Cooling Inflation Data Are Good News for Canadian Mortgage Rates

November 27, 2023Five Key Take-Aways from the Bank of Canada’s Latest Policy-Rate Decision

December 11, 2023 The Bank of Canada (BoC) is almost certain to hold its policy rate steady when it meets this week.

The Bank of Canada (BoC) is almost certain to hold its policy rate steady when it meets this week.

The Bank may also soften its language around the need for additional hikes, albeit with a reminder that it will do whatever is required to return inflation to its 2% target (to ensure that falling bond yields don’t loosen financial conditions by too much).

But the writing on the wall, which now includes last week’s GDP and employment data, makes it clear that the BoC’s policy rate has finally peaked.

Let’s start with a quick summary of last week’s two key Canadian economic data releases.

GDP Shrinks in Q3

Last Thursday, Statistics Canada confirmed that our GDP shrank in Q3, this time by 0.3% on a quarter-over-quarter (q/q) basis. That result was weaker than the consensus forecast of +0.1% and further below the BoC’s most recent forecast of 0.8%.

Stats Can also revised its previous forecast for q/q GDP growth in Q2 from -0.2% to +0.3%. That means we haven’t yet experienced two consecutive quarters of negative GDP growth, which is widely viewed as a recession indicator.

On the bright side, Stats Can’s initial estimate for GDP growth in October came in at +0.2% month-over-month. (It takes time to tabulate the data, so Stats Can will firm up the October print in its next GDP release.)

The upshot is that the robust economic momentum that we saw coming out of the pandemic has now convincingly succumbed to higher rates. Furthermore, the BoC’s previous rate hikes have not yet exerted their full bite. That’s why BoC Governor Macklem recently noted that “more downward pressure on inflation is [already] in the pipeline.”

Unemployment Increases

Last Friday Stats Can confirmed that our economy added 25,000 new jobs last month, well above the consensus forecast of 10,000.

Despite that strong monthly print, our unemployment rate rose from 5.7% to 5.8% last month because our total labour force is adding workers (+78,000 in November) more quickly than it is creating new jobs.

Our unemployment rate has now spiked from 5.0% in April up to 5.8% in November. While average wage growth managed to hold steady at 4.8% last month, that kind of sharp increase in our unemployment rate is a clear indicator that labour market conditions are deteriorating. (Note that total hours worked decreased by 0.7% month-over-month in November.)

Pay rates are still adjusting to higher prices, and it will take time for excess labour capacity to affect average wages, but the prerequisites are all falling into place for average wage growth to decline to a level that is consistent with overall inflation in the BoC’s 2% target range.

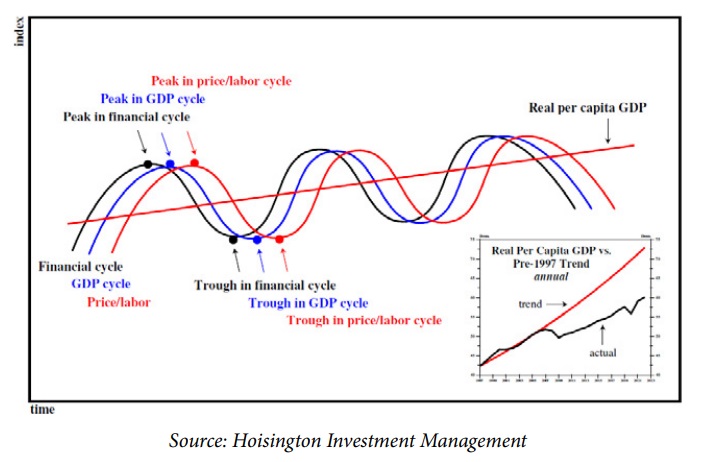

To fully understand where we are in our economic cycle, let’s take a look at a chart from venerated US economist Lacy Hunt (at the US investment firm Hoisington Investment Management) with our current economic backdrop in mind: Our financial cycle has now almost certainly peaked. It is unlikely that the BoC will hike again, and Government of Canada (GoC) bond yields are already declining in anticipation of rate cuts sometime next year.

Our financial cycle has now almost certainly peaked. It is unlikely that the BoC will hike again, and Government of Canada (GoC) bond yields are already declining in anticipation of rate cuts sometime next year.

Our GDP shrank in Q3 and, while the debate about whether we are in a recession (or soon to enter one) is still ongoing, the mere existence of that conversation indicates that we are no longer in an expansion phase.

The final cycle components to turn are prices and labour. Inflation has already fallen to 3.1%, and as per BoC Governor Macklem’s observation above, more downward pressure on inflation is in the offing. We can now see continuing evidence that excess labour capacity is increasing, and while wage growth hasn’t fallen yet, the necessary pieces are rounding into place for that to occur.

As price growth slows and inflation falls back to within range of the BoC’s 2% target, the Bank will start cutting its policy rate. The bond market is now betting that will happen in late Q2 2004, and it is currently pricing in a total of three 0.25% cuts next year.

If you’re in the market for a mortgage today, variable rates look increasingly appealing. That is, if you can tolerate variable-rate risk (both financially and psychologically) and if you are prepared to be patient. The bond market does better anticipating the future direction of rates than it does forecasting the specific timing of when they will move.

On the other hand, if you’re more conservative and want to guard against the risk that inflation will prove stickier than the above analysis indicates, I think three-year fixed rates make sense. The premiums for shorter one- and two-year fixed rates are prohibitively high, and I worry that five-year fixed rate terms will lock borrowers into today’s historically high rates for too long.

As for the BoC’s policy-rate meeting this week, put me down for a rate hold accompanied by less hawkish language than we have seen in a while. The Bottom Line: GoC bond yields dropped again last week, and lenders continue to lower their fixed rates in response. There is room for these rates to fall further, and the current downtrend is both clear and well established.

The Bottom Line: GoC bond yields dropped again last week, and lenders continue to lower their fixed rates in response. There is room for these rates to fall further, and the current downtrend is both clear and well established.

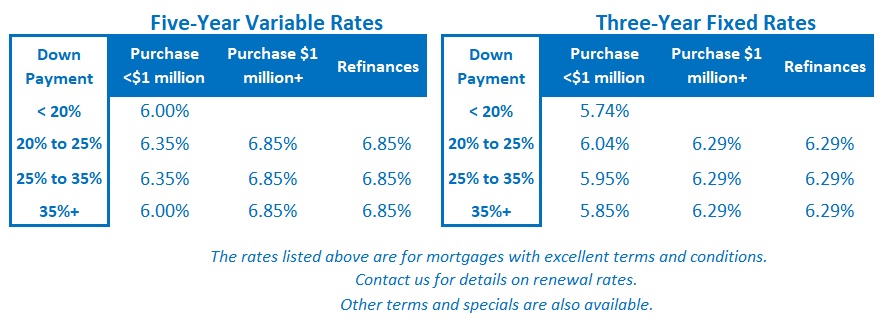

Five-year variable-rate discounts were unchanged last week.

Variable rates look increasingly appealing now that the BoC’s policy rate appears to have peaked. Even if rate cuts take longer to materialize than currently expected, the odds favour variable-rate options to produce the cheapest borrowing cost in almost all falling rate environments.