Thoughts on Diverging US/CDN Economic Momentum, the Mortgage Stress Test, and an Unfair Policy Trapping Many Mortgage Borrowers

October 3, 2023Why Fixed vs. Variable is Getting More Interesting + Five Key Mortgage Updates

October 23, 2023

Last week, Statistics Canada confirmed that our economy added 63,800 new jobs in September, more than three times the consensus forecast of 20,000. Average hourly wage growth also accelerated last month on a year-over-year basis, increasing from 5.2% in August to 5.3% in September.

The bond futures market increased the odds of another Bank of Canada (BoC) rate hike this year from 25% to 40%. I think the odds should be higher than that.

Since the BoC’s last meeting on September 6, we have had two employment reports come in higher than expected. Job creation increased from 39,900 in August to 63,800 in September and overall inflation increased from 3.3% in July to 4% in August. Our core inflation measures also swung higher last month.

Higher energy prices and less favourable base effects will all but guarantee that our next Consumer Price Index (CPI) print, due out on October 17, will show further acceleration last month.

I grant that the slowing economic momentum confirmed by our latest GDP print will help to cool inflation going forward. But it hasn’t had much impact thus far, and the BoC doesn’t have much leeway to wait for the rate hikes they have already made to increase their bite.

If expectations of higher inflation become more firmly entrenched, that psychological shift will make price pressures much more difficult to rein in.

Interestingly, while the details outlined above support a higher-for-longer outlook for rates, the bond market’s increased willingness to fully price in that view may end up being the reason the BoC doesn’t hike again.

The higher-for-longer consensus has pushed Government of Canada (GoC) bond yields to their highest levels in nearly twenty years, along with the consumer borrowing rates that are tied to them. Those higher costs have significantly tightened financial conditions, and that means that the bond market is essentially doing the BoC’s job for it.

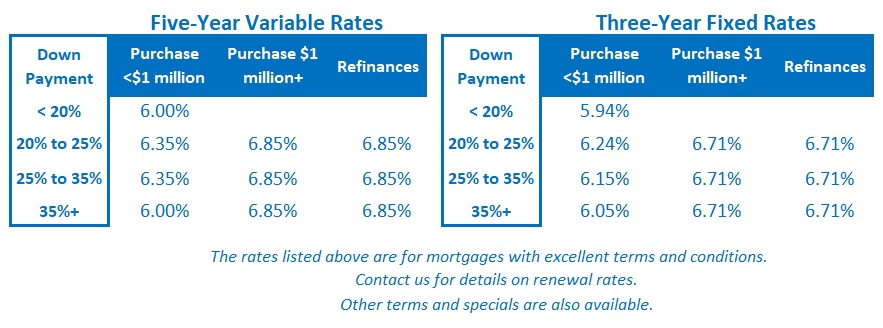

Surging GoC bond yields have more impact than BoC rate hikes because they cause fixed mortgage rates to increase, and the majority of Canadians are still choosing fixed-rate options. BoC rate hikes impact only variable mortgage rates directly.

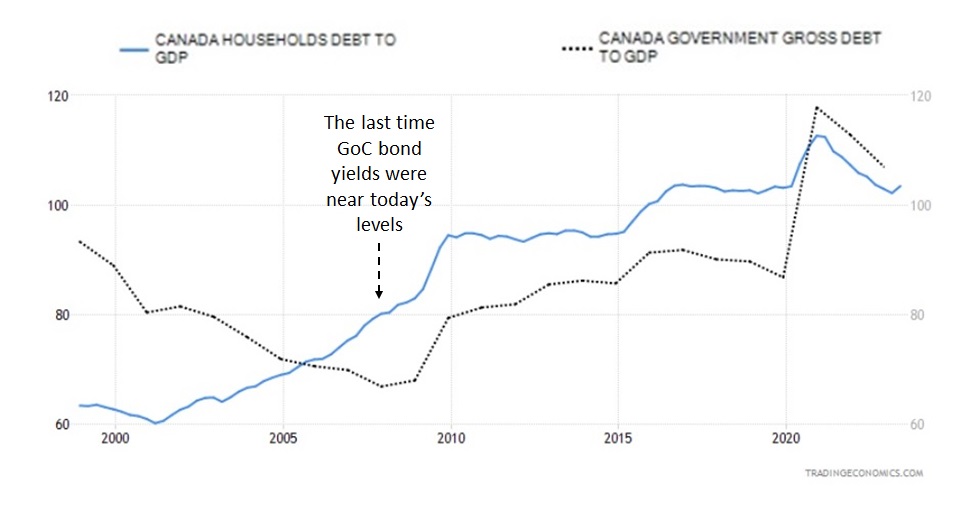

When making historical rate comparisons it is also important to remember that both our household and government debt-to-GDP levels are much higher now than they were the last time we saw bond yields and mortgage rates near today’s levels (see chart).

The higher the debt load, the greater the relative impact of higher rates.

The higher the debt load, the greater the relative impact of higher rates.

The week ahead is a light one on the Canadian economic data calendar, and that translates into a quiet one for mortgage-related news. The following week will be busy with releases of the latest CPI data, the Business Outlook Survey, and Canadian Survey of Consumer Expectations for Q3.

I’ll check back with my take on those items, and I will also look ahead to the BoC’s next policy-rate meeting on October 25. The Bottom Line: GoC bond yields and the US Treasury equivalents, which they closely follow, had some brief run-ups last week but couldn’t hold at those levels. The higher-for-longer view now seems fully priced in on both sides of the 49th parallel.

The Bottom Line: GoC bond yields and the US Treasury equivalents, which they closely follow, had some brief run-ups last week but couldn’t hold at those levels. The higher-for-longer view now seems fully priced in on both sides of the 49th parallel.

If that view is correct, there should be a lid on fixed mortgage rates for the time being.

Variable mortgage-rate discounts were unchanged last week.

The bond market’s bets on another BoC rate hike this year remain volatile. Where they settle looks like a coin flip either way, but there is a growing consensus that rates will need to stay higher for longer.