Why Fixed vs. Variable is Getting More Interesting + Five Key Mortgage Updates

October 23, 2023Canadian Fixed Mortgage Rates (Finally) Falling

November 6, 2023

The Bank of Canada (BoC) held its policy rate steady last week, as most of us expected it would, but not without a warning that it would hike again if needed.

In addition to its policy statement, the Bank issued its latest Monetary Policy Report (MPR) for Q3, and BoC Governor Tiff Macklem and Deputy Governor Carolyn Rogers held a Q & A session with reporters.

Here are my five key takeaways from the BoC’s latest communications:

- We’re probably done with hikes for this cycle.

The Bank cited “growing evidence” that its previous rate hikes are “dampening economic activity and relieving price pressures”.

It noted that consumption has become “subdued”, “recent job gains have been below labour force growth”, and “higher borrowing costs are weighing on business investment”.

It expects that “the broadening impact of past [interest] rate increases” will combine with reduced foreign demand to dampen our near-term momentum.

Barring any surprises from spiking energy prices and/or a resurgence in real-estate activity, it looks as though the Bank will hold its rate steady and play out its current hand.

- Rate cuts are likely still a long way off.

It didn’t sound as though the BoC will be loosening its monetary-policy tourniquet any time soon.

It expressed concern that its preferred measures of core inflation “show little downward momentum” from their current 4% range, that “near-term inflation expectations and corporate pricing are normalizing only gradually”, and that wages “are still growing around 4% to 5%”. It also observed that “progress towards price stability is slow and inflation risks have increased”. It raised its inflation forecast for Q4 2024 from 2.1% to 2.5%.

It’s going to take time for inflation to get near to the Bank’s 2% target, and Deputy Governor Rogers reiterated that rate cuts won’t be on the table until that happens.

- The BoC believes the slowdown will be more pronounced than previously thought.

The Bank slashed its forecast for year-over-year GDP growth from 1.8% to 1.0% in 2023 and lowered its projection for 2024 from 1.5% to 1.3%. At his press conference, Governor Macklem acknowledged that the path to a soft landing “has gotten narrower”.

The BoC is probably reluctant to forecast a domestic recession before it occurs, lest it hasten its arrival, but it is increasingly clear that’s where we’re headed. Forecasting stall-speed growth may be as close as our central bankers will come to acknowledging that expectation.

The analysis doesn’t have to be over-complicated.

We have just experienced the sharpest series of BoC rate hikes in the modern era, and the effect of those hikes will be magnified by record-high government and household debt levels. The resulting headwind may be taking time to reach its full force, but when it does, it will stop our economic momentum in its tracks.

The question still to be answered is whether inflation cools as our economic momentum fades or whether other factors beyond the BoC’s control, such as global energy prices, prevent that from happening.

On that note, Governor Macklem warned that the Bank may not “look through” a spike in energy prices attributed to geopolitical instability, as it might if inflation was in its target range. Instead, the persistence of elevated inflation might compel it to tighten further this time around.

- Macklem: Canada’s economic growth is more inflationary than US economic growth.

In his press conference, BoC Governor Macklem drew an important distinction between the compositions of US and Canadian economic growth.

He explained that Canada is currently growing its economy by expanding its population, via immigration, whereas the US economic output is increasing primarily because of productivity enhancements via business investment.

On the Canadian path, GDP-per-capita is falling, which is inflationary. On the US path, GDP-per-capita is rising, and that “pays for higher wages without stoking inflation”. Productivity-led growth “makes everything easier”.

If the US economy is becoming more efficient as it grows and our economy is becoming less so, inflation should be stickier on the north side of the 49th parallel.

- The weaker Loonie is hurting more than it is helping right now.

When the Loonie weakens against the Greenback, it increases the cost of everything we buy from the US and, as such, stokes our domestic inflation pressure.

Normally, there is an offsetting economic benefit, because a cheaper Loonie lowers the relative cost of the exports we sell into those same US markets. But that benefit is being muted this time because the Loonie has strengthened against a basket of other currencies from countries that compete with Canada for US import business.

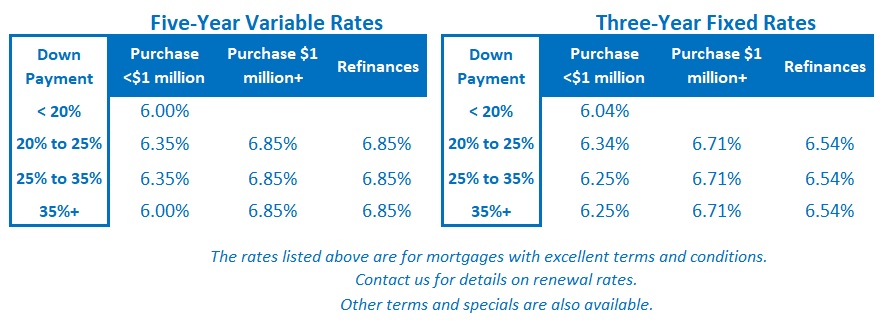

If I were in the market for a mortgage today, I would still be choosing between a three-year fixed rate and a five-year variable rate.

A fixed-rate three-year term offers conservative borrowers a good cost/risk balance among today’s fixed-rate options.

Borrowers pay a premium of about 0.35% over five-year fixed rates, but in exchange, they can come back to the market two years sooner. I would be reluctant to lock in for longer than three years when rates have just spiked to their highest levels in more than a decade.

The premiums for one- or two-year fixed rates are higher. The shorter the term, the greater the risk of renewing before rates have fallen by enough to leave borrowers better off in aggregate.

If you can tolerate variable-rate risk, the BoC’s decision to hold last week increases the odds that your rate won’t rise further during this rate cycle. But there is still the risk that eventual rate cuts will take longer to materialize than the middle of next year (which is the current consensus forecast).

That said, if you’re prepared to be patient, I believe that today’s five-year variable rates offer the greatest potential for saving over their full five-year term. The Bottom Line: Global bond yields cooled last week. While it may have been just a relief rally after their recent extended upsurge, I think it is more likely a reflection that the higher-for-longer inflation view has now been fully priced in.

The Bottom Line: Global bond yields cooled last week. While it may have been just a relief rally after their recent extended upsurge, I think it is more likely a reflection that the higher-for-longer inflation view has now been fully priced in.

Fixed rates are off the boil for the moment, and if bond yields continue their recent drop, mortgage borrowers may even see some rate relief. But for now, over the short term, fixed rates appear range bound.

Five-year variable-rate discounts were unchanged last week.

Variable-rate borrowers breathed a sigh of relief when the BoC held steady last week, and it appears that the bar for additional BoC policy-rate hikes has been moved higher.

Now it’s time for speculation about the timing and extent of future rate-cuts to begin in earnest.