Canadian Inflation Rises. Will Mortgage Rates Follow?

August 21, 2023Has the Bank of Canada’s Policy Rate Peaked?

September 11, 2023 Last week we learned that our Gross Domestic Product (GDP) contracted by 0.2% in the second quarter on an annualized basis, well below both the consensus forecast of +1.2% and the Bank of Canada’s (BoC) forecast of +1.5%.

Last week we learned that our Gross Domestic Product (GDP) contracted by 0.2% in the second quarter on an annualized basis, well below both the consensus forecast of +1.2% and the Bank of Canada’s (BoC) forecast of +1.5%.

As a result, most economists now believe that the BoC will hold its policy rate steady when it meets this week, and the bond futures market has reduced the probability of a hike to about 10%. Bond-market investors have also reduced the odds that we will see another hike this year from 90% down to 20%.

That report is the clearest evidence of slowing economic momentum that we have seen to date, and it confirms that the bite from the BoC’s previous rate hikes is intensifying. As one would expect, two of the most interest-rate sensitive parts of our economy, consumer spending and housing investment, contributed significantly to the Q2 slowdown.

The latest GDP update may also be a sign that the pandemic saving buffers have been depleted to the point where many consumers will no longer be able to raise their spending to absorb additional price increases.

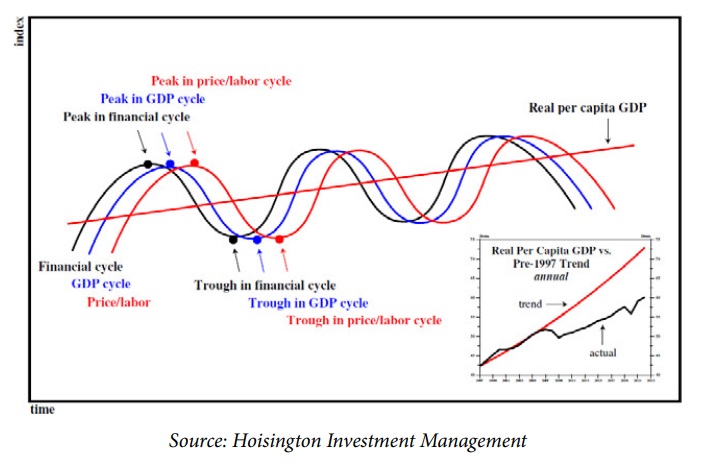

These developments will be welcome signs of progress to the BoC. As per the chart below from US economist Lacy Hunt of Hoisington Management, both the monetary policy and GDP cycles need to peak before labour costs and overall prices will begin to cool.

The question for this week is whether the BoC has seen enough signs of slowing to hold off on another hike.

While I hope for the sake of variable-rate borrowers that the BoC will reach that conclusion, the coming decision isn’t the slam-dunk that many now predict it will be.

Everything still comes down to inflation, which is back on the rise and will likely continue to climb higher over the remainder of 2023 (as I explained in this recent post).

Inflation has been running hot for more than two years now, and the longer that continues, the greater the risk that higher inflation expectations will become entrenched and lead to self-reinforcing changes in consumer behaviour.

If the BoC wants to drive a stake through the heart of inflation and inflation expectations, one last hike when the market isn’t expecting it might do the trick. And remember that the Bank has repeatedly indicated that it prefers to err on the side of overtightening if it can’t hit the bullseye.

At the very least, borrowers shouldn’t expect the BoC to announce a formal pause. The Bank will remember that the last time it did that, our real-estate markets rallied hard and significantly undermined its efforts to slow our economy.

This time around, if the BoC decides not to hike, it will likely do so with a hawkish reminder that further hikes will be forthcoming if needed.

Put me down (hesitantly) for a hawkish hold this Wednesday.

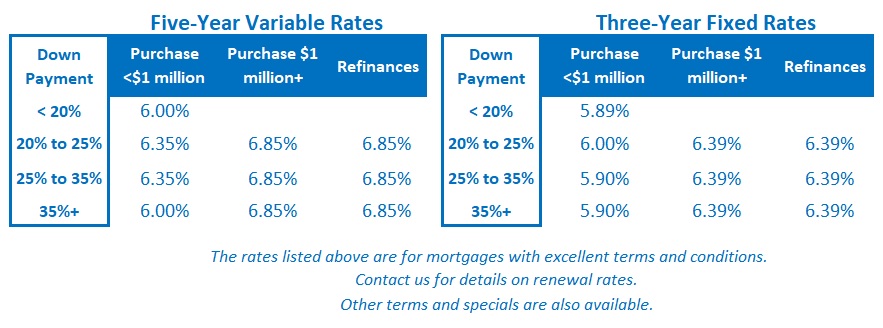

The Bottom Line: Last week Government of Canada bond yields fell by about 0.20% and if we hold at those levels, there will finally be some air under our fixed mortgage rates after their long, steady run up.

Expect our fixed rates to hold steady in the lead up to the BoC’s meeting this Wednesday. Then, if the Bank holds steady, we may see fixed rates drop in response.

Variable-rate mortgage discounts were unchanged last week. I think variable-rate borrowers will be spared from another increase this Wednesday, but there is certainly a risk that the inflation data will compel the BoC to tighten again, despite the clearest sign yet that our economic momentum is finally slowing.