The Bank of Canada Cuts and Coos

July 29, 2024Why the Canadian Employment Narrative Is About to Change

August 12, 2024

Bond yields plunged last week as investors repositioned themselves for a US led global economic slowdown.

The US economy has been relying on temporary supports for some time now. It has been buoyed by unsustainably high deficit spending by its federal government and a rapid drawdown of pandemic savings, which allowed US consumers to absorb higher prices without reducing their spending.

Until last week, the consensus bet was that the US economy would experience a “soft landing” whereby its momentum would slow enough to return inflation to the Fed’s 2% target without stalling out.

My primary concern with the soft-landing narrative is that there is no historical precedent for the US economy achieving one under conditions remotely like those in place when the Fed started hiking this time around.

In March 2022, BMO economist Sal Guatieri looked back at the thirteen Fed tightening cycles since 1960, and he noted that a US recession followed in nine of those instances. In the four cases where Fed hikes did not lead to recession, he observed that inflation “was generally low”, in two of those cases “unemployment was relatively high”, and “with one exception … the real Fed funds rate … was not overly loose at the start of the tightening period”.

By comparison, Guatieri noted that the Fed’s current rate-hike cycle started with “inflation at multi-decade highs … the unemployment rate skirting half-century lows … and the real funds rate deeply negative.” He concluded that “current conditions for inflation, unemployment and policy have never (since 1960) been more stacked against the Fed achieving a soft landing.”

Our recent past has been a reminder that economic expansions can be sustained for longer than expected, especially when temporarily supported by factors like heavy deficit spending and an aggressive drawdown of savings. But the current financial market reckoning is also a reminder that even the US economy can only resist the gravitational pull of tighter monetary policy for so long.

Last week’s sharp shift in market sentiment was initially a response to dovish comments from US Fed Chair Jerome Powell about downside risks to US employment, which were then backed up by the weaker-than-expected employment report for July. (The US economy added 114,000 news jobs last month, well below both the consensus forecast of 175,000 and the June result of 206,000.) Growing concerns about the worsening US economic backdrop were also spurred on by lackluster US manufacturing and construction data and by disappointing earnings updates from bellwether tech companies.

Bond-market investors responded by aggressively repositioning their bets on when the Fed will start to reduce its policy rate from its current level of 5.25%. They are now pricing in an 85% chance that the Fed will cut by 0.50% at its next meeting on September 18. They are also putting 90% odds on the Fed’s policy rate being at or below 4% by the conclusion of its meeting on January 29, 2025.

That is a stunning and sudden change in outlook.

Mortgage Selection Advice for Now

If the Fed starts slashing its policy rate, that will give the Bank of Canada (BoC) leeway to accelerate its own rate-cut timetable. The Bank will be less concerned about the gap between US and Canadian policy rates getting too wide and more concerned that weakening US demand for our exports will diminish a key source of support for our economy.

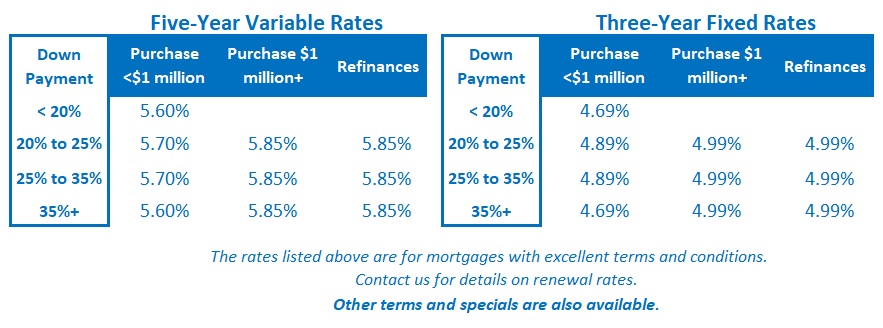

As downside risks to our economy increase, so too do the odds that variable rates will outperform today’s fixed-rate options. While variable-rate borrowers must still accept a higher initial rate at the outset, their rates will fall in lockstep with each BoC rate cut (whereas fixed-rate borrowers will have to wait until the end of their terms). In a falling rate environment, the faster your rate resets, the sooner you benefit.

That said, while I think the strength of the case for variable rates is increasingly compelling, there are myriad factors that determine the direction of mortgage rates.

If you prefer the stability of a fixed interest rate, I think you are well advised to consider shorter fixed-rate terms today. While five-year fixed rates are the lowest on offer, I worry that five years may be too long to be locking in when rates are still near their recent peak.

If you are leaning towards a fixed rate, you should also pay extra attention to the terms and conditions in your mortgage contract. They vary widely among lenders and can have a surprising impact on the overall cost of your loan, especially if rates drop significantly during your term.

(If you want to learn more about this topic, my post entitled What’s in the Fine Print is a good place to start. It provides a detailed summary of the terms and conditions to watch out for and links to other posts that dive deeper into the most important ones.) The Bottom Line: Government of Canada (GoC) bond yields fell sharply last week. To wit, the five-year GoC yield started the week at 3.24% and was down to 2.92% by close of business on Friday. That’s the lowest it’s been since January 2022.

The Bottom Line: Government of Canada (GoC) bond yields fell sharply last week. To wit, the five-year GoC yield started the week at 3.24% and was down to 2.92% by close of business on Friday. That’s the lowest it’s been since January 2022.

Lenders should be cutting their fixed rates across the board in short order (both to stay competitive for new business and to hold onto their existing pipeline of approved applications that are waiting to fund).

Variable rates held steady last week.

Variable-rate borrowers must like what they are seeing in the bond market of late with investors increasing their bets that rate cuts will come sooner, and in greater magnitude, than they dared hope only a short while ago.