Canadian Mortgage Rate Update – Top Five Recent Posts

May 21, 2024Fixed vs Variable Mortgage Rates: Which Option Will Save You Money?

June 3, 2024

Last week, Statistics Canada confirmed that inflation pressures declined again in April.

Our overall Consumer Price Index fell to 2.7% in April on a year-over-year (YoY) basis, down from 2.9% in March. This latest print was in line with consensus expectations, and it marks our lowest CPI growth rate since March 2021.

The Bank of Canada’s (BoC) most closely watched measures of core inflation also fell last month. CPI-trim declined from 3.2% in March to 2.9% in April (YoY), and CPI-median fell from 2.9% to 2.6% over the same period.

As has been the case for some time now, shelter costs still account for a significant portion of pressure on our overall CPI. Removing shelter costs reduces our April CPI all the way down to 1.6% – well below the BoC’s 2% target.

Many economists have argued that the BoC should discount price pressures from shelter inflation. They point out that shelter inflation is being driven by a combination of: 1) the immigration-policy led structural supply/demand imbalance in our most volatile housing markets, which the Bank’s policy rate can’t impact, and 2) by higher mortgage costs, which are mostly under the control of the BoC itself and will be reduced as soon as the Bank starts cutting its policy rates.

For my part, I think last week’s inflation data substantially increases the likelihood that the BoC will enact its first rate cut on June 5. Here are several points in support of that view.

- Inflation has continued to cool.

At the BoC’s last policy-rate meeting, on April 10, BoC Governor Macklem said that the Bank is “seeing the progress we need to see” with inflation, but that it needs “to see it for longer to be confident that we are clearly on a path to 2%”.

We have received two more months of softer inflation data since then.

- Payment shocks from mortgage renewals are increasing.

The BoC knows that only about half of Canadian mortgage borrowers have renewed at higher rates thus far. The borrowers who have yet to renew will experience much greater payment shocks if rates remain at their current levels. Most of the second half of borrowers will be resetting from mortgage rates locked in at pandemic lows. Last week, our banking regulator highlighted this as a key concern in its Annual Risk Outlook.

If the BoC waits too long to start cutting rates, the negative impacts associated with rate resets will intensify.

- Our economic momentum has slowed by more than expected.

In its latest monetary-policy report, the BoC forecasted quarter-over-quarter (QoQ) GDP growth of 2.8% for Q1. The actual number was 1.7%. Not a small difference. Furthermore, Stats Can is estimating that our economy grew by only 0.3% month-over-month in April, so Q2 is off to an even less encouraging start.

South of the border, US GDP growth has also slowed by more than expected. It came in at 1.6% in Q1, way below the consensus forecast of 2.8%.

Just as with rate hikes, rate cuts will impact our economy with a lag. If the BoC still intends to “skate where the puck is going”, the softer than expected GDP data on both sides of the 49th parallel should compel it to focus on bolstering the momentum our economy has left, rather than continuing to constrain it.

- The BoC should now be less concerned about triggering a sharp rise in house prices.

The BoC was worried that cutting rates too soon would re-ignite our housing markets. In fact listings have recently risen sharply in Vancouver and Toronto, and sales haven’t kept up with the rise in inventories, particularly for condominiums.

More balanced market conditions and slowing momentum in our two largest (and, previously, our two hottest) regional real-estate markets should help allay the Bank’s concern that rate cuts will lead to price spikes and/or a resurgence in speculative investment.

In addition, only variable mortgage rates will be directly impacted by BoC rate cuts. Our fixed mortgage rates are priced on Government of Canada (GoC) bond yields, which closely follow their US Treasury equivalents. US Treasury yields are likely to remain higher if the more positive consensus view of the US economy’s trajectory prevails. That means that our fixed rates may remain near their current levels, or perhaps even increase, even as our variable mortgage rates fall (a risk I outlined in this recent post).

- One strong employment report doesn’t override our weaker longer-term employment trends.

Our latest employment data came in much stronger than expected in April, but that surprise aside, there is still convincing evidence to support the BoC’s previous assessment that “labour market conditions continue to ease”.

For example, while we added an impressive 90,400 new jobs in April, our record immigration levels require that we add 60,000 new jobs each month just to keep pace with the expansion of our workforce. We have only added an average of 31,000 new jobs each month over the past year. That is the primary reason why our unemployment rate has risen from 5.2% to 6.1% over that period.

Simply put, one strong monthly employment report should not be enough to alter the BoC’s rate-cut timetable, especially when so many other factors support cutting now.

Mortgage Selection Advice for Today

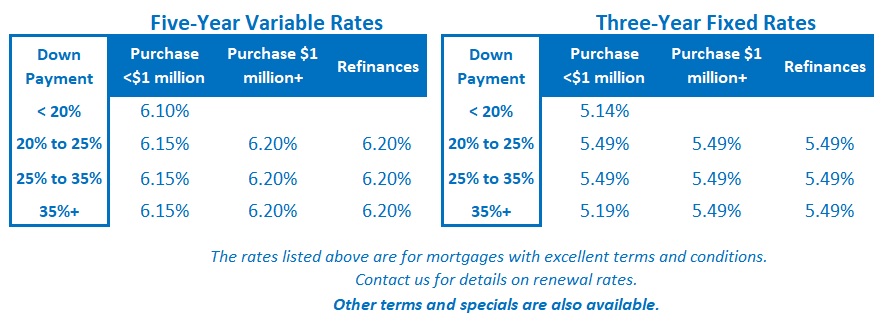

If you’re willing to start your term with a higher rate, and to assume the inherent risk that the BoC’s policy rate may not fall as quickly, or by as much, as expected, I think five-year variable rates are now most likely to generate the lowest borrowing cost over the entire term of the mortgage.

The BoC’s first rate cut is not very far off. Whether or not it makes its first cut at its next meeting on June 5th,most forecasters expect the BoC to cut by 1.50% to 2.00% (or even more) by the end of 2025. While we can never be certain exactly how things will play out, if variable rates drop within that range by the end of next year, variable-rate mortgages should easily outperform all of today’s fixed-rate options.

Alternatively, if you’re a more conservative borrower who is concerned that the future path of inflation may compel the BoC to keep its policy rate higher for longer, I think three-year terms are still the best choice among today’s available fixed-rate options.

The premiums required for one- and two-year fixed rates remain substantial. And while five-year fixed-rate terms come with today’s lowest rates, I still worry that five years is too long to be locking in when rates are still near their highest levels in more than three decades.

In addition to selecting the right mortgage type and term, borrowers are always well advised to pay close attention to all the terms and conditions in their mortgage contract. Those details, which may vary widely from lender to lender, can have a significant and sometimes surprising impact on the overall cost of a loan.

The Borrower Beware section of my blog provides plenty of detail on that front. If you want to start with a post that provides a detailed summary of the terms and conditions to watch out for, What’s in the Fine Print is a good place to start.

The Bottom Line: GoC bond yields fell sharply in response to our latest CPI data, but that drop was short lived as the gravitational pull of US bond yields quickly reasserted itself. When the dust had settled, GoC bond yields had returned to their previous range, and as such, our fixed mortgage rates held steady.

The Bottom Line: GoC bond yields fell sharply in response to our latest CPI data, but that drop was short lived as the gravitational pull of US bond yields quickly reasserted itself. When the dust had settled, GoC bond yields had returned to their previous range, and as such, our fixed mortgage rates held steady.

Variable-rate mortgage discounts were unchanged last week.

For the reasons outlined above, I think the BoC will enact its first rate cut this cycle when it next meets on June 5. If I’m right, June 5 will bring welcome news for hard-pressed variable-rate borrowers.