents.

Just recently, the 10-year US Treasury yield has increased by 0.90% since the US Federal Reserve cut its policy rate by 0.50% on September 18.

While sovereign bond yields are impacted by the policy-rate movements of their central banks, their trajectories are also determined by other, longer-term factors.

For example, right now US bond-market investors are more focused on inflation and government spending.

US inflation bottomed at 2.4% in September before then increasing to 2.6% in October and to 2.7% in November. That re-acceleration was caused in no small part by the US federal government’s eye-watering budget deficit, which hit 8% of GDP in 2024. (For comparison, the long-term average budget deficit for the US federal government is less than half of that.)

Bond-market investors are also likely pricing in more inflation resulting from Donald Trump’s promised policies of mass deportation, high tariffs, and tax cuts.

Bluntly put, if US Treasury yields are headed higher from here, GoC bond yields aren’t going to move lower for any sustained period.

We also still have an inverted yield curve.

Without getting too technical, an inverted yield curve means that the yields on shorter-term bonds are higher than those on longer-term bonds. That is an anomaly that will likely normalize in 2025, both because short-term yields will fall (thanks to additional BoC rate cuts) and longer-term yields will rise (primarily due to the gravitational pull of US Treasuries).

Our fixed mortgage rates will mirror those higher long-term yields, and if I’m right, won’t have much (or any) additional downside from here.

2025 Prediction #3: Canadian house prices will continue to rebound.

I agree with the consensus view that average Canadian house prices will continue to rise in 2025, helped along by several key tailwinds.

Mortgage rates are now well below their recent peaks and house prices are already increasing in almost every major metropolitan area across the country. Recently enacted mortgage-rule changes will also help increase affordability for a subset of borrowers.

Over the BoC’s last five rate-cut cycles, which stretch back over twenty-five years, house prices have always increased by an average of about 10% per cycle. (For reference, the average resale price has risen by approximately 1% since March, which is the when the BoC enacted its first cut.)

We still have much more demand for housing than supply. While immigration rates will fall, that change won’t be enough to offset this structural imbalance.

(I should acknowledge that there will likely continue to be pockets of price weakness, such as with small condos in major metropolitan areas.)

Our saving rate is now 7%, the highest it has been since 1996. According to Scotiabank economist Derek Holt, Canadian households now have an additional $470 billion in savings compared to our pre-pandemic data.

Those elevated savings appear poised to come off the sidelines as buyers are dipping their toes back in the water. As a mortgage broker, I see this unfolding on a daily basis.

Mortgage Selection Advice for Early 2025

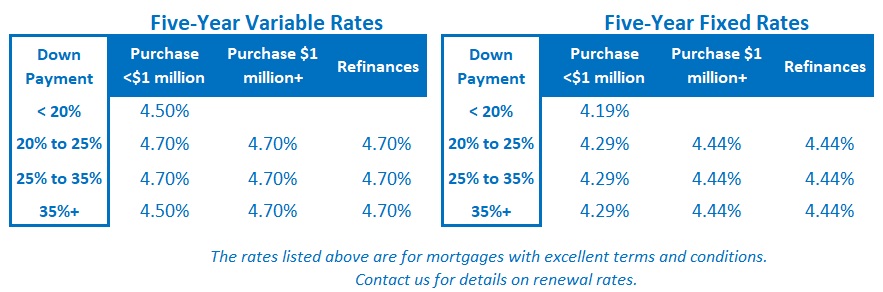

As per Prediction #1, I expect further substantial BoC rate cuts ahead. If I’m right, today’s variable mortgage rates will outperform all of today’s available fixed mortgage rates (notwithstanding the fact that they are a little higher right now).

That said, according to Yogi Berra, “It’s tough to make predictions, especially about the future”. There are many factors that influence where rates are headed, and we currently live in an environment where both economic and geopolitical risks are elevated.

If you prefer the stability of a fixed rate, and value the good night’s sleep that can come with it, I don’t think you need to shy away from five-year fixed rates any longer. They have now fallen below their long-term average, and if I am right with Prediction #2, the GoC bond yields that our fixed rates are priced on will be pulled higher in 2025 by their rising US Treasury equivalents.  The Bottom Line: GoC bond yields remained range bound over the holidays. There is no immediate pressure on fixed mortgage rates, in either direction, but that will probably change on January 20 because it appears that President Trump plans to hit the ground running.

The Bottom Line: GoC bond yields remained range bound over the holidays. There is no immediate pressure on fixed mortgage rates, in either direction, but that will probably change on January 20 because it appears that President Trump plans to hit the ground running.

The bond market isn’t pricing in a BoC rate cut at its next meeting on January 29, but we’ll see another full round of monthly economic data between now and then and will also have more clarity on the Trump tariffs. At this point, and against the consensus, I’m expecting the BoC to cut its policy rate by another 0.25% at the end of this month.