Thoughts on the Bank of Canada’s Most Recent Rate Cut and Commentary

September 9, 2024A Smorgasbord of Good News for Canadian Mortgage Borrowers

September 23, 2024 The US Federal Reserve meets this week, and the market unanimously expects that it will reduce its policy rate for the first time since the start of the pandemic.

The US Federal Reserve meets this week, and the market unanimously expects that it will reduce its policy rate for the first time since the start of the pandemic.

In a recent speech, US Fed Chair Jerome Powell left no doubt about the Fed’s near-term plans when he said, “The time has come for policy to adjust. The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.”

The question now is whether the Fed will cut by 0.25% or 0.50%. It’s a dead heat right now, with the bond futures market putting 50/50 odds on those options at the time of this writing.

Here is a quick look at the current state of the US economy:

- The US Consumer Price Index (CPI) fell from 2.9% in July to 2.5% year-over-year (YoY) in August. That was encouraging. But US core CPI, which strips out volatile food and energy prices, increased by 3.2% YoY, a little above the consensus forecast.

- US GDP increased by an impressive 3.0% YoY in Q2, but that result comes with an asterisk. A lot of that growth was driven by two unsustainable boosts: 1) extraordinarily high deficit spending by the US Federal Government, and 2) a continued decline in the US saving rate (which fell to 2.9% in July, marking its lowest level since the US financial crisis in 2008).

- US employment growth has undershot the consensus forecast for several months now, and a recent revision to previous estimates subtracted 816,000 US jobs from the initial counts over the last twelve months. (Large revisions like these often occur when the US economy is at a turning point.)

- Average US wage growth is still strong, at 3.8% YoY, and the US unemployment rate dropped from 4.3% to 4.2% last month. Thus far, while hiring has slowed, layoffs haven’t increased. But if the US economy continues to slow, layoffs will be the next stage.

I think that last point will weigh heavily on the Fed this week.

Unlike the Bank of Canada, whose sole mandate is to keep inflation low and stable, the Fed is charged with both maintaining price stability and promoting maximum employment.

That dual mandate increases the urgency for the Fed to respond to slowing US employment momentum. It may also help explain why the Fed has started five of its past six rate-cut cycles with a 0.50% cut, whereas the BoC has more typically favoured a 0.25% cut.

If downside risks to the US economy are increasing, and I think recent US economic data make that case, so too is the risk that the Fed has left its policy rate too high for too long.

Put me down for a 0.50% cut by the Fed this Wednesday. The Bottom Line: Government of Canada (GoC) bond yields continued to melt lower last week, and lenders have continued to lower their fixed mortgage rates in response.

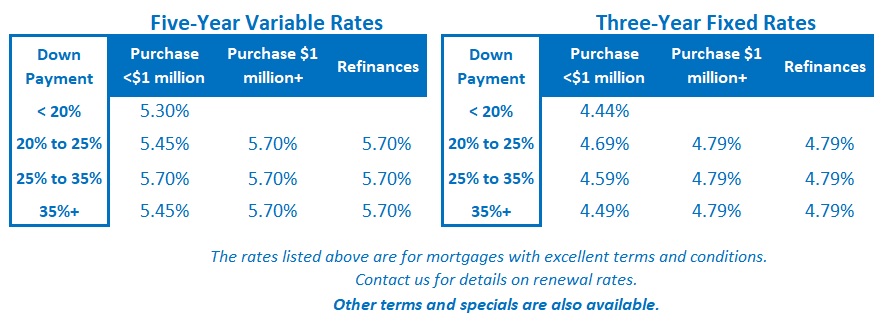

The Bottom Line: Government of Canada (GoC) bond yields continued to melt lower last week, and lenders have continued to lower their fixed mortgage rates in response.

If the Fed does cut by 0.50% this week, US Treasuries will likely drop further. If that happens, GoC bond yields will be taken along for the ride. For now, all the momentum in the US and Canadian bond markets points toward lower fixed rates ahead.

Variable-rate discounts held steady last week. A Fed rate cut won’t have any direct impact on our variable mortgage rates, regardless of whether it is by 0.25% or 0.50%. But a half-point reduction would give the BoC a little more leeway to enact a larger cut of its own (and that certainly isn’t out of the question at this point).