Monday Morning Interest Rate Update

October 15, 2024The Bank of Canada Beats a Hasty Retreat

October 28, 2024 The Bank of Canada (BoC) needs to sharply reduce its policy rate, and fast.

The Bank of Canada (BoC) needs to sharply reduce its policy rate, and fast.

It currently stands at 4.25%, a level that restricts demand and acts as a drag on our overall economic momentum. The Bank’s policy rate won’t be back to a neutral level, where it neither restricts growth nor stimulates it, until it is reduced to a range between 2.5% and 3%.

Tight monetary policy was necessary when inflation was running too hot, but that is clearly no longer the case.

Last week, Statistics Canada confirmed that our overall Consumer Price Index (CPI) increased by only 1.6% year-over-year in September, well below the BoC’s 2% target. Core inflation, which excludes volatile food and energy prices, increased by the same amount.

Once again, most of last month’s inflation pressure came from the mortgage-interest costs that are both a directly (variable rates) and indirectly (fixed rates) tied to the BoC’s policy rate decisions. These costs are still driving inflation higher because past BoC rate hikes hit our economy with a lag, and it takes time for them to be absorbed into our CPI data.

Our CPI increased by only 1% last month when mortgage-interest costs are excluded (which is standard practice in most other countries).

Now that the Bank knows that inflation has fallen faster, and by more, than it expected, it should return its policy rate to its neutral-rate range more quickly. Furthermore, if below-target inflation persists, the Bank should soon be considering dropping its policy rate beyond its neutral range to a stimulative level below 2.5%.

After all, BoC Governor Macklem has long said that the Bank cares as much about below-target inflation as it does about above-target inflation.

Accelerating disinflation isn’t just a made in Canada story. It is now increasingly evident across the globe. September brought lower-than-expected inflation data in China (+0.4%), the Euro Area (+1.7%), the UK (+1.7%), Japan (+2.5%), South Korea (+1.6%) and New Zealand (+2.2%).

Sharply rising oil prices were briefly concerning a couple of weeks ago, but that spike faded quickly. They have now returned to their previous trading ranges.

While the need for restrictive rates has faded, their deleterious impact on our economic momentum has not.

Our GDP has declined on a per capita basis over five of the past six quarters. Consumers are increasingly stretched, businesses are increasingly cautious, and the gap between our economy’s actual output and its maximum potential output is widening. There is now urgency for the BoC to make its policy rate less restrictive.

At this point, the only upward pressure on inflation that appears likely to persist is coming from the Loonie. It has continued to weaken against the Greenback as currency investors price in diverging policy-rate trajectories between the BoC and the US Federal Reserve.

The drop in the value of the Loonie is increasing the cost of everything we import, and depend on, from the US.

That inflationary impact may end up factoring into the BoC’s rate-cut timetable at some point. But Governor Macklem has insisted that the Bank’s policy rate can diverge from the Fed funds rate by much more than it has thus far before that divergence might compel the Bank to alter its policy-rate path.

So, it doesn’t sound as though we’re there yet.

For reference, the widest the gap between the BoC and the Fed policy rates ever got was in 1997, when the BoC was 2.50% lower than the Fed. Today, that gap is only 0.50%.

I believe the Loonie’s recent weakening was caused by currency-market investors pricing in more policy-rate divergence to come. If that assessment is correct, a greater divergence is already “in the price”, and the Loonie won’t weaken by as much as expected if/when the divergence between the US and Canadian policy rates widens out again. The Bottom Line: Government of Canada (GoC) bond yields continued to fall last week as investors raised their bets on a 0.50% rate cut by the BoC this Wednesday.

The Bottom Line: Government of Canada (GoC) bond yields continued to fall last week as investors raised their bets on a 0.50% rate cut by the BoC this Wednesday.

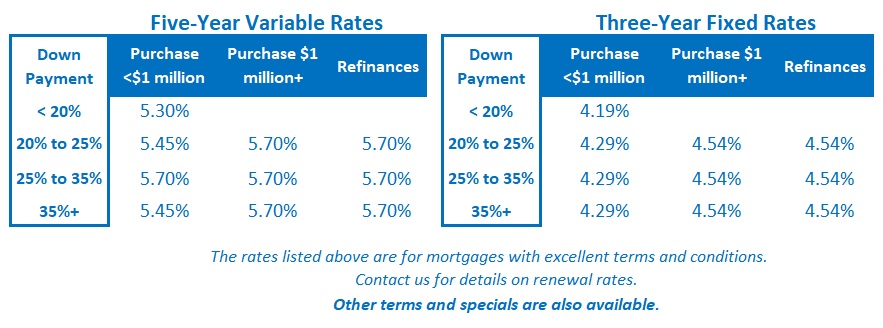

Lenders have already started to lower their fixed rates in response, and it shouldn’t take too much longer for the round of fixed-rate hikes we saw two weeks ago to completely unwind.

Variable-rate borrowers have been on a bumpy road for some time and their associated highs and lows over the past few weeks are a reminder that these products are not for the faint for heart.

In late September, the Fed cut by 0.50% and our CPI fell to 2%. An imminent 0.50% cut by the BoC seemed inevitable. Then oil prices spiked by 10% in a week on geopolitical concerns and the latest US employment print blew past expectations. Suddenly, we wondered whether the BoC would cut by even 0.25% at its next meeting. And now, only a week later, our latest CPI print has come in well below target and it looks as though the BoC hasn’t cut fast enough.

Fun times.

Put me down for a no-brainer 0.50% cut by the BoC this Wednesday.